Ian Cowie: winners and losers in my ‘forever fund’ in third quarter

7th October 2021 10:18

by Ian Cowie from interactive investor

Our columnist reports on his personal experience as a DIY investor over the past three months.

After a fabulous first half of 2021 the third quarter (Q3) saw the post-pandemic panic stock market bull run take a bit of a breather. The three months to the end of September saw mixed returns from global markets and the investment trusts in my ‘forever fund’ followed suit.

Six of my 19 investment trusts lost money during Q3, compared to five losers in the previous quarter. On a brighter note, four of those whose prices fell during Q2 managed to deliver positive total returns during the last quarter.

Nine of my investment trust shares beat the Association of Investment Companies (AIC) average return of just under 2.6% during Q3. That compared with an industry-wide average return of 6.5% during Q2, according to independent statisticians Morningstar via the AIC.

Before getting into the detail, it is worth emphasising the intention of this quarterly review is not to brag or suggest that I am doing better than anyone else. The aim is to report the personal experience of one DIY investor, seeking to avoid poverty in old age by means of a diversified portfolio of investment companies and other shares.

- Top 10 most-popular investment trusts: September 2021

- The 10 trusts that have raised the most money in 2021

- Fund Finder: the key differences between funds and investment trusts

The full list of my holdings can be found at the bottom of this article.

The losers

Let’s get the pain out of the way before the pleasure. BlackRock Latin American (LSE:BRLA) was Q3’s standout stinker, losing more than 14% of its value. That more than wiped out the 13% positive return it delivered in Q2. Volatility is to be expected in emerging markets but this one is testing my patience. No wonder City wags joke that Brazil is the country of tomorrow - and always will be.

Aberdeen Standard European Logistics Income (LSE:ASLI) was more disappointing because its woes were self-inflicted. After a satisfactory 11% positive return during Q2, ASLI’s discounted rights issue last month caused its market price to fall sharply, leaving shareholders with a negative return of minus 5.8% in Q3.

Most disappointingly,Worldwide Healthcare (LSE:WWH) fell by nearly 5.5% during the last quarter and remains almost 3% down over the last year. This matters to me because WWH is one of my top 10 shares by value. However, it remains 78% up over the last five years and I remain hopeful that it will return to form, not least because of the long-term trend towards rising demand for healthcare.

JPMorgan US Smaller Companies (LSE:JUSC) was the only loser from Q2, when it was 0.6% down, that also shrank in Q3, when it fell by nearly 3.5%. My forever fund’s other more marginal losers in the last quarter were JPMorgan Mid Cap (LSE:JMF), down 2.5%, and Gore Street Energy Storage (LSE:GSF), which slipped 1.8% lower.

The winners

Sad to say, I can’t claim much credit for the forever fund’s two biggest winners in Q3 because Tufton Oceanic Assets (LSE:SHIP), which soared by 22%, and India Capital Growth (LSE:IGC), 13% better, were only added to the portfolio on August 2 and September 10, respectively. However, it is always reassuring to start with positive returns and, even over this very short period, I am currently 11% ahead aboard SHIP and 2% up with IGC, with hopes of more to come.

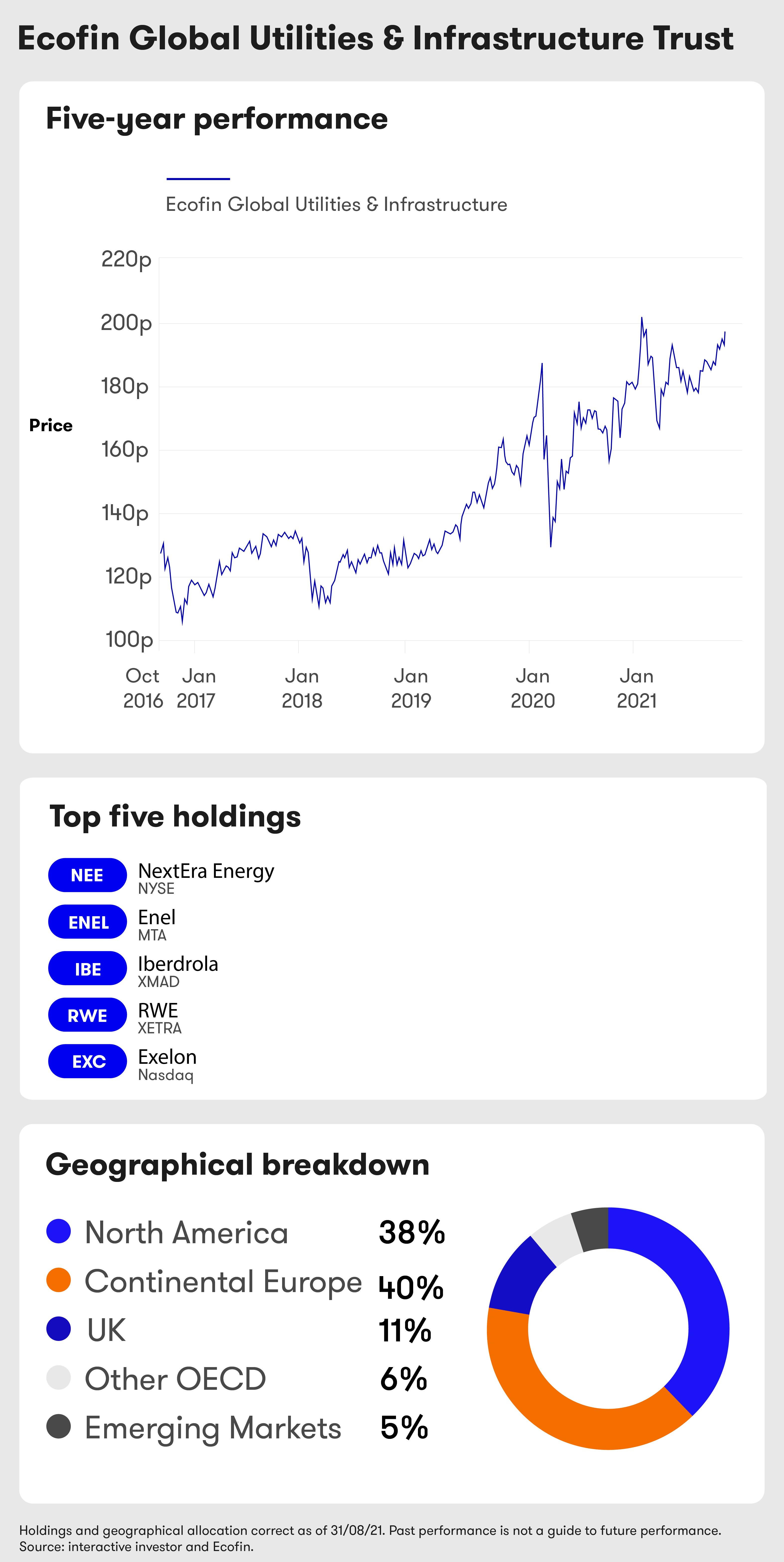

Ecofin Global Utilities (LSE:EGL) led the way among shares held continuously during Q3 with total returns of nearly 12%. I first bought shares in EGL in September, 2019, and am 22% ahead with a running yield of 3.4%.

JPMorgan Indian (LSE:JII) was next best with a total return of more than 11% during Q3. This was my first ten-bagger, after I first invested a quarter of a century ago, and remains close to my wallet. I expect the world’s biggest democracy to continue to benefit from problems in the world’s most populous country, as the cold war between America and China displaces economic activity away from the latter.

Baillie Gifford Shin Nippon (LSE:BGS) is another long-term Asian holding. More than a decade after I first bought shares in this Japan smaller companies specialist, I am glad to see it recovering from a recent fallow period. BGS suffered a 3.4% loss in Q2 but bounced back with a 7.6% positive return in Q3.

Schroder UK Public Private Trust (LSE:SUPP) bounced back even more strongly. After shrinking by 9.6% in Q2, this UK biotechnology specialist grew by 5.2% in Q3 on early signs that some of its start-ups may be maturing. However, those of us who invested at launch in April 2015, remain nearly two-thirds in down.

- Read more articles by Ian Cowie here

- Energy crisis: investor Q&A and share tips

- Subscribe to the ii YouTube channel for our latest interviews

European Assets (LSE:EAT), a recent addition to the ‘forever fund’ on August 23, and International Biotechnology Trust (LSE:IBT) were the other holdings that beat the AIC industry average with returns of 3.3% and 3%, respectively.

Northern 2 VCT (LSE:NTV), Polar Capital Technology (LSE:PCT) and sterling-denominated shares in US Solar Fund (LSE:USF) delivered marginally positive total returns.

Nick Britton, head of intermediary communications at the AIC, said: “After a very strong first half-year, the third quarter of 2021 was more mixed, with plenty of downs as well as ups.

“Worries about Chinese corporate debt and government policies dominated the quarter, with the China sector down 25%. Conversely, India staged a comeback as Covid-19 case numbers began to recede, with the sector returning 13.1%. Other sectors performing well included Leasing (up 14.8%), Growth Capital (13.7%) and Private Equity (10.2%).”

All things considered, I am glad to have dodged the worst of the last quarter’s setbacks - having sold all my China shares in 2020, as reported here at that time. Looking forward, I continue to believe a diversified portfolio of investment trusts should minimise risks and maximise returns whatever the future holds.

Ian Cowie’s ‘forever fund’

This is a complete list of Ian Cowie’s stock market investments as of 30 September 2021. It is not financial advice nor is any recommendation implied. Share prices can fall without warning and you might get back less than you invest.

| Holding | Ticker | Sector* or industry |

| International Biotechnology | LSE:IBT | * AIC Biotechnology & Healthcare |

| Worldwide Healthcare | LSE:WWH | * AIC Biotechnology & Healthcare |

| Vietnam Enterprise Investments Limited | LSE:VEIL | * AIC Country Specialist |

| European Assets | LSE:EAT | * AIC European Smaller Companies |

| Schroder UK Public Private Trust | LSE:SUPP | * AIC Growth Capital |

| India Capital Growth | LSE:IGC | * AIC India |

| JPMorgan Indian | LSE:JII | * AIC India |

| Ecofin Global Utilities & Infra | LSE:EGL | * AIC Infrastructure Securities |

| Baillie Gifford Shin Nippon | LSE:BGS | * AIC Japanese Smaller Companies |

| JPMorgan Japan Small Cap Growth & Income | LSE:JSGI | * AIC Japanese Smaller Companies |

| BlackRock Latin American | LSE:BRLA | * AIC Latin America |

| Tufton Oceanic Assets | LSE:SHIP | * AIC Leasing |

| JPMorgan US Smaller Companies | LSE:JUSC | * AIC North American Smaller Companies |

| US Solar Fund | LSE:USF | * AIC Renewable Energy Infrastructure |

| Polar Capital Technology | LSE:PCT | * AIC Technology & Media |

| JPMorgan Mid Cap | LSE:JMF | * AIC UK All Companies |

| Northern 2 VCT | LSE:NTV | * AIC VCT Generalist |

| Aberdeen Standard European Logistics Inc | LSE: ASLI | *AIC Property - Europe |

| Deere & Co | NYSE:DE | Agricultural equipment |

| Archer-Daniels Midland Co | NYSE:ADM | Agriculture commodities |

| Antofagasta | LSE:ANTO | Basic materials |

| BHP Group | LSE:BHP | Basic materials |

| Givaudan SA | SIX:GIVN | Basic materials |

| Helium One Global | LSE:HE1 | Basic materials |

| Versarien | LSE:VRS | Basic materials |

| Chapel Down Group | CDGP** | Beverages |

| Diageo | LSE:DGE | Beverages |

| Fevertree Drinks | LSE:FEVR | Beverages |

| Heineken | EURONEXT:HEIO | Beverages |

| Verizon | NYSE:VZ | Communications |

| Fuller Smith & Turner A | LSE:FSTA | Food and beverages |

| Nestle | SIX:NESN | Food and beverages |

| Unilever | LSE:ULVR | Food, personal and household goods |

| Dignity | LSE:DTY | Funerals |

| Essilorluxottica | MTA:EL | Healthcare |

| Smith & Nephew | LSE:SN | Healthcare |

| Sonova Holding | SIX:SOON | Healthcare |

| Nintendo | NTDOY | interactive Home Entertainment |

| Carnival | LSE:CCL | Leisure travel |

| Royal Dutch Shell | LSE:RDSB | Oil and gas |

| Reckitt Benckiser | LSE:RKT | Personal and household goods |

| Novo Nordisk | NOVO | Pharmaceutical |

| Pfizer | NYSE:PFE | Pharmaceutical |

| McDonald's | NYSE:MCD | Restaurant |

| adidas AG | XETRA:ADS | Retail |

| Apple Inc | NASDAQ:AAPL | Technology |

| ITM Power | LSE:ITM | Technology |

| Orsted | ORHE | Utilities |

* AIC stands for Association of Investment Companies.

**available to trade on the ii platform under the ticker CDGP.

Ian Cowie is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.