ii investment performance review 2024

In 2024, Trump secured a return to the White House and Labour won power in the UK election, while AI and the Magnificent Seven continued to lead the market. We round up the headlines and data for the year.

14th January 2025 14:48

Market round-up

2024 was another year of strong performance for equities as the MSCI ACWI rose 19.59%, while fixed income returns although positive, paled in comparison as the Bloomberg Global Aggregate Index rose 0.07% over the period.

Continuing on from 2023, technology stocks, semiconductors and those exposed to artificial intelligence (AI) in particular continued to lead the market although there were indications that investors had begun to reassess their lofty expectations for AI; as returns broadened out into other sectors as economic momentum in the US continued to feed through.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Despite the US economy continuing to gather momentum throughout the year, there were recession fears at times as indications of a softening US market emerged in Q3, which saw the Federal Reserve respond with a 50-basis point (bps) rate cut in September, kick-starting its rate-cutting cycle. The Fed Funds Rate was cut three times in the second half of 2024 from a target range of 5.25%-5.50% to 4.25%–4.50% by year end.

US inflation, however, despite hovering just above target, remains sticky, which has lowered the number of rate cuts expected in 2025. Last year also saw a Trump victory in the US presidential elections along with a Republican sweep of both chambers of Congress with expectations that lower taxes and deregulation to boost growth will be central to the incoming administration's agenda.

After entering a technical recession in the latter half of 2023, the UK saw a rebound in early 2024 although there were indications this could be short-lived as the unemployment rate began to tick up and the UK seeing no growth in Q3. Last year also saw inflation in the UK continue to decline, falling to 2% in May and then fluctuating around that level as the Bank of England began its rate-cut programme in August.

The UK also had its general election in July, which the Labour Party won by a landslide, boosting UK equities and bonds. However, this positivity faded with the Autumn Budget that included increases to national insurance contributions by employers, dampening business sentiment and the macroeconomic outlook.

In contrast to the US, European economic momentum weakened throughout the year with manufacturing being worst hit due to subsidised competition from China, lower demand and higher energy costs. Economic momentum was further stifled by political instability in France and Germany, where political consensus cracked due to the rise of populist parties and the worsening fiscal outlook. Against this backdrop, the European Central Bank (ECB) cut its key rate four times since June from 4.50% to 3.15% by year end, with a clear direction of travel in 2025 despite stickier than expected inflation.

China continued to struggle with an ailing property sector, faltering consumer spending and geopolitical tensions, all of which have weighed on the Chinese economic machine and battered valuations with early policy response struggling to change investor sentiment. This changed in September however, as a significant stimulus package was announced by policymakers in an attempt to restart the spluttering economy, and this appeared to sway the market.

Note: all returns are quoted on a sterling basis unless otherwise stated.

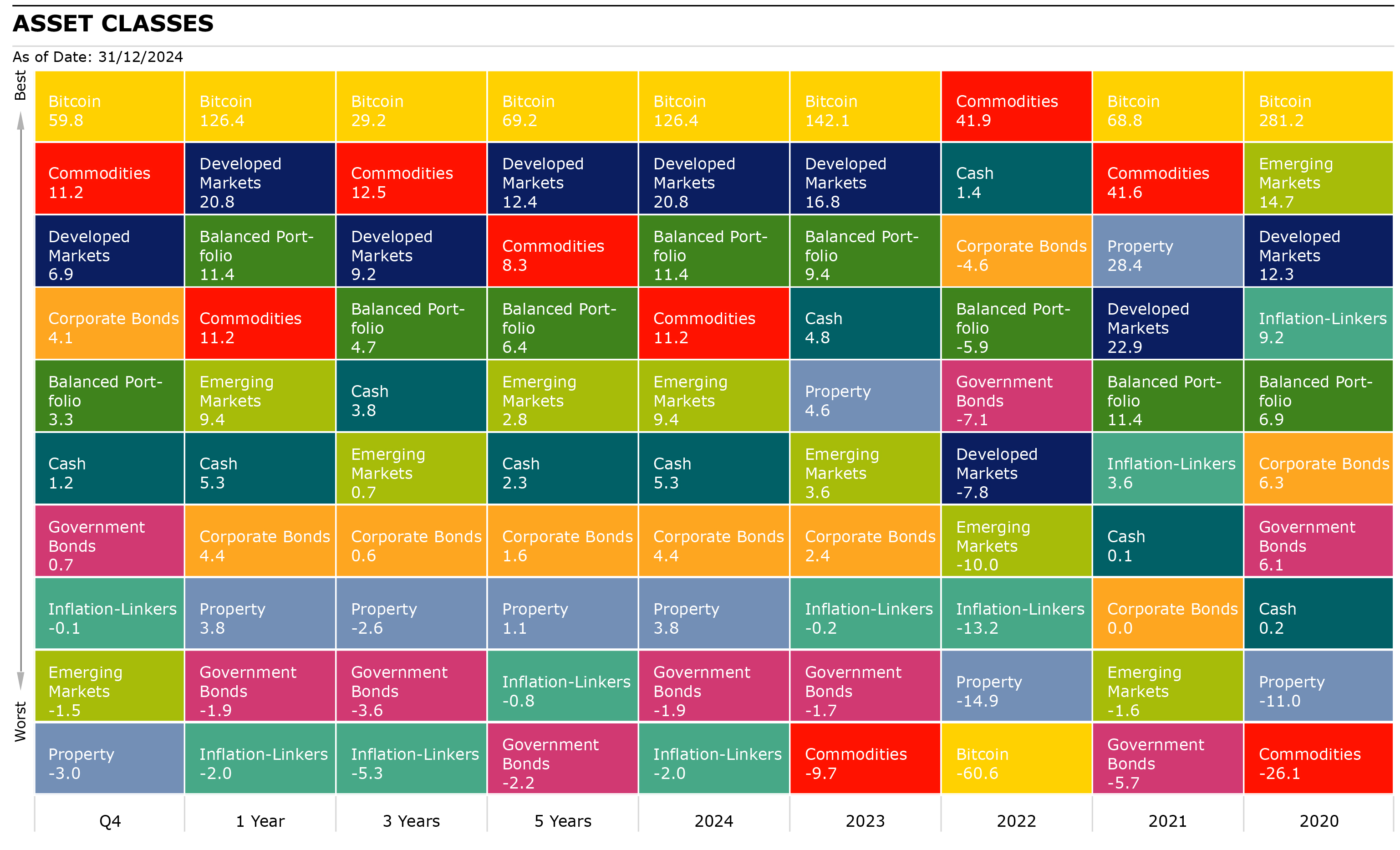

Source: Morningstar as of 31 December 2024. Total Returns in GBP. Developed Markets: MSCI World, Emerging Markets: MSCI EM, Corporate Bonds: Bloomberg Global Aggregate Corporate, Commodities: S&P GSCI, Property: FTSE EPRA Nareit Developed, Inflation-Linkers: Bloomberg Global Inflation Linked, Government Bonds: Bloomberg Global Treasury, Bitcoin: MarketVector Bitcoin, Balanced Portfolio: FTSE UK Private Investor Balanced, Cash: SONIA Lending Rate.

Equities

Global equities rose 19.59% in 2024, up from 15.31% in 2023, with returns driven by developed markets, which grew 20.79% versus emerging markets, which were up 9.43% for the year.

US equities shone once again as the S&P 500 returned 27.26% for the year, up from 2023 when it rose 19.17%, with communication services (42.3%) and IT (38.9%) continuing to lead the market as AI was a tailwind for those with exposure to it. 2024 also saw the broadening out of returns from AI stocks as all sectors saw positive returns with consumer discretionary (32.2%), financials (32.2%), utilities (24.5%), industrials (19.0%) and consumer staples (16.0%) all registering double-digit returns.

Despite slowing economic growth and a dampening economic outlook, UK equities as measured by the FTSE All-Share index rose 9.47% for the year as all but four sectors saw double-digit returns, with financials (24.2%), industrials (12.6%) and consumer discretionary (11.5%) leading the way. Basic materials (-11.1%), energy (-3.6%) and utilities (-0.1%) delivered negative returns with rate cuts no doubt providing respite for many companies, especially small-caps.

- Fund manager predictions for US, UK and other markets in 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

European equities were the major laggard among equity regions having risen a measly 1.94% for the year, despite multiple rate cuts, as the region struggled with slowing economic momentum, political instability and the threat of trade wars as a result of Trump’s election win. The biggest detractors were consumer staples (-17.6%), energy (-15.8%) and materials (-5.7%), while financials (16.2%), communication services (9.0%) and industrials (8.5%) were the main contributors to positive returns.

In Japan, the Topix closed the year up 9.99% as the Tokyo Stock Exchange’s corporate governance reforms, which brought much interest to the market in 2023, continued throughout the year with foreign inflows helping the market rally. Last year also saw the continued depreciation of the yen against major currencies, eventually resulting in the Bank of Japan raising its interest rate, which, coupled with weaker economic data out of the US in August, culminated in the unwinding yen carry trade and bringing a brief but significant level of volatility in Japanese and wider global equities.

The best-performing areas of the market were banks (38.5%), financials ex banks (35.8%) and retail trade (12.9%), while transportation & logistics (-8.3%), raw materials and chemicals (-5.1%), and power & gas (-2.7%) detracted the most.

Emerging markets rose 9.43% in 2024 with big EM constituents such as Taiwan (36.8%), China (21.6%) and India (13.2%) being predominant drivers of returns, while the major detractors were South Korea (-22.0%) and Brazil (-28.6%). Taiwan benefited from the continued AI tailwind, while Chinese equities saw cautious flows from foreign investors due to attractive valuations, boosted by the raft of stimulus measures announced by Chinese policymakers in September. Brazil underperformed due to concerns on economic growth, fiscal policy and rising inflation, which caused a reversal in the easing of interest rates.

| 1 year | 3 years | 5 years | |

| India | 13.20 | 10.18 | 13.79 |

| TOPIX Japan | 9.99 | 6.09 | 5.94 |

| World Value | 12.74 | 7.38 | 7.62 |

| FTSE 100 | 9.66 | 7.41 | 5.36 |

| China | 21.56 | -3.62 | -2.35 |

| FTSE All Share | 9.47 | 5.83 | 4.81 |

| Emerging Markets | 9.43 | 0.67 | 2.85 |

| FTSE Small Cap | 10.66 | 0.69 | 6.12 |

| S&P 500 | 27.26 | 11.82 | 15.82 |

| Asia Pacific Ex Japan | 12.12 | 1.82 | 4.18 |

| MSCI ACWI | 19.59 | 8.22 | 11.31 |

| World | 20.79 | 9.15 | 12.42 |

| Brazil | -28.52 | 4.78 | -5.53 |

| FTSE 250 | 8.14 | -1.18 | 1.49 |

| World Growth | 26.45 | 8.51 | 14.35 |

| Europe Ex UK | 1.94 | 2.64 | 6.29 |

Source: Morningstar as of 31 December 2024. Total Returns in GBP. MSCI ACWI World Indexes. Past performance is not a guide to future performance.

Sectors/Style

Stylistically, global growth outperformed global value as it rose 26.45% over the year, while value rose 12.74%.

From a global sector perspective, the best performers were IT (33.9%), communication services (33.9%), financials (26.5%) and consumer discretionary (22.5%) with materials being the only sector seeing negative returns (-6.5%).

Given the US makes up two-thirds of the global equity market it should not be surprising that returns have also broadened out into other sectors at the global level too, with only materials and industrials failing to post higher returns than in 2023.

Global large-caps continue to dominate smaller companies as they returned 21.14% for the year, while global mid and small-caps returned 11.44% and 9.59% respectively. There are regional variations, however, such as the UK, where small-caps (10.7%) outpaced large (9.7%) and mid-caps (8.1%), and in Europe where mid-caps (5.0%) outperformed large (1.3%) and small-caps (-1.9%).

| 1 years | 3 years | 5 years | |

| Energy | 3.47 | 15.38 | 7.86 |

| Communication Services | 33.92 | 8.12 | 11.05 |

| Financials | 26.54 | 11.89 | 10.39 |

| Health Care | 2.88 | 2.05 | 7.00 |

| Materials | -6.45 | -0.49 | 5.99 |

| Industrials | 14.28 | 8.75 | 10.20 |

| Consumer Discretionary | 22.49 | 4.67 | 10.81 |

| Information Technology | 33.94 | 14.00 | 21.86 |

| Consumer Staples | 5.94 | 2.54 | 4.84 |

| Utilities | 13.82 | 5.02 | 5.29 |

Source: Morningstar as of 31 December 2024. Total Returns in GBP. MSCI ACWI World Indexes. Past performance is not a guide to future performance.

Fixed Income

The Bloomberg Global Aggregate Index rose 0.07% as major central banks begun their rate-cutting programmes over 2024, with the European Central Bank beginning in June as an economic slowdown was more apparent, followed by the Bank of England in August and the Federal Reserve in September.

Despite rate cuts, rises in long-dated government bond yields were seen due to political instability, fiscal pressures, the threat of trade wars and fewer than expected rate cuts in 2025, due to inflation expectations as a result of fiscal policies.

- Bond Watch: what the gilt sell-off means for your money

- Bond Watch: Bank of England expects four rate cuts in 2025

In the UK, markets reacted negatively to the new Labour government’s Autumn Budget as Chancellor Rachel Reeves announced £40 billion worth of tax increases with borrowing also expected to increase, which caused UK 10-year government yields to rise from 3.54% to 4.57% in 2024. There are also inflationary concerns off the back of the Autumn Budget, which has dampened the possibility of further rate cuts.

In the US, there were concerns over potential inflationary policies with an incoming Trump administration and a Republican sweep of Congress as the US saw an unexpected uptick in inflation leading to an increase in US 10-year yields from 3.86% to 4.58% over the year. Despite the Fed having cut their target rate three times in 2024, they have signalled fewer rate cuts in the future due to inflationary concerns.

Overall, riskier assets outperformed as high-yield bonds rose 11.14% outperforming investment-grade counterparts (3.0%), and global corporates outperformed global treasuries including in the UK, Europe and US.

| Q4 | 1 year | 3 years | 5 years | |

| Global High Yield | 6.71 | 11.14 | 5.54 | 4.44 |

| Sterling Corporate | -0.44 | 1.74 | -3.13 | -0.99 |

| EURO Corporate | 0.17 | -0.25 | -1.49 | -0.76 |

| Global Corporate | 4.11 | 4.41 | 0.64 | 1.62 |

| Global Aggregate | 1.64 | 0.07 | -1.99 | -0.85 |

| Global Government | 0.68 | -1.85 | -3.57 | -2.16 |

| UK Gilts | -3.10 | -3.32 | -8.60 | -4.75 |

| Global Inflation Linked | -0.08 | -2.02 | -5.33 | -0.81 |

| UK Inflation Linked | -5.93 | -8.59 | -15.52 | -6.95 |

Source: Morningstar as of 31 December 2024. Total Returns in GBP. Global Aggregate: Bloomberg Global Aggregate, Global Government: Bloomberg Global Treasury, UK Gilts: FTSE Act UK Conventional Gilts All Stocks. Global Corporate: Bloomberg Global Corporate, Sterling Corporate: ICE BofA Sterling Non-Gilt, Euro Corporate: Markit iBoxx EUR, Global High Yield: Bloomberg Global High Yield, Global Inflation Linked: Bloomberg Global Inflation Linked, UK Inflation Linked: Bloomberg Global Inflation Linked UK. Past performance is not a guide to future performance.

Alternatives

The S&P GSCI rose 11.20% in 2024 led by precious metals (28.4%) and livestock (22.0%) and all sectors closed the year with positive returns. The relative underperformers were agriculture (2.2%) and industrial metals (4.7%).

Within precious metals, gold and silver rose 28.4% and 22.8% respectively, while palladium fell 15.3%. In agriculture, cocoa and coffee were the bright spots due to high demand and poor harvests, while soybeans, wheat and cotton all saw double-digit declines.

| Q4 | 1 year | 3 years | 5 years | |

| Volatility | 11.07 | 41.85 | 2.90 | 8.04 |

| Brent crude oil | 14.39 | 12.36 | 17.44 | 10.89 |

| Commodity | 11.18 | 11.20 | 12.53 | 8.33 |

| Energy | 15.14 | 11.86 | 17.05 | 6.25 |

| Global Natural Resources | -5.50 | -6.66 | 4.43 | 7.02 |

| Cash | 1.23 | 5.27 | 3.82 | 2.32 |

| Gold | 5.51 | 28.86 | 15.76 | 12.64 |

| UK REITs | -14.67 | -11.67 | -12.67 | -6.31 |

| Global REITs | -3.02 | 3.82 | -2.59 | 1.10 |

| Global Infrastructure | 4.45 | 17.15 | 9.89 | 6.47 |

| Bitcoin | 59.77 | 126.37 | 29.21 | 69.23 |

Source: Morningstar as of 31 December 2024. Total Returns in GBP. Global REITS: FTSE EPRA Nareit Developed, UK REITs: FTSE EPRA Nareit UK, Gold: LBMA Gold Price AM, Oil: Oil Price Brent Crude, Global Infrastructure: S&P Global Infrastructure, Natural Resources: S&P Global Natural Resources, Commodities: S&P GSCI , Energy : S&P GSCI, Volatility: CBOE Market Volatility (VIX), Cash: SONIA Lending Rate, Bitcoin: MarketVector Bitcoin. Past performance is not a guide to future performance.

Most-traded shares on the ii platform in 2024

Most-bought shares on ii platform in 2024

| NVIDIA Corp (NASDAQ:NVDA) |

| Legal & General Group (LSE:LGEN) |

| BP (LSE:BP.) |

| Tesla Inc (NASDAQ:TSLA) |

| Rolls-Royce Holdings (LSE:RR.) |

Most-sold shares on ii platform in 2024

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.