Income seekers will love this company’s dividend history

21st July 2021 09:27

by Rodney Hobson from interactive investor

This household name has paid a dividend since the 1800s and grown it every year since the 1950s. What’s not to like?

Consistent dividend payers are always worth considering as a long-term holding to provide stability for any investor’s portfolio. Even better is a record of raising the payout over several years. Step forward consumer products maker Procter & Gamble (NYSE:PG).

Remarkably, P&G has paid a dividend for more than 130 consecutive years and has raised it in each of the past 65. Unusually for an American company, it pays out just over half its earnings in dividends, with $3.48 paid in the past financial year. It plans to return $8 billion to shareholders in dividends during the current financial year, with the latest instalment of 86.98 cents coming on 16 August. To qualify, though, investors need to buy in before the closing bell tonight (21 July).

The company is best known for Tide washing detergent and Oral-B toothpaste, but it also makes Olay skin lotion, Pantene shampoo, Gillette razors and Pampers nappies. Annual sales top $70 billion, with more than half coming from outside the United States. There is plenty of scope in emerging markets, which already account for about a third of sales as growing middle classes boost consumer spending.

- US results season forecasts and latest trades

- A top fund that loves these dull and boring stocks

- Are US stocks fast approaching peak earnings?

- Want to buy and sell international shares? It’s easy to do. Here’s how

The group’s products dominate many of its markets. For example, the Bounty brand accounts for 40% of all paper towels sold in the United States.

The dividend looks safe, even if there is a post-pandemic reduction in consumer spending. Admittedly, a near-60% payout ratio leaves a few concerns should profits dip, but P&G makes a lot of products that will still be in demand and has a strong cash flow, so there is surely enough leeway to get through short-term turbulence. Only 50% of free cashflow was paid to shareholders during the turbulent past year.

Earnings per share have grown at an average of 14% a year for the past five years, so, despite the dividend increases, there is adequate cash left over to be reinvested in the company to fund further growth. For the January-March quarter this year net sales rose 5%, while net earnings were up 12%. Figures for the following three months come out next week.

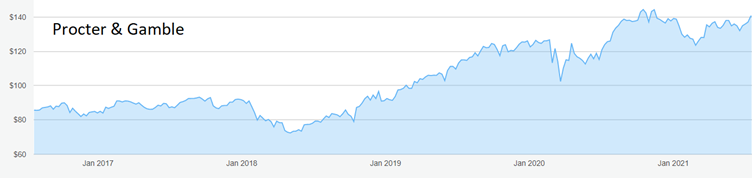

Source: interactive investor. Past performance is not a guide to future performance

One possible cloud on the horizon is a rise in the cost of raw materials and distribution. Some resins, chemicals and other ingredients have doubled or even tripled in price since the start of last year. A shortage of drivers is pushing up wages and fuel costs are also rising.

So far, P&G has managed to pass higher costs on to the consumer in increased prices, but that may not always be possible if smaller competitors try to undercut the dominant market player. So far, however, that has not been an issue.

P&G is also trying to cut production costs through trying out new ideas at its robotics laboratories near its Cincinnati, Ohio, headquarters, where automation is being developed to replace jobs done laboriously by hand. Such innovations can shade a few cents off products and boost profit margins.

- Top 20 most-bought US stocks so far this year

- Hot sector: should investors put down roots in plant-based foods?

- Stock market recovery 2021: half-term report

- Take control of your retirement planning with our award-winning, low-cost Personal Pension

The group invests well, achieving a return on capital employed over 20%, a good five percentage points better than the average for the household products sector.

The shares were only $72 just over three years ago, but now trade at nearly double that despite an inevitable dip in February and March last year when the pandemic sent stocks plummeting. They have since been as high as $147 in intra-day trading. The yield is 2.3%.

Hobson’s choice: Don’t worry about trying to beat the deadline to qualify for the next dividend. If you buy in haste you often repent at leisure. In any case, share prices tend to slip when the stock goes ex-dividend and cautious investors may prefer to wait a few days for the next quarterly update. Procter & Gamble is an ideal candidate for a long-term portfolio. Fair value at the moment looks to be around $144.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.