Ian Cowie: three trusts built to survive war and recession

For investors seeking diversification and less risk, our new columnist names the trio he’d buy.

16th April 2020 09:13

by Ian Cowie from interactive investor

For investors seeking diversification and less risk, our new columnist names the trio he’d buy.

What a roller coaster 2020 has been so far, but how can stock market investors ride it out for happy returns?

The MSCI World Index plunged by more than 25% from its peak in February to its trough in March before bouncing 16% to its level now; down 10% year-to-date.

Wow. Now the American corporate earnings season is revealing how much of a cold the world’s biggest economy has caught from the coronavirus crisis.

The Standard & Poor’s 500 - a broad measure of the US markets - plunged 34% from peak to trough, then climbed 25% to close at 2,790, ahead of the Bank Holiday. A gain of 12% in that four-day week was the strongest seen since 1974 and left the S&P trading about 18% below February’s record high.

Extreme volatility - or, in plain English, stock market shocks - make life difficult for investors, but may remind us of financial facts of life easily forgotten in more stable, less challenging times. For example, diversification is the simplest and surest way to diminish the risk inherent in shares.

Global investment trusts are a tried and tested way to spread your money over many different companies, countries and currencies. Many also offer savings schemes which make it easy to drip feed money into markets and reduce the risk of bad timing or investing a lump sum just before prices fall.

Better still, global investment trusts’ lower risk profile need not mean lower returns. While all types of conventional investment trust - that is, excluding venture capital trusts - suffered average shrinkage of 8% over the last year after total returns of 26% over five years and 121% over the last decade; the average total returns from the global sector were consistently higher at 1.7%; 71% and 203% over the same periods, according to independent statisticians at Morningstar.

Even better, if you believe in reversion to mean theory - or a return to form - this might be a good time to buy the top-performer in this sector over both the last five and 10-year periods because it has suffered a fallow year, with shrinkage or losses of 24% over the last 12 months.

But I won’t be buying Lindsell Train (LSE:LTI) (stock market ticker: LTI) because of its unusual underlying holdings, specifically investing half its assets in its own unlisted parent company; Lindsell Train Limited.

True, LTI has delivered spectacular returns of 179% and 657% over the last five and 10-year periods but this opaque ‘fund of fund management company’ structure requires a leap of faith from investors. So does LTI’s 22% premium to net asset value (NAV).

- Nick Train interview part 1: three big ideas

- Nick Train interview part 2: the share he really loves

- Nick Train part 3: your questions answered

Similarly, the second-best performer in the global sector, Scottish Mortgage (LSE:SMT), and the only investment trust in the FTSE 100 index, is also out-of-bounds for me because its biggest underlying holding is Tesla (NASDAQ:TSLA), the electric car-maker with a tiny output and massive stock market capitalisation.

I salute its stellar performance to date and its investors’ faith but, bearing in mind I am allocating my life savings, cannot in all conscience share either.

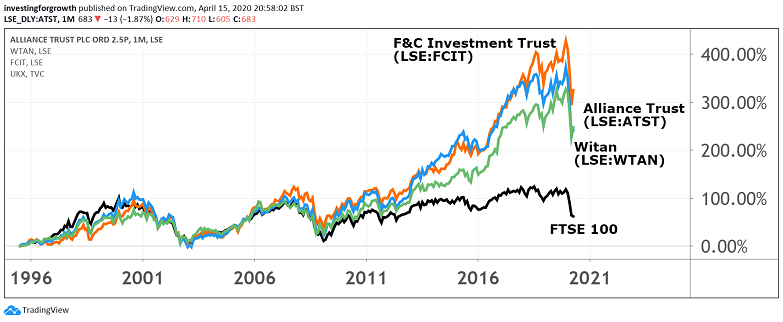

For investors seeking more diversification and less risk, I would still favour Alliance Trust (LSE:ATST); F&C Investment Trust (LSE:FCIT) and Witan (LSE:WTAN). Full disclosure: I used to be a shareholder at ATST and FCIT and also bought shares in the latter for my son, Joe.

The attractions of this triumvirate of trusts include longevity - ATST was founded in 1888; FCIT in 1868 and WTAN in 1909 - and scale; they have assets of about £2.7 billion; £4 billion and £1.8 billion respectively.

Size is no guarantee of safety but, while the global economy faces what feels like an existential threat, there is some comfort to be had in investment trusts that survived both World Wars and the Great Depression.

Source: TradingView Prices as at close of play 15 April 2020 Past performance is not a guide to future performance

Income-seekers might also be reassured by reserves sufficient to pay 2.4 years’ dividends, even if the underlying return was zero, at ATST, where the yield is 2% and payouts grew by an average of 7.3% per annum over the last five years.

If that rate of growth is maintained it would double payouts within a decade. The equivalent numbers at FCIT are 1.8 years’ cover for a yield of 1.9% with a five-year annual growth rate of 4.5%. At WTAN they are 1.9 years; 3.1% and an eye-stretching 11.7%.

Any of the above investment trusts can be seen as a relatively low-risk bet that the world will beat this bug and, eventually, become less exciting but more profitable.

Ian Cowie is a freelance contributor and not a direct employee of interactive investor.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.