ii SIPP Index Q3 2024: how are pension savers investing?

Gilts rise in popularity, and men and women are neck and neck with their investing returns.

14th November 2024 14:08

by Camilla Esmund from interactive investor

interactive investor, the UK’s second-largest investment platform for private investors, has launched the latest iteration of its ii SIPP (Self-invested Personal Pension) index, covering Q3 2024.

- Invest with ii: What is a SIPP? | Is a SIPP right for me? | SIPP Cashback Offers

Launched earlier this year, the SIPP Index comes at a vital time for pension savers. With many of us increasingly reliant on investing to fund our retirement, the data released today explores how interactive investor SIPP customers are investing and positioning their pension portfolios. The data compares how customers invest both before retirement, when they are accumulating wealth, and after retirement once they are in drawdown.

You can download the full researchhere.

Summary of key findings for Q3 2024:

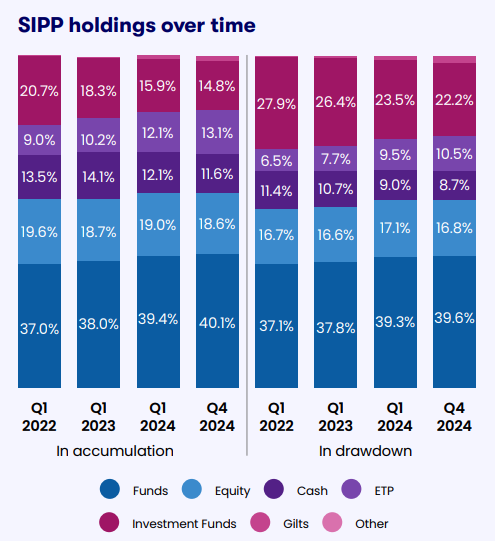

- SIPP customers continued to favour passive tracker funds, increasing their allocations to exchange-traded-funds, with a passive fund taking the top spot for holdings among customers in accumulation

- SIPP customers reduced their holdings of investment trusts and cash, instead increasing their holdings of ETFs, funds, and individual gilts

- Gilt investing is increasingly popular, with SIPP customers in drawdown now allocating 1.9% of their holdings to individual gilts compared to 0.2% in Q1 2022

- Money market funds gained in popularity, entering the top 10 holdings for both customers in accumulation and drawdown

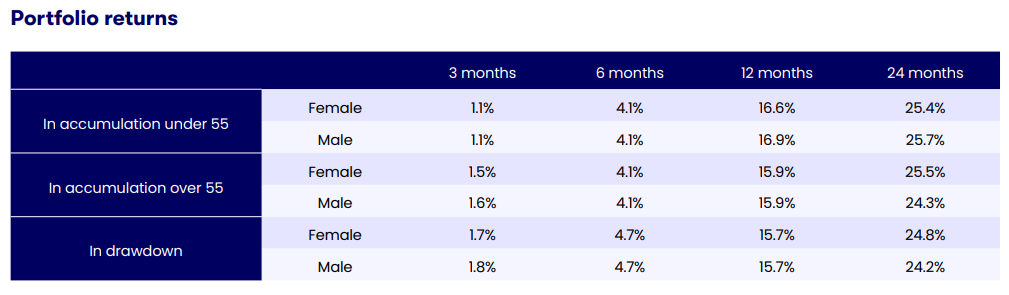

- Both male and female SIPP customers enjoyed strong performance over the last two years. Male customers under 55 slightly outperformed female customers, while female customers over 55 slightly outperformed men the same age.

Source: interactive investor

Gilts continue to rise in popularity for SIPP investors

Sam Benstead, Fixed Income Lead at interactive investor, says, “Gilts continue to be popular among ii customers. They give investors a fixed return, backed by the UK government, and are therefore a very useful defensive investment for SIPP accounts.

“This year saw the introduction of IPOs on gilts at ii, which may have contributed to the increased trading activity in 2024. But consistently high yields could also have been a factor, with 10-year gilts offering around 4% for most of 2024, and shorter gilts hitting highs of around 4.6% at the start of the year.

“The most popular gilts in SIPPs mature soon, including TR25, TN25 and TN28. There are some popular longer-dated gilts as well, including TG61 and T42. These gilts will be more volatile due to their longer maturity dates (2061 and 2042).

“SIPP assets in money market funds also continue to grow. Similar to gilts, they are a ‘cash-like’ investment that can be held inside the tax wrapper. But there are some key differences to understand.

“Yields on money market funds closely track the Bank of England base rate, this means that although they are around 5% currently, they are set to fall as interest rates drop. On the other hand, gilts allow investors to lock in the ‘yield-to-maturity' of the bond, which is the predicted total return when accounting for the coupons and redemption value of the gilt.

“Royal London Short Term Money Market is consistently the most popular money market fund in SIPP portfolios.”

Source: interactive investor

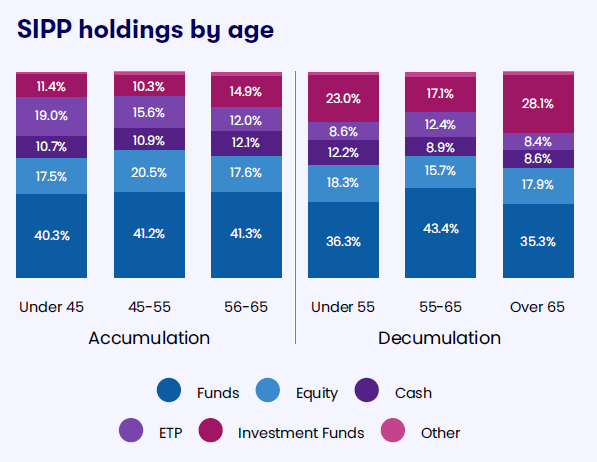

Myron Jobson, Senior Personal Finance Analyst, says, “As pension savers approach retirement, they are making subtle changes to their investment strategy. Those in drawdown tend to invest in less individual equities and hold slightly lower cash balances than those in accumulation, instead opting for more investment trusts and gilts.”

“With many of us living for years in retirement, it’s encouraging to see so many customers remaining invested through this period of their life. Making the most of investment compounding is one of the best ways to insulate your wealth from the impact of long-term inflation.

“Funds are the most in-demand investment vehicle across all age groups, with investment trusts remaining extremely popular with older investors. Meanwhile, exchange-traded funds (ETPs or ETFs) are gaining popularity, particularly with younger investors who want to be able to own the whole market in an affordable way.”

Source: interactive investor

Men and women tied when it comes to portfolio performance

Camilla Esmund, Senior Manager, interactive investor, says: “There is still a staggering gender pensions gap, but we know that when women invest, they do very well. It’s brilliant to see both men and women enjoying stonking portfolio performance during the recent bull market.

“Despite subtle differences in allocations, men and women are almost neck and neck when it comes to investing returns. The recent performance is a valuable reminder of the potential opportunities that come with patient, long-term investing. Stock market volatility means some years can deliver outsized rewards, and it’s vital to remain invested to make the most of those opportunities.

“With pensions rarely far from the news, the last two years have seen three prime ministers, four chancellors and continuing economic uncertainty. Yet, many customers have seen stellar performance over the same period as they continue to benefit from steady and patient investing and a well-diversified portfolio.”

Notes to Editors

Glossary

Accumulation: Customers who have not yet taken income from their SIPP but may have taken a tax-free lump sum

Drawdown: Customers who have taken income from their SIPP

Returns: Trailing returns including dividend income ii customer performances quoted are median values to avoid the influence of outlier performance skewing the data. The performance is calculated using the Time Weighted Rate of Return with returns calculated before each money transaction, then the results compounded over the reporting period. The time-weighted rate of return (TWR) is a measure of the compound rate of growth in a portfolio. It eliminates the distorting effects on growth rates created by inflows and outflows of money.

Then median averages are calculated independently for each group we analysed – so that outlier performances did not skew the results.

Index performance, unless otherwise stated, is ii using Morningstar, total return in GBP, to end September 2024.

Source: interactive investor - index performance: Morningstar Total Returns (base currencies) to 31 September 2024

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.