Inflation watch: cost of living at highest since March 1992

19th January 2022 13:18

by Graeme Evans from interactive investor

As living costs keep rising at breakneck speed, savers are desperately hoping that anticipated interest rate increases quickly feed through to their bank accounts.

Savers can expect inflation to eat away at their nest eggs for some time yet after today's consumer prices index (CPI) surged by more than expected to 5.4% in December.

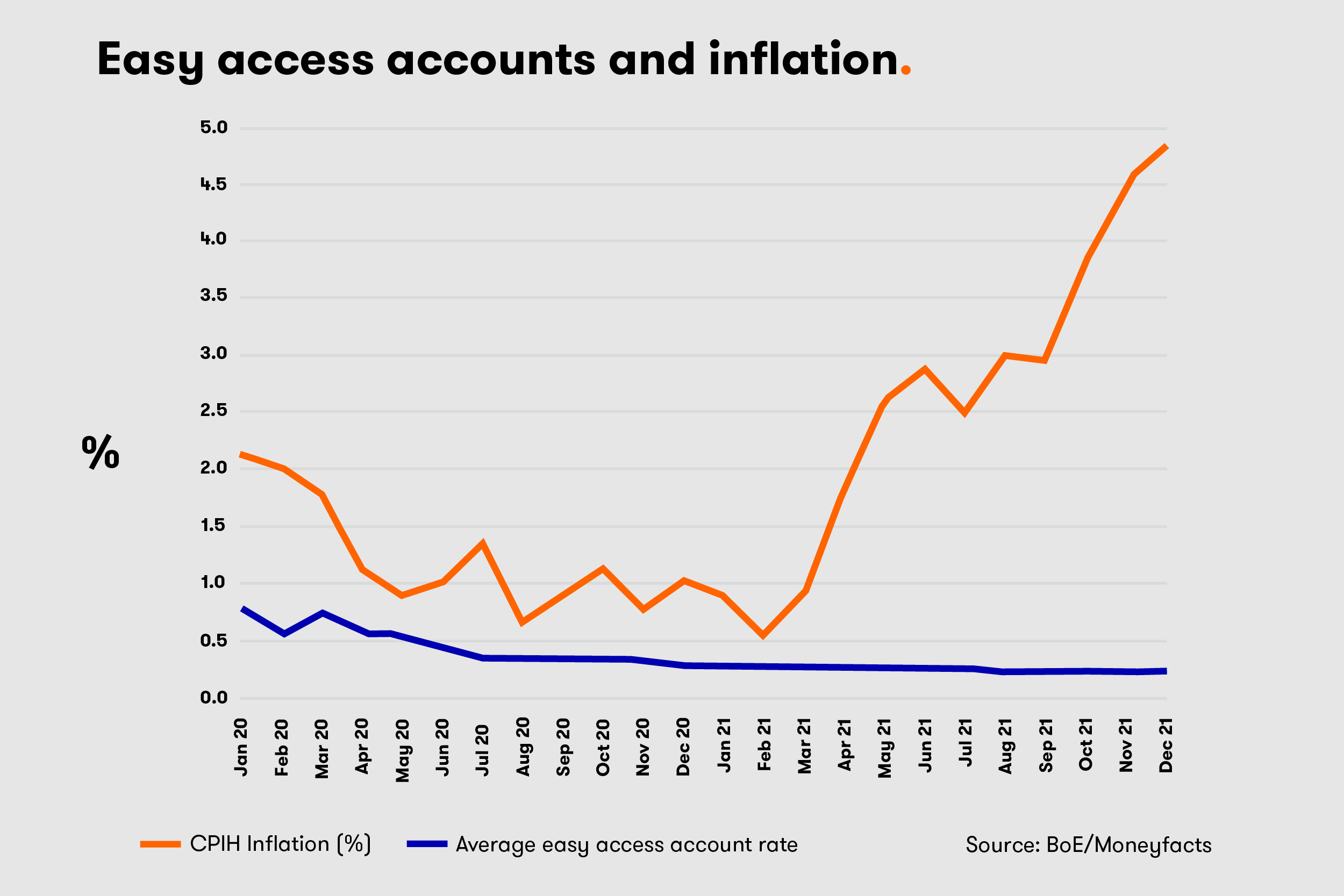

The figure from the Office for National Statistics (ONS) compares with the best easy access rate of 0.72% from the Family Building Society and the best five-year fix of 2.14% from UBL.

The situation will only get worse in the coming months as economists are predicting that CPI will be near to 7% once regulator Ofgem increases its energy price cap in April.

Interest rates look certain to rise in February to 0.5%, but the Bank of England's response is small comfort for savers as banks and building societies take time to pass on higher rates.

Their best rates do not always stay on the shelf for long, meaning savers will need to be vigilant if they want to work their finances harder in these challenging times.

- How to turbo-charge your budgeting

- 10 stocks that could protect investors from inflation

- Watch our New Year share tips here and subscribe to the ii YouTube channel for free

Last month's top easy access deal was Investec Bank at 0.71%, but this was withdrawn after a few weeks and the market-leading one-year bond from Gatehouse Bank ended this week.

Moneyfacts finance expert Rachel Springall said: “Comparing and switching deals is crucial for consumers to get the best return on their cash, signing up to newsletters and checking top rate tables regularly is wise to keep up with changes.”

Many consumers will now be looking to ramp up their savings in order to ensure they have a safety net to cope with future price pressures. As well as higher energy costs, they can expect mobile phone bills to rise sharply after several operators announced inflation-linked rises.

Virgin Mobile, for example, is planning to increase tariffs in April by next month's retail prices index (RPI) rate of inflation, plus 3.9%. The use of the RPI figure is a particular blow for its customers after the rate surged to 7.5% in today's ONS release, much bigger than the 7.1% predicted in the City.

Based on the consumer prices index including owner occupiers’ housing costs (CPIH), inflation is running at 4.8%, up from 4.6% a month ago and 3.8% in October.

The more recognised CPI rate came in higher than the 5.2% forecast, meaning it is further above the Bank of England's 2% target than at any point since the UK first adopted an inflation target in October 1992.

Remarkably, CPI started the year at just 0.7% when the savings market was awash with deals that could outpace this figure.

Two-thirds of today's 0.3 percentage point rise in headline CPI came from the increase in food price inflation from 2.4% to a nine-year high of 4.5%. Capital Economics said previous gains in agricultural commodity prices suggest that prices on the supermarket shelves will soon rise further, perhaps pushing up food price inflation to 5%.

Furniture and household equipment inflation also contributed as strong demand driven by problems sourcing products from Asia resulted in price inflation rising from 6.1% to 7.3%, which is the highest rate since this series began in 1989.

Paul Dales of Capital Economics said: “It’s no secret that inflation is going to rise even further. The further rise in core producer price inflation, from 8.2% to 8.7% in December, will soon push core goods CPI inflation higher.

“And the surge in wholesale gas and electricity prices could result in an increase in utility prices on 1 April in the region of 50%.”

Such an increase could boost the inflation rate by 1.5%, although Investec said it seemed “politically inconceivable” that a rise in utility prices of this magnitude will be sanctioned.

Investec economist Sandra Horsfield said: “We expect the government to take a range of mitigating measures to limit the increase in the CPI inflation rate, and additionally to provide extra help for low-income households that stand to be particularly affected. The exact mechanism and size of the offset are, as yet unclear.”

- Six ways to shield against the rising cost of living

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

She expects a 0.25% rise in the Bank of England base rate on 3 February, while Capital Economics thinks the Bank will raise rates during this year to 1.25%.

The Bank increased the rate from 0.1% to 0.25% at its December meeting, when it forecast a 6% peak for inflation rather than the 7% expected in the City today. Although inflation is expected to fall, Capital Economics thinks it will stay above 4% for all of this year and will remain above the 2% target until April 2023.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.