Inflation watch: cost of living surges to 10-year high

17th November 2021 13:22

by Graeme Evans from interactive investor

With the price of fuel, energy and food all rising fast, life for savers continues to get harder, and there’s no sign it will get easier any time soon.

Households have been braced for inflation to peak at 5.4% after figures for October today fuelled fears that post-pandemic price pressures are proving to be more persistent.

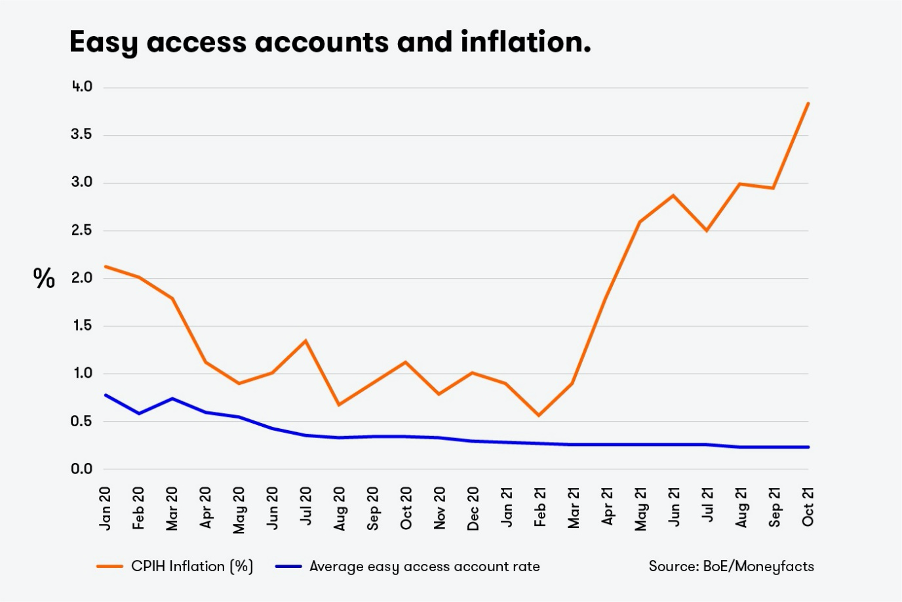

The consumer prices index (CPI) jumped to a decade-high of 4.2%, which is above the rate of 3.9% forecast in the City and compares with the 3.1% seen in September. The CPI including owner occupiers’ housing costs (CPIH) rose by 3.8%, up from 2.9% in the 12 months to September. The retail prices index (RPI) measure of inflation is now at 6%, its highest level in two decades.

Analysis of the CPI figures from the Office for National Statistics shows no hiding place for households, with fuel inflation running at 21.5%, energy price inflation surging from 0.2% to 7.8% and food inflation up to 1.3% from 0.9%.

- ii Top 10...things you need to know about inflation and your money

- The inflation-proof shares fund managers are backing

- Get £100 cashback when you switch to an ii ISA in November. Terms apply

- Read more of our content on UK shares here

Economists at Deutsche Bank now see the consumer prices measure of inflation peaking at 5.4% in April, with RPI nearing 7% as a result of that month's expected change in Ofgem's energy price cap. There's the additional threat that second-round effects stemming from a tight labour market will prolong the inflationary pressures.

This means the Bank of England will be a long way off its 2% inflation target for much of next year, even if policymakers do next month deliver the 0.15% rise in interest rates most in the City had expected in November.

With inflation heading upwards and the jobs market proving robust after the end of the furlough scheme, there's now little standing in the way of a rate rise to 0.25%.

Such a move will be scant consolation for savers, who can expect to experience the pain of inflation eating into their cash reserves for some time yet.

This month the average rate on an easy access savings account stood at a paltry 0.19%, some 0.43% lower than two years ago. Today's best rate is with Shawbrook Bank at 0.67%.

The fixed bond market is improving compared to a year ago, meaning savers can get a better rate on a one-year bond than they could have secured on a two-year bond last year. According to Moneyfacts, Union Bank of India offers 1.35% while the best one-year fixed in the ISA market is 1% from West Bromwich Building Society.

The lack of a standard savings account that can outpace inflation compares with last year's 227 deals that could beat the inflation figure of 0.7% for the same month a year ago.

The gulf between inflation and savings rates will widen further next month, with Capital Economics predicting that CPI will rise to 4.9% due to unfavourable base effects.

Its chief UK economist Paul Dales sees the Bank of England raising interest rates to 0.5% by February but doubts they will go any higher in 2022 as he believes inflation should fall back to 2.2% by December 2022.

- ii COP26 hub: see tips, news, comment and analysis from our experts

- Subscribe to the ii YouTube channel for interviews with popular investors

He believes the City is going too far by pricing in interest rates of 1%-1.25% by the end of next year.

Deutsche Bank, meanwhile, fears that pressures on core goods will remain entrenched through the next two quarters and that services inflation will likely tick up as rising labour costs continue to feed through into retail prices.

Its senior economist Sanjay Raja said: “Put another way, the peak and duration of the surge in excess inflation will leave the Bank's monetary policy committee in a more uncomfortable position heading into 2022.”

He said upside surprises in today's figures included in seasonal food prices, where fruit, vegetables, meat and fish all ticked up by more than 1% month-on-month.

Airfares also rose by 5.5% and overseas and domestic university tuition fees pushed up the overall education basket of prices by 3.4% month-on-month.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.