ii Winter Portfolio doubles after fifth market-beating year

With a five-year track record and having doubled in value, our portfolio proves you can time the market.

10th May 2019 15:01

by Lee Wild from interactive investor

After an amazing fifth winter, our portfolio almost doubles in value and beats all the global indices, proving that international investors are wrong to ignore UK stocks. It also proves it is possible to time the market.

Five years ago, our interest was piqued by a stock market phenomenon that promised consistent market-beating returns year after year in the winter months between 31 October and 30 April. If something sounds too good to be true, it often is, they say. Nevertheless, we ran a pair of portfolios to test the theory.

They started well, delivering total returns of 15% and 18% compared with 9% for the FTSE 350 benchmark index. Encouraged by results, we've continued both six-month strategies ever since.

Consistent Winter Portfolio |

|---|

Compiling the two winter portfolios is straightforward. The Consistent portfolio is a basket of five FTSE 350 stocks with the most stable track record of returns over the past decade. Each has risen every year for the past 10 years. |

Aggressive Winter Portfolio |

|---|

For the Aggressive Winter Portfolio, the FTSE 350 constituents must have delivered the highest average annual returns over the winter. While average returns are our primary criterion, stocks must also have risen over the winter months in at least nine of the past 10 years. |

In the winter period 31 October 2018 to 30 April 2019, the interactive investor Consistent Winter Portfolio generated a total return (capital appreciation plus dividend income) of 20.30%!

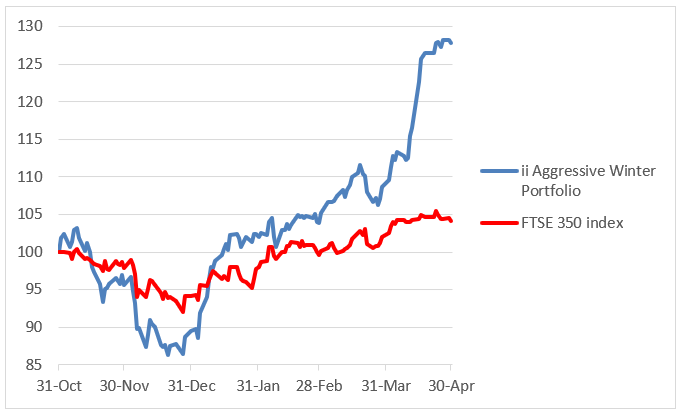

The higher-risk interactive investor Aggressive Winter Portfolio did even better, making 29.03% for investors who stuck to the portfolio's rules of buying and selling on the specific dates in October and April. By comparison, the FTSE 350 benchmark index managed a gain of just 6.40%.

Now, with a five-year track record, the strategy has been proved a massive success, delivering mouth-watering returns for loyal followers.

The 2018-19 Aggressive portfolio easily beat the globe's major market indices, even factoring in all purchase costs. That's proof, if it were needed, that international investors have been wrong to use Brexit as an excuse to ignore UK equities. Even a big winter for recovering China and tech stocks failed to topple our higher-risk basket of shares from first place.

Rich rewards for the faithful

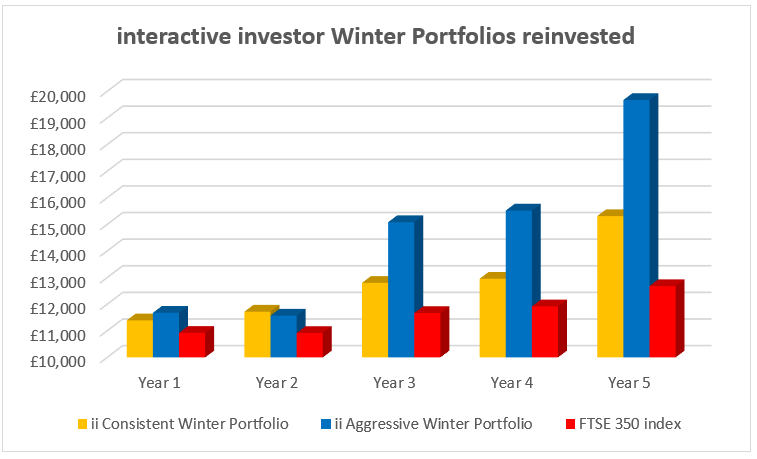

If you had bought the maiden interactive investor Aggressive Winter Portfolio at the end of October 2014 and sold the following 30 April, reinvested the proceeds into the 2015-16 portfolio and repeated the process each year, you would have generated a return of 96.7%, which includes all commission and stamp duty.

Doing the same with the consistent portfolio would have returned 52.7%.

On the same basis, but including no costs at all, the FTSE 350 index reinvested each winter would have returned 26.8% including dividends.

The numbers should speak for themselves, but many continue to reject this approach, espousing the virtues of "Time in the market rather than timing the market." For the most part, there's no arguing with that approach, and there are plenty of statistics to prove the point.

However, the interactive investor Winter Portfolios have consistently proved themselves as worthy of any diversified investment strategy.

It's also worth pointing out that had you bought the FTSE 350 index at the end of October 2014, and held it continuously until the end of April 2019, you would have made 36.9% on a total return basis, excluding charges.

Total returns based on £10,000 lump sum at 31 October 2014, sold at the end of April 2015, reinvested the proceeds into the 2015-16 portfolio and repeated the process each year

Source: interactive investor. Includes buying/selling costs and stamp duty.

Past performance is no guide to future performance. Investments and the income from them can go down as well as up and you may not get back the original investment.

Winter 2018-19 round-up

interactive investor Aggressive Winter Portfolio constituents 2018-19

Source: SharePad. Past performance is no guide to future performance. Investments and the income from them can go down as well as up and you may not get back the full amount invested.

The interactive investor Aggressive Winter Portfolio constituents 2018-19 had a remarkable six months, turning a 14% deficit during the broad fourth-quarter equities market sell-off, to end with a 29% gain.

High street sports fashion chain JD Sports Fashion (LSE:JD.) was among the worst hit, down over 20% mid-December, but fears of a poor Christmas for the retail sector proved wide of the mark, and JD delivered strong results. That's why buyers chased the shares up until late April to end with a 54% gain for this year's seasonal strategy.

The spike in portfolio performance mid-April was also driven by serviced offices player IWG (LSE:IWG). Agreeing to sell its Japanese business and enter into a franchise agreement with the buyer is a potentially lucrative strategy. Plans to replicate the idea worldwide are in place.

| Company | Activity | Winter Strategy performance (%) |

|---|---|---|

| Ashtead Group (LSE:AHT) | Equipment rental | 9.6 |

| JD Sports Fashion (LSE:JD.) | High street fashion chain | 54.2 |

| IWG (LSE:IWG) | Workspace provider | 47.8 |

| Bodycote (LSE:BOY) | Heat treatment engineer | 7.7 |

| Rightmove (LSE:RMV) | Property website | 19.6 |

Source: SharePad. Past performance is no guide to future performance. Investments and the income from them can go down as well as up and you may not get back the full amount invested.

interactive investor Consistent Winter Portfolio constituents 2018-19

FTSE 100 speciality chemicals giant Croda International (LSE:CRDA) extended its run of positive winter returns to at least 15 years with another profitable strategy. But it's gains looked rather modest against the other four constituents.

Pubs and brewers have been struggling for years, and Greene King (LSE:GNK) has not been immune – the shares had halved in value from almost £10 in 2015 and sat near a six-year low when the latest winter portfolio was launched in October.

But, while the chart screams sell, closer inspection reveals its share price does incredibly well during the winter months. That said, we didn't think it would do quite this well. A run of solid results and trading updates underpinned a near-33% gain for the six months, although had the strategy ended a couple of days earlier it would have been 46%!

Motorway gantries and barrier expert Hill & Smith (LSE:HILS) delivered the goods again. A profits warning in August sounded alarm bells, but we trust the data and do not tinker with our portfolio choices. Our faith was repaid in spades with a steady recovery through the winter months.

| Company | Activity | Winter Strategy share price performance (%) |

|---|---|---|

| Howden Joinery (LSE:HWDN) | Kitchen supplier | 8.3 |

| InterContinental Hotels Group (LSE:IHG) | Hotelier | 14.8 |

Infrastructure products | 28.8 | |

| Greene King (LSE:GNK) | Pub chain and brewer | 32.8 |

| Croda International (LSE:CRDA) | Speciality chemicals | 4.9 |

Source: SharePad. Past performance is no guide to future performance. Investments and the income from them can go down as well as up and you may not get back the full amount invested.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.