Inflation Watch: biggest ever jump in inflation explained

15th September 2021 12:00

by Alex Sebastian from interactive investor

Inflation has jumped by a record 0.9%, with the hospitality sector leading the way on price rises in August.

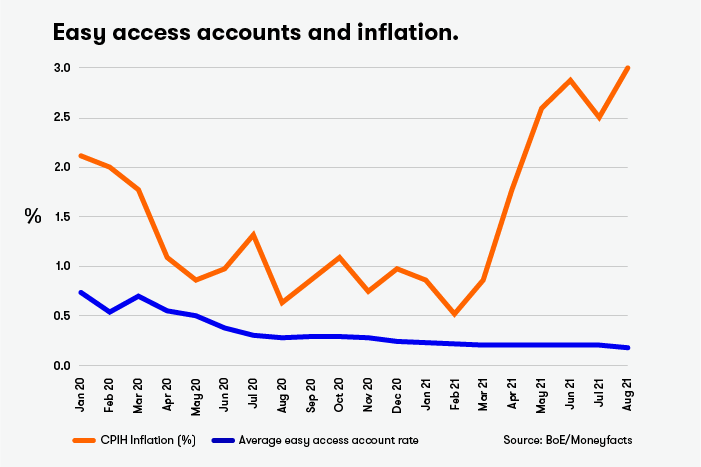

Inflation across the British economy has surged, with the Consumer Price Index including owner occupiers' housing costs (CPIH) measure hitting 3% for the 12 months to August.

In its latest update, the Office for National Statistics (ONS) also revealed Consumer Price Index inflation (CPI), without housing costs, has reached 3.2%.

The climb of 0.9% on last month’s 2.1% CPIH figure represents the biggest jump recorded since the introduction of the measure in January 2006.

A 3% reading is uncomfortable for the Bank of England, which is mandated to keep inflation to 2%. It further calls into question claims that above-target inflation is merely a short term blip, or ‘transitory’.

- Check out our award-winning stocks and shares ISA

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

- Visit the ii Knowledge Centre for a wide range of investor education content

The ONS said the largest contributors to the overall rise in prices were restaurants, hotels, recreation, culture, food and non-alcoholic beverages.

This does offer some mitigation for policymakers to point to, as August 2020 saw the government’s Eat Out To Help Out scheme artificially supress pricing across the hospitality sector.

There is diminishing room for manoeuvre however, and each reading well above 2% brings rate rises nearer.

“It’s undeniable that markets are worried,” commented Scott Spencer, investment manager at BMO Global Asset Management. If inflation persists, it could spur the Bank of England to lift interest rates to quell rampant economic growth.”

“The concerns are not new, but investor unease is the highest it has been for around 15 years. In broad-brush terms, rising inflation tends to be seen as bad news for markets.”

“For equities, it can make it harder for companies to increase their earnings growth and, with bonds, it can make the securities that investors hold feel less valuable. If interest rates go up, it makes the returns available on newly issued bonds look more attractive.”

Becky O’Connor, Head of Pensions and Savings at interactive investor, said: “Rapidly rising prices affect everyone, and today’s data confirms what people have felt over the summer – that everything is suddenly, noticeably more expensive."

“While inflation affects everyone, it is more of a problem for people on lower fixed incomes, including pensioners. It’s also relentlessly hard on savers, who are also likely to be older and who were already struggling to make saving at low interest rates worthwhile."

Debapratim De, senior economist at Deloitte, said: “August's annual inflation figure overstates price rises due to base effects, but the monthly inflation estimate, which has hit a three-year high, does not. The higher-than-expected monthly rise in inflation and input prices testifies to supply shortages, building up further price pressure.”

“The data seem consistent with the Bank of England's expectations of some modest tightening in the coming years. If UK growth continues as currently forecast, we are likely to see the first rate rise by next summer.”

- Will ‘transitory’ inflation start to be worryingly persistent soon?

- The inflation-proof shares fund managers are backing

- Ian Cowie: four inflation-beating trusts yielding 4.5% or more

Rachel Springall, finance expert at Moneyfacts.co.uk, said: “Savings rates have improved vastly since last month which will be great news for consumers looking for a competitive return on their cash.

“However, inflation overshadows the positive shift, as the latest figure of 3.2% is the largest rise month-on-month since records began and not one standard savings account can beat its eroding power.

“There is an expectation for inflation to stay above the Bank of England target of 2% for some time yet, but it is vital savers do not become apathetic as they could miss out on some of the best rates we have seen all year.”

“Locking cash away for longer may not be feasible for some, indeed consumers may be reluctant to invest longer than a year at most due to the impact of the Coronavirus pandemic on their financial health.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.