ii view: discover what is the main event at Informa

2020 was a year to forget for this media company but will 2021 be better? We assess prospects.

22nd April 2021 16:37

by Keith Bowman from interactive investor

2020 was a year to forget for this media company but will 2021 be better? We assess prospects.

Full year results to 31 December

- Revenue down 42% to £1.66 billion

- Adjusted operating profit down 71% to £268 million

- Pre-tax loss of £1.14 billion, down from a profit of £319 million

- Net debt down 24% to £2 billion

- No dividend payment

Chief executive Stephen Carter said:

"The strength and performance of Informa's subscriptions businesses, combined with actions undertaken in 2020 to protect and preserve our brands and customer relationships in B2B Events, are delivering continuing Stability and Security in 2021, in what will be the year of transition."

ii round-up:

The global pandemic and cancelled events such as the Monaco Yacht Show underlay a 71% drop in adjusted operating profit to 3268 million at Informa (LSE:INF).

Sales for the media and events organiser fell by 42% to £1.66 billion in the year to the end of December 2020.

Informa shares fell by more than 2% in UK trading, leaving them little changed year-to-date, although they're up around 40% since pandemic induced market lows in March last year.

Looking ahead, management sees 2021 as being a transitional year. Ongoing growth in its subscriptions-led media businesses and expansion in business-to-business (B2B) digital services are expected to be supported by a progressive return in B2B physical events, as virus restrictions relax.

A baseline revenue outcome of £1.7 billion is expected for 2021, similar to 2020. The extent of any further revenue growth is dependent on the pace and scale of return of physical events outside of Mainland China.

Trade shows in North America are expected to recommence later this summer. Informa hosted more than 500 virtual events of different shapes and sizes through 2020, enabling it to accelerate its digital product development programme.

Strong performances by its subscription-led, specialist knowledge and information businesses over 2020 had continued into 2021. The group, which also owns academic publisher Taylor & Francis, continued to invest in specialist content and digital platforms.

Halted at the start of the pandemic, the dividend payment remains suspended, helping reduce net debt by 24% to £2 billion. Available group liquidity stands at over £1 billion.

ii view:

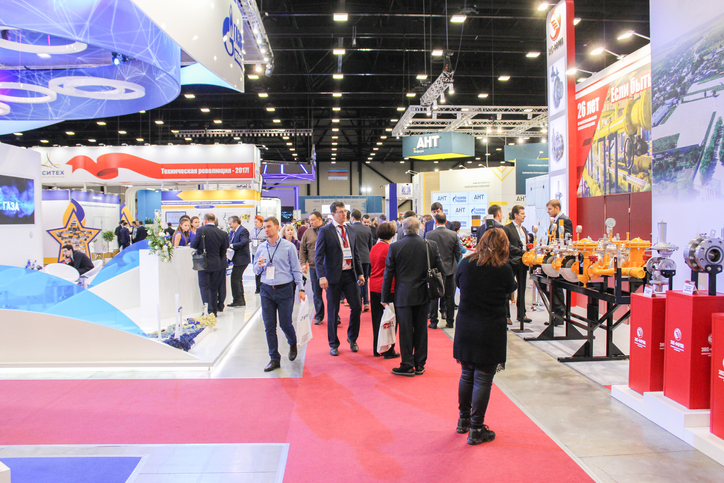

Informa organises international exhibitions and events, and provides information services and scholarly publishing. At the end of 2019 it boasted a record of six consecutive years of growth in underlying revenue, profit, adjusted earnings and cashflow. But the global pandemic and social distancing have severely disrupted its events related businesses. Group sales over 2020 of £1.66 billion contrast with a total of nearly £2.9 billion in 2019.

For investors, ongoing Covid related uncertainty cannot be overlooked. Additional costs to run exhibitions, albeit shared with venue operators, are likely to be suffered going forward. And a move to virtual events for some industries may see them continue to shun physical events in future.

That said, rebooking of events to 2022 is said to be strong. Growth at its media subscriptions business is also countering some of the downturn at events, while Informa’s solid track record gives reason for a degree of future confidence. In all, and with the share price sat below analysts’ estimate of fair value at around 608p per share, investors might view the shares as one for the longer term.

Positives:

- Subscription sales proving resilient

- A previously strengthened balance sheet

Negatives:

- Suspended dividend payment

- Uncertain outlook for events business given the pandemic

The average rating of stock market analysts:

Buy

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.