Ian Cowie: six top trusts keeping their dividend promise

Our columnist names the star investment trusts protecting shareholders’ income through thick and thin.

11th June 2020 09:32

by Ian Cowie from interactive investor

Our columnist names the star investment trusts protecting shareholders’ income through thick and thin.

As part of a trial, we are encouraging readers to comment on Ian’s article by emailing interactive investor at editorial@ii.co.uk. Please add the words IAN COWIE 11 JUNE 2020 in the email subject. If successful, we will include a selection of responses in a separate regular article. Also, if readers would like Ian to cover a particular topic or sector, please email your ideas to the same address.

Despite widespread dividend cuts elsewhere, six high profile investment trusts - including Britain’s biggest - have pledged to protect income distributions to shareholders this year. That demonstrates the practical value of how this form of pooled fund - unlike more heavily promoted rivals, such as unit trusts and exchange traded funds (ETFs) - can sustain payouts and smooth returns in turbulent markets.

This is particularly important for rising numbers of people - including your humble correspondent - who aim to exercise newish pensions freedom to fund retirement from investment income. Sam Slator of the independent analysts FundCalibre, told me: "Dividend cuts are likely to be brutal this year, with some estimates going as far as a 50% drop in the UK and 30% in most other regions.

“This is when investment trusts can really come to the fore. They can build up revenue reserves in good years, so they have a buffer for leaner periods - exactly like those we are facing today.”

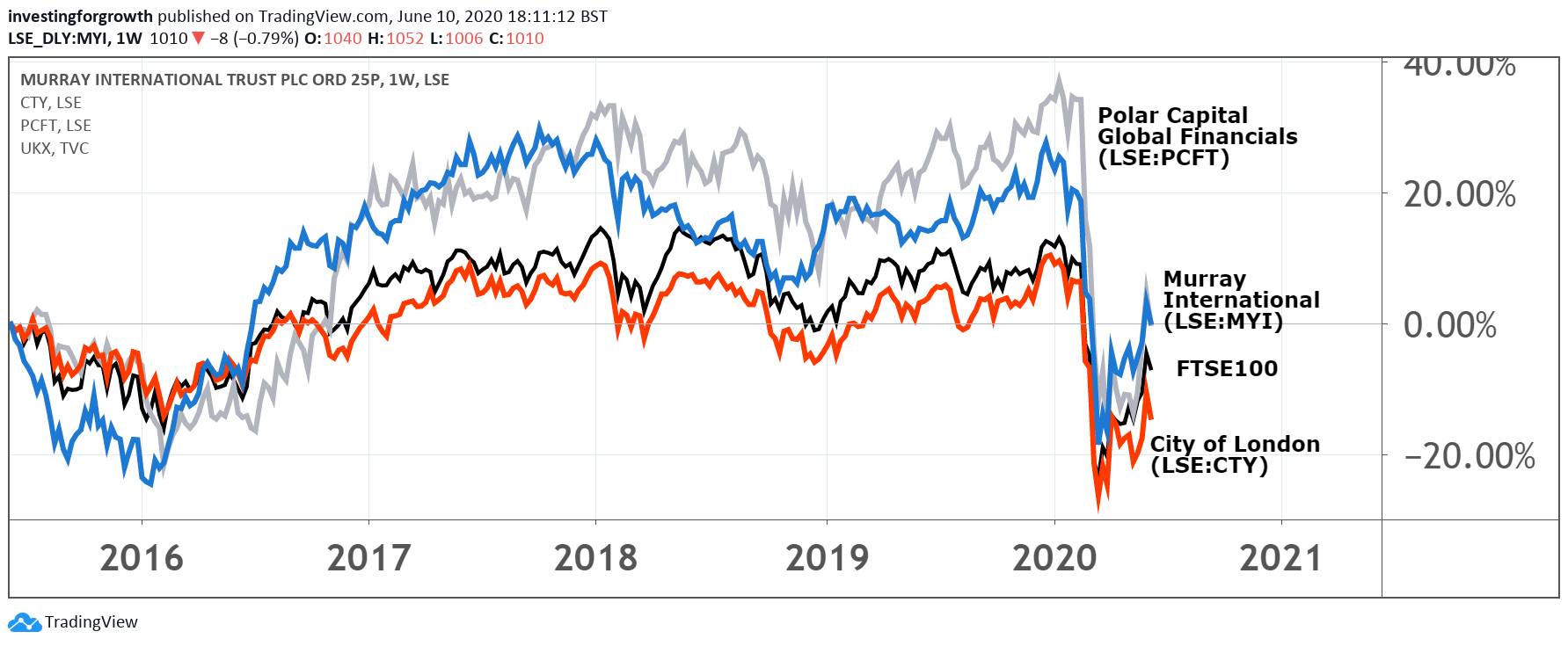

Global asset allocation and shrewd exposure to healthcare and technology stocks have helped Murray International (LSE:MYI) shelter from the coronavirus crisis. MYI fund manager Bruce Stout said: “We are relatively defensively positioned in businesses not being interrupted as much as others because people are using more data, so cash flow dynamics are good.

“The trust has been building reserves for the past 10 years and we have about 58.5p per share saved. Last year we paid out 53.5p per share, so we have a lot put away for a rainy day and this is the rainy day.”

Closer to home, City of London (LSE:CTY), a ‘dividend hero’ that has increased investors’ income every year for more than half a century, has pledged to raise its payout next month. Its chairman, Philip Remnant, explained: "In our interim report, I said that the board was confident that it would be able to increase the dividend for a 54th consecutive year.

“Over the last 10 years, have set aside over £30 million in reserves to underpin dividends in circumstances such as we face now. If this July we need to draw on those reserves to maintain our unique record of annual dividend growth, then it is our intention to do so.”

- Small-cap tips: how to invest during a recession

- Liontrust explains how its top small-cap fund is thriving

- Coming soon: More fund manager videos. Click here to subscribe

Few sectors have been hit as hard as banking, with interest rates falling to historic lows and bad debts rising. But Polar Capital Global Financials (LSE:PCFT) aims to give shareholders good news next month. The trust’s chairman, Robert Kyprianou, said: “We are aware of the importance of income to shareholders, especially at a time when many companies are cutting or suspending their dividends.

“Our company has built up reserves which may be utilised to support payments to shareholders at times when the underlying portfolio delivers lower than expected income returns.

“This is a unique feature of the investment trust structure which the board expects will enable it to maintain the dividend for the current financial year at an equivalent level to last year, with the first such declaration expected to be in July for the August payment.”

Source: TradingView. Share price performance only. Past performance is not a guide to future performance.

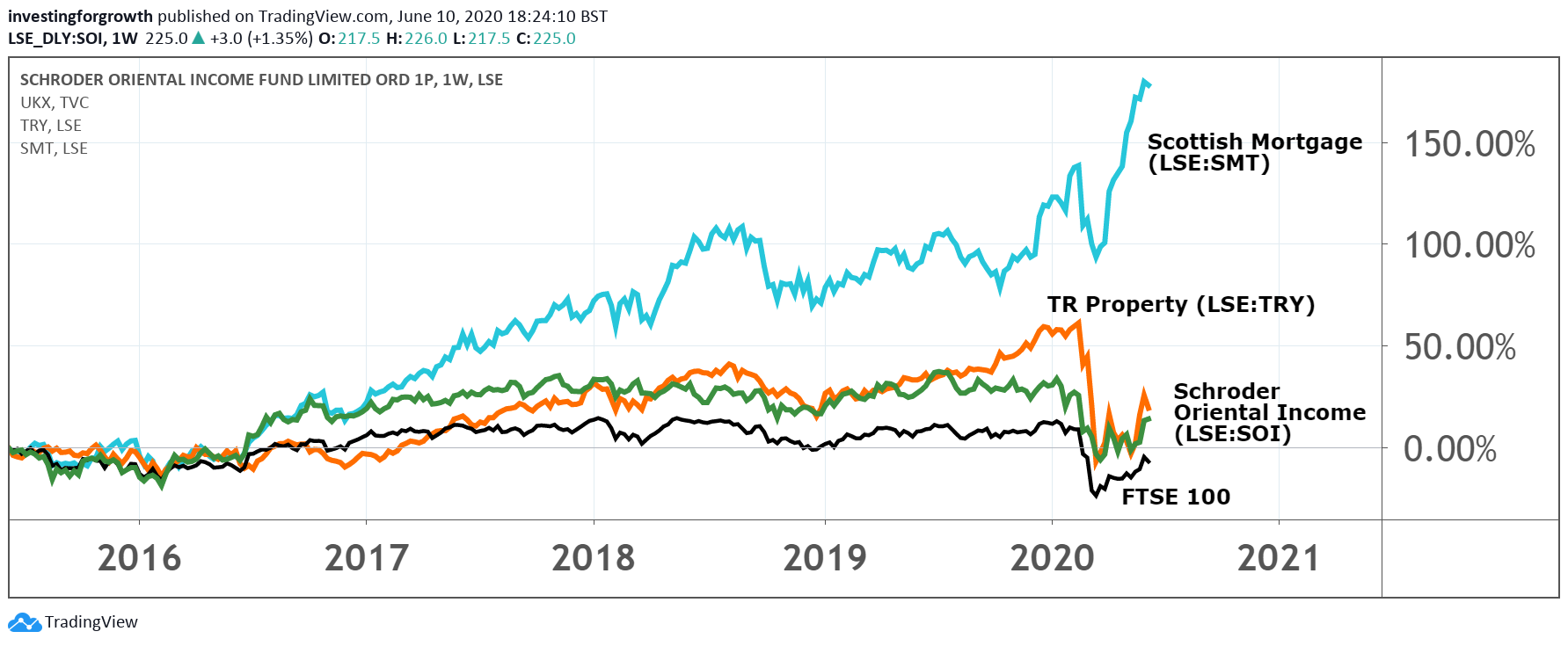

Asia is the geographical region at the eye of the coronavirus storm but Schroder Oriental Income (LSE:SOI) seems set to shelter dividends. Its manager, Matthew Dodds, told me: “We take comfort from the fact that the company’s revenue reserves are equivalent to nearly nine months’ dividends.

“This could enable us to weather any medium-term shortfall in dividends received without jeopardising our payments to shareholders. So I am optimistic that we are well-positioned to maintain our approach to payment of dividends. The dividend has not been cut in the past.”

- Stock market rally poll: too much too soon, or only the start?

- 10 stocks that pass four important dividend tests

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Commercial property is another sector that has suffered serious setbacks, with falling valuations and rising insolvencies among corporate tenants. But solid foundations should protect shareholders in TR Property (LSE:TRY), according to its manager Marcus Phayre-Mudge. He said: “Our revenue reserves total approximately 14p per share. So, if we receive no income for the whole of the year to March 2021, the board could use those reserves to pay the dividend. That's what they're there for.”

Britain’s biggest investment trust, Scottish Mortgage (LSE:SMT), is primarily focussed on capital growth but also recognises the importance of income. Its chair, Fiona McBain, explained: “We recognise that many companies are having to cut or postpone their dividends, so the income upon which many investors rely from other FTSE 100 companies may not be available in the coming months.

Source: TradingView. Share price performance only. Past performance is not a guide to future performance.

“Fortunately, Scottish Mortgage does not face the same challenges. Our long run total return continues to justify supporting shareholders who do value our modest but progressive distribution policy. The board is therefore recommending that this year, the total dividend be increased by 4% on the level of the previous year to a total of 3.25p, compared to 3.13p in 2019.”

Interestingly, there is no evidence that smoothing income during the coronavirus crisis damaged total returns. While the FTSE All Share index fell by 19% during the first five months of this year, investment trusts in that index fell by an average of 7.4%. So this particular type of pooled fund not only protected shareholders’ income but also sheltered them from more than half the capital destruction suffered elsewhere.

Ian Cowie is a freelance contributor and not a direct employee of interactive investor.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.