Inflation watch: does slowdown affect interest rate expectations?

20th October 2021 13:25

by Graeme Evans from interactive investor

Increases in the cost of living slowed last month, but rumour is that the Bank of England is about to increase rates. We look at the possible impact.

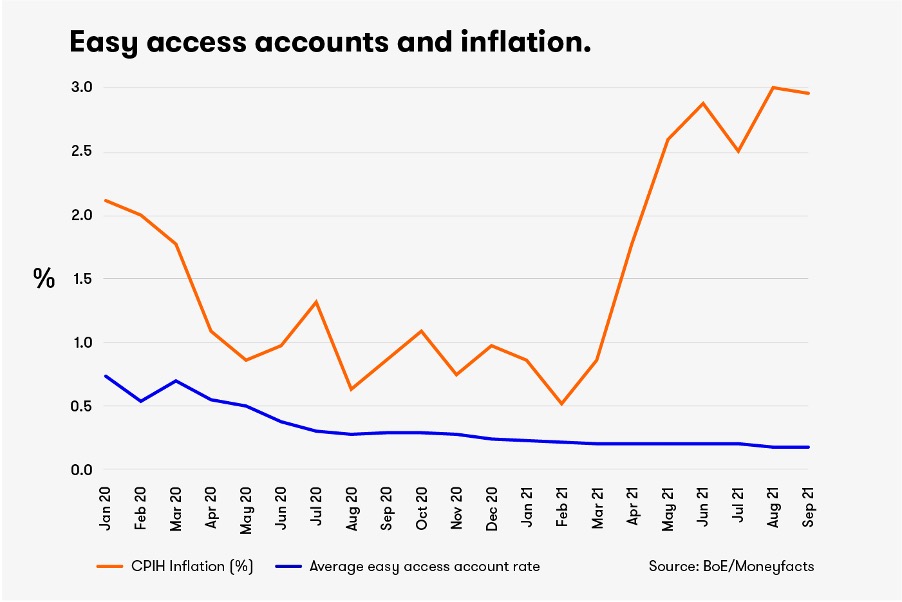

Inflation is the enemy of the saver, especially when it's impossible to find savings deals that beat it. Some of the most popular savings deals are easy access accounts, but the average deal doesn't come close to beating inflation - which is set to soar further this year.

This is the latest article in a monthly series that examines the effect of inflation on your savings.

Interest rates are about to rise, but for savers this will be little consolation when there's such a huge gulf between the cost of living and the accounts on offer in the savings market.

Today's consumer prices index (CPI) figure came in at 3.1% for September, which compares with the best easy access account rates of 0.65% with Coventry Building Society and for ISA customers with Cynergy Bank.

The largest upward contribution to the September 2021 CPIH 12-month inflation rate came from transport (0.91 percentage points), with further large upward contributions from housing and household services (0.69 percentage points), restaurants and hotels (0.34 percentage points), and recreation and culture (0.31 percentage points).

CPI including owner occupiers’ housing costs (CPIH) rose by 2.9% in the 12 months to September 2021. That’s down a fraction from 3% in the year to August. It was up 0.3% on the month in September 2021 versus a 0.4% rise in September 2020.

- Market snapshot: US earnings optimism and UK inflation

- Spectre of inflation is trigger for investors to tweak portfolios

- ii Top Ten: things you need to know about inflation and your money

- How to prepare your finances for an interest rate rise

November is now seen as a good bet for the Bank of England to hike its base rate to 0.25% from 0.1% currently, but that month will also see a huge jump in the annual inflation rate.

As Capital Economics put it this morning, today's slight weakening in the CPI rate from 3.2% in August to 3.1% represents the “lull before the storm”.

It expects a 12% rise in utility prices to mean the CPI figure for October jumps to 4%, while it warns of a peak near 5% by April as labour and supply chain pressures filter through to prices.

The inflation outlook weakens activity by reducing real incomes, one reason why the Bank of England is likely to be cautious about how quickly it unwinds pandemic support despite the surge in inflation pressures.

Paul Dales of Capital Economics thinks that the City has gone too far pricing in interest rates of 1% next year, adding that he expects inflation to fall back to 2% by the end of next year as supply chain shortages ease and base effects drop out of calculations.

Savers on variable rates will be the first to see the impact of higher interest rates, but over the coming months there will still be no escape from the pain of inflation eating into their cash.

Unsurprisingly, there's not one product on the market that can outpace 3.1% inflation.

According to Moneyfacts, the highest rate anywhere at the moment is the 2.05% from a five-year fixed-rate bond with Shariah-compliant challenger bank Gatehouse. The best notice account is 1.06% with OakNorth Bank.

Current rates are much lower than pre-pandemic times, when the best easy access account on offer in October 2019 was Coventry Building Society at 1.46%.

But Moneyfacts reports that some of the leading savings deals have improved since the last inflation announcement a month ago.

- The inflation-proof shares fund managers are backing

- Stockwatch: an inflation survival plan for investors

- A guide on how investors can protect against inflation

- How to invest: why you can’t ignore inflation

Rachel Springall, finance expert at Moneyfacts, said: “Should the murmurings of a base rate rise before the year-end come to fruition, variable rate deals would typically be the first type of savings accounts to see improvements.

“However, there is no guarantee for rates to do so immediately and this could even take a few months to flow through, or indeed may not even be passed on in full.

“Savers sitting on the fence about whether to switch now or wait would be wise to keep in mind there is no certainty that interest rates on savings accounts will rise sharply leading into 2022.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.