ii view: Nvidia misses very highest of forecasts

Now producing an even more powerful computer chip to host AI software on. We assess prospects for what is now the biggest US company by stock market value.

21st November 2024 11:10

by Keith Bowman from interactive investor

Third-quarter results to 27 October

- Revenue up 94% year-over-year to $35.1 billion

- Adjusted earnings up 103% to $0.81 per share

- Gross profit margin of 75%, down from 75.7% in the second quarter

- Cash dividend unchanged from the previous quarter at $0.01 per share

Guidance:

- Expects fourth-quarter sales of around $37.5 billion

- Expects Q4 gross profit margin of around 73.5%

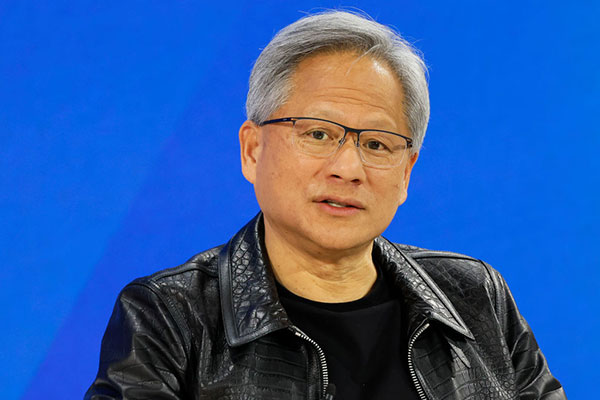

Chief executive Jensen Huang said:

“The age of AI is in full steam, propelling a global shift to NVIDIA computing. Demand for Hopper and anticipation for Blackwell — in full production — are incredible as foundation model makers scale pretraining, post-training and inference.

“AI is transforming every industry, company and country. Enterprises are adopting agentic AI to revolutionize workflows. Industrial robotics investments are surging with breakthroughs in physical AI. And countries have awakened to the importance of developing their national AI and infrastructure.”

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

ii round-up:

Computer chip maker NVIDIA Corp (NASDAQ:NVDA) detailed third-quarter sales almost doubling from a year ago, but estimated fourth-quarter sales below the high end of Wall Street hopes.

Third-quarter sales to 27 October soared 94% year-over-year to $35.1 billion, driving a doubling in adjusted earnings from a year ago to $0.81 per share and beating analyst forecasts of $0.75 per share. Fuelled by the start of shipping for its new more powerful AI capable Blackwell chip, Nvidia estimates sales of around $37.5 billion for the current fourth quarter to late January. Some analysts had been predicting as much as $41 billion.

Shares in the Nasdaq 100 company fell 2% in afterhours US trading having almost tripled year-to-date coming into this latest news. The tech heavy Nasdaq index itself is up a quarter in 2024. Former semiconductor darling Intel Corp (NASDAQ:INTC) has halved.

Nvidia makes computer microchips used across areas such as datacentres hosting ever more powerful AI software, gaming consoles and autonomous potential cars.

The group, still headed by founder Jensen Huang, pointed to an expected profit margin for the current fourth quarter of 73.5%, down from 75% in Q3 and below 75.7% in Q2.

Costs in relation to the commencement of production and shipping for the new Blackwell chip are now being swallowed. Nvidia pointed to suppliers of components in relation to recent Blackwell overheating issues.

Data Centre related revenues for the three months to late October more than doubled from a year ago to $30.8 billion, aided by ongoing demand for its existing Hooper chip by customers such as Amazon.com Inc (NASDAQ:AMZN), Microsoft Corp (NASDAQ:MSFT) and Oracle Corp (NYSE:ORCL). Automotive and robotic related sales rose 72% year-over-year to $449 million. Gaming sales climbed 15% to $3.3 billion.

Broker Morgan Stanley reiterated its ‘overweight’ stance on Nvidia shares post the results, upping its estimated price target to $168 from $160 previously.

ii view:

Started in 1993 and headquartered in Santa Clara, California, Nvidia today employs over 25,000 people. Nvidia credits its invention of the Graphics Processor Unit (GPU) in 1999 for fuelling the boom in the PC gaming market. Today, wide use of its microchips and own supporting Cuda software in data centres globally leaves it describing itself as the world leader in accelerated computing.

For investors, a potential dip in gross profit margin given the rollout of its next generation Blackwell, as well as likely supply chain challenges, cannot be overlooked. US government restrictions on sales of its top-spec products to China persist. Power consumption concerns for the wider datacentre industry sit against climate change threats, while the worries of many governments regarding the potential power of AI and its impact on human society continue to require deep contemplation.

- How to protect yourself against a major tech correction

- Why we’ve dipped our toes back into Baillie Gifford American

- Scottish Mortgage explains why it has reduced Nvidia

To the upside, demand for its datacentre products is going from record to record, with future demand now supported by the new Blackwell product. Nvidia’s supply chain management has proved robust to date. The potential for AI innovation including new ground-breaking medicines cannot be ignored, while its founder, Jensen Huang, with many years of experience, continues to lead the company.

For now, valuing Nvidia, given its status as the eminent play on the future of AI, remains highly difficult and leaves the shares extremely volatile. That said, sales momentum for its now core datacentre products continues, with investors likely to stay onboard this innovative US tech titan.

Positives:

- Exposure to growth in data centres and AI

- Launching new generation product

Negatives:

- Uncertain economic outlook

- US and China tensions

The average rating of stock market analysts:

Buy

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.