Inflation watch: cost of living up 9% at 40-year high

18th May 2022 13:17

by Graeme Evans from interactive investor

Average fixed savings rates just registered their biggest monthly increase in over a decade, but the inflation boom continues to wreck savers’ plans.

Misery for savers after a year-long drought of inflation-beating deals heightened today as the consumer prices index (CPI) jumped to 9% on its way towards 10% later this year.

April’s 40-year high for the annual rate of inflation compares with 7% in March and the 1.5% seen last May, as the eye-watering upward momentum caused by sharply higher utility, fuel and food costs more than offsets a recent upturn in savings rates.

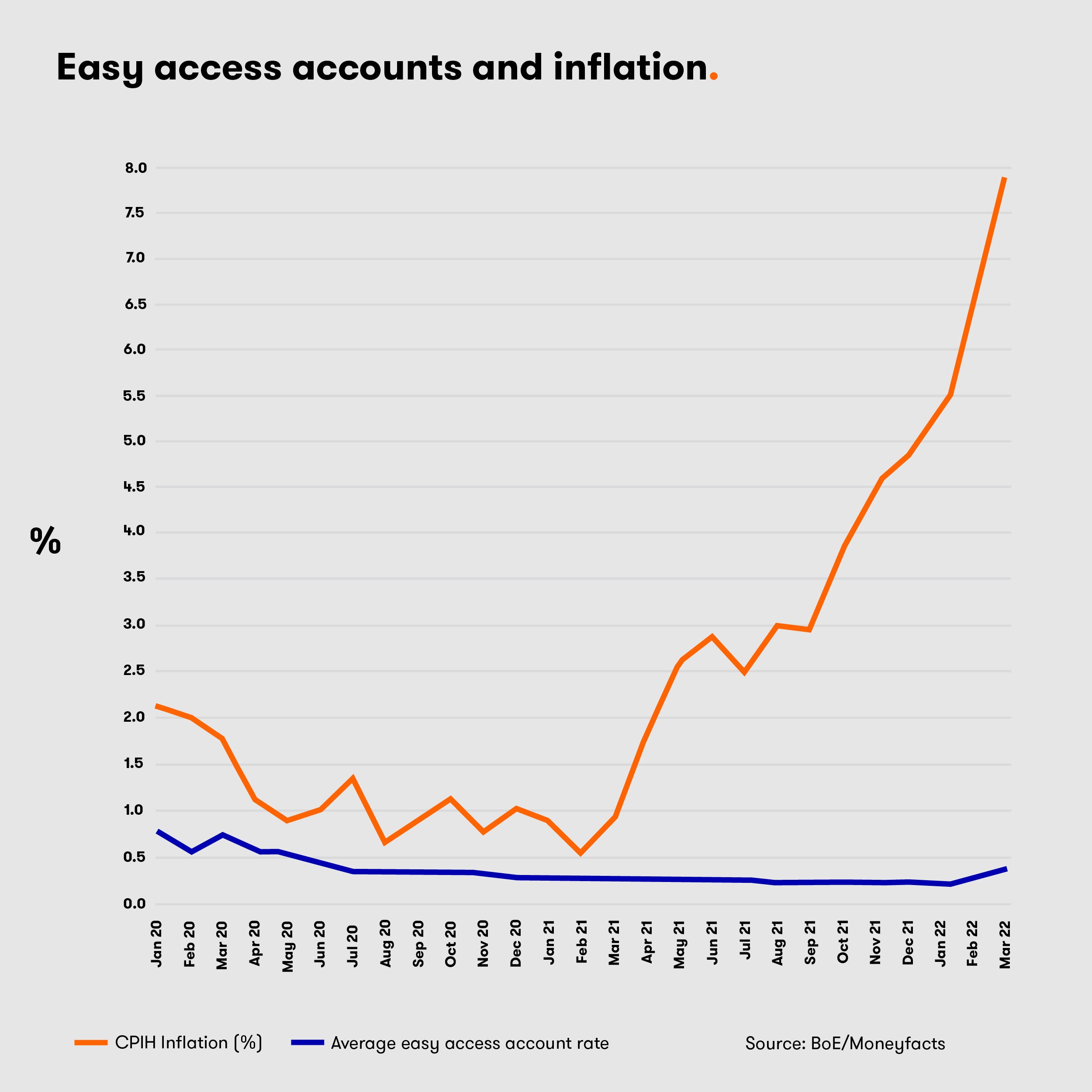

Including owner occupiers' housing costs, the CPIH measure rose by 7.8% in the 12 months to April 2022, up from 6.2% in March.

Boosted by a series of Bank of England interest rate rises since December, Moneyfacts notes that average fixed savings rates have just registered their biggest monthly increase in over a decade. However, the average one-year fixed ISA is still only at 1.02% and the easy access ISA rate is 0.45%, albeit its highest average since June 2020.

- Recessions are becoming more likely – here’s how to invest

- How this investor is fighting fear amid market turbulence

- A tactic to ride out the inflation storm using these funds and trusts

Moneyfacts finance expert Rachel Springall said: “An entire year has now passed since there were any standard savings accounts available on the market that could outpace inflation.”

She said there was no end in sight as the Bank of England has forecast inflation to be near 6.6% in the second quarter of next year, which is still far above its current 2% target.

Springall added: “Savings rates are encouragingly on the rise and far superior to what could have been acquired a year ago, but inflation would still need to drop down considerably for savers to beat it today.”

The current market leader for easy access accounts based on £10,000 gross is the 1.49% on offer from Chase Bank, falling to 1% in the ISA market with Marcus by Goldman Sachs. The best fixed rate is a five-year bond of 2.83% from Hodge Bank.

The message that things are likely to get worse for households as well as savers reflects expectations for October’s energy price cap to go up by a further 30% on top of last month’s 54% increase.

- The investment lessons from the 1970s as inflation soars and rates rise

- Tips for recession-proofing a portfolio: where to start?

Last month’s change by Ofgem meant the rate of utilities price inflation went from 24.8% to 69.6% in today’s CPI figures, while fuel price inflation hit 31.4% after the recent rise in petrol to a record high of 175p a litre.

Increases in agricultural commodity prices, meanwhile, pushed up food price inflation from 5.8% to an 11-year high of 6.7%.

Paul Dales, chief UK economist at Capital Economics, said core inflation also rose from 5.7% to a new 30-year high of 6.2% after gains in recreation and culture price inflation from 4.9% to 5.9% and restaurant and hotels inflation from 6.9% to 7.9%.

He added: “We think CPI inflation will rise to a peak of 10% in October. Inflation will fall back after that, as the boost from global factors unwinds.

“But the tight labour market and high wage growth suggests that domestic price pressures will remain strong. We think interest rates will need to rise from 1% to 3% to get inflation back to the 2% target.”

Yesterday’s job market figures showed annual earnings growth of 7% as companies appear to be using bonuses to support their workers through the cost-of-living crisis without having to make inflation-busting pay rises.

Excluding bonuses, the earnings growth was 4.2% in the first quarter of the year and representing a 1.2% decline in real terms when adjusted for inflation.

- Stockwatch: will consumer spending squeeze dampen appetite for this stock?

Insider: directors and analysts both buyers of these shares at multi-year low

The Bank of England has hiked rates four times since December but has been accused of acting too slowly, particularly at November’s meeting when it wrong-footed economists by not increasing rates.

Another 0.25% rate rise is expected next month, but the Bank’s battle to bring inflation back under control is now taking place against a backdrop of a slowing economy.

An additional problem for policymakers is that the medicine of higher interest rates takes a while to be felt and will probably do little to moderate inflation in the near term.

Bank of America economists believe that the central bank will need to keep on hiking even if the economy toys with recession. They see GDP slowing to just 0.4% in 2023.

The Bank said: “Domestic and pipeline pressures are strong. We see four more consecutive 0.25% rate hikes by the Bank of England, with a high risk rate-setters choose to hike by 0.5% in August.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.