Inflation hits 30-year high and could rise much further

23rd March 2022 12:08

by Graeme Evans from interactive investor

After hitting its highest level this century, Brits are being told to prepare for the cost of living to keep rising fast.

The plight of savers continues to deteriorate in alarming fashion after inflation today hit another 30-year landmark on its way towards a peak of at least 8% by the summer.

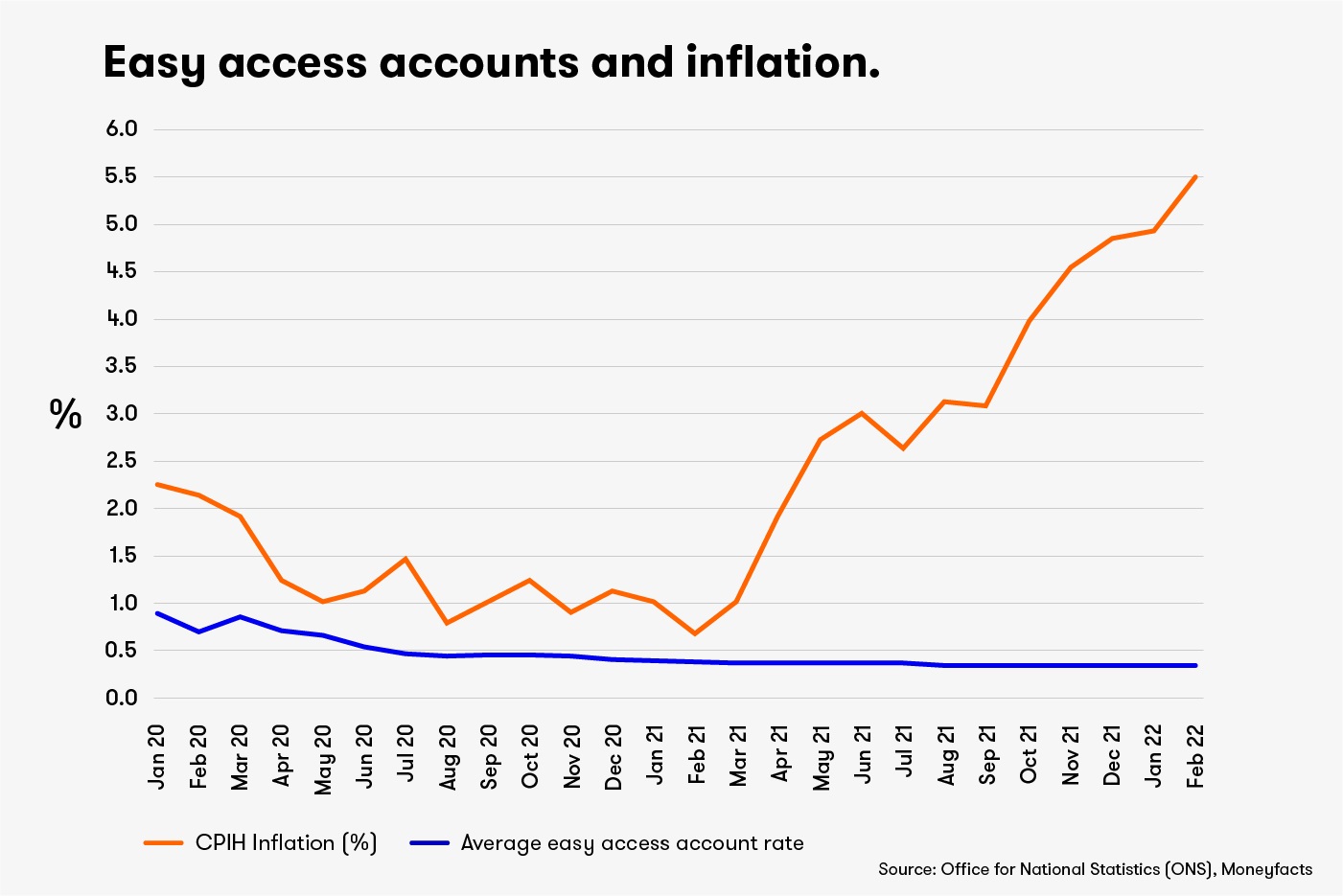

February’s consumer prices index (CPI) of 6.2%, and CPI including owner occupiers’ housing costs (CPIH) of 5.5%, compares with the average easy access cash ISA rate of 0.35% and market leading rates no better than 1%.

As Moneyfacts points out today, cash savers have an impossible task trying to protect their nest eggs from the eroding impact of inflation. This compares with a year ago, when inflation was just 0.4% and there were 326 savings deals outpacing CPI.

Interest rates have risen three times since December to 0.75% but not every saver has benefited. Moneyfacts finance expert Rachel Springall said: “At present it is the challenger banks and building societies who are competing in the cash savings sector, with notable improvements to the easy access sector in recent weeks.

“However, as the biggest high-street banks fail to pass on the full rises to their customers, and some pay as low as 0.01% in interest, it would be sensible for savers to ditch and switch.”

The best easy access account in the ISA market is Paragon Bank at 0.8%, while Virgin Money is paying 1% for a non-ISA account. To make matters worse, the Bank of England's 2% inflation target is only beaten by savers willing to lock into at least a three-year fixed bond.

- Bank of England raises interest rates again to battle inflation surge

- Interest rate hike means savers are damned if they do, damned if they don't

- Video: inflation, dividends and a new commodities supercycle

- Tips for retirees as state pension increase dwarfed by soaring living costs

The market’s best rates are expected to improve in the coming months as the Bank of England has already said it expects further rate rises this year.

But that will be of limited consolation for savers at a time when household budgets are being squeezed on several fronts, most significantly in terms of energy and car fuel costs.

Much of February’s increase in CPI to 6.2%, from 5.5% in January, was due to unfavourable base effects as the Covid-19 lockdown in 2021 meant price changes were softer a year ago.

This was reflected in clothing inflation rising to 8.9%, furniture to 9.1% and recreation/culture to 4.7%. However, food and drink inflation also lifted in today’s release, from 4.3% to 5.1% and the highest rate since September 2011.

Today’s figures from the Office for National Statistics were compiled before Russia’s invasion of Ukraine sent wheat and many other commodity prices to record or multi-year highs. This surge means economists expect food inflation will soon climb above 6%.

The leap in oil prices, meanwhile, has left the average petrol price at a record high of £1.78 per litre. Capital Economics reckons that this will lead to a record month-on-month jump in fuel inflation and add 0.3 percentage points to CPI inflation next month.

The consultancy also sees the forthcoming 54% rise in the utility price cap adding an extra 1.4 percentage points to CPI inflation in April.

As a result, it predicts that April’s inflation rate will peak at 8.4% and stay above 7% for most of this year before remaining above 3% for the majority of 2023.

Its chief UK economist Paul Dales said: “With high inflation feeding into price/wage decisions, we think the Bank of England will have to raise rates further than it expects.”

- Tips from three pros on fighting inflation

- Energy independence: shares to benefit from green energy boom

- Commodities shock: wild times as scarcity looms

- Investment lessons from 122 years of stock market data

In contrast to the Federal Reserve’s vow to raise rates at all six of its remaining meetings this year, the Bank adopted a more dovish tone when it raised rates last week to 0.75%.

But with inflation now more than three times the Bank’s 2% target, Dales expects that policymakers will have no choice but to raise rates to 2% by next year.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.