The Ian Cowie portfolio: how I would access this technology boom

Ian discusses three trusts that give exposure to one of the most dynamic parts of the global economy.

23rd April 2020 09:03

by Ian Cowie from interactive investor

In his latest weekly column for interactive investor, Ian discusses exposure to one of the most dynamic parts of the global economy and a robust performance by three trusts during this pandemic.

Technology is a standout winner from the war against the coronavirus and, despite existential uncertainty elsewhere, likely to remain so. There is no intention to downplay the threat to public health, but this column is tasked to write about the risks and rewards for individual wealth; including how private sector savers can hope to fund retirement.

While biotechnology and healthcare companies search for a vaccine against the virus, or some other way to control this pandemic, the digital economy that enables the public to work and play remotely is already experiencing a sharp increase in demand. Fortunately, several investment trusts have demonstrated expertise in giving everyone cost-effective access to innovatory technology we may scarcely understand.

Scottish Mortgage (LSE:SMT) (stock market ticker: SMT) is the biggest and best-known, holding total assets of £10.2 billion. While the average investment trust, excluding venture capital trusts, has shrunk shareholders’ capital by 8.7% over the last year, SMT delivered a total return of 20%.

Nor was that eye-stretching outperformance a flash in the pan. Over the last five and 10-year periods, SMT soared by 141% and 482% respectively, according to independent statisticians Morningstar, while the average trust lagged with gains of 27% and 123% respectively.

- Dividend poll: find out where investors are turning for income

- Funds Fan: dividends, Terry Smith, and Impax Environmental Markets

- Investors dump bond funds and increase exposure to UK equities

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

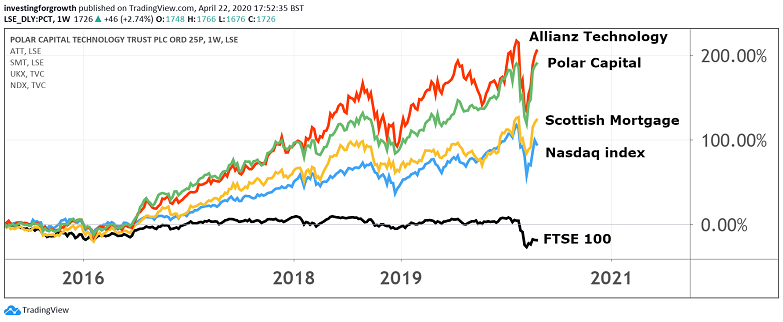

Now here’s the surprise; two specialist investment trusts that dominate the Association of Investment Companies (AIC) Technology & Media sector did as well or even better. Allianz Technology Trust (LSE:ATT) led over the last decade, with a total return of 536%, followed by 198% and 18% over the last five and one-year periods.

Meanwhile, Polar Capital Technology (LSE:PCT), in which I have been a shareholder for more than 10 years, delivered total returns of 481%, 200% and 31% respectively. No wonder it is now my second-most valuable holding.

Source: TradingView Prices as at close of play 15 April 2020 Past performance is not a guide to future performance

So it’s well worth taking a look under the bonnet to assess how these investment trusts did it and what might happen next. As briefly mentioned last week, Scottish Mortgage Investment Trust has always been too risky for me because I am allocating my life savings, and capital preservation is a priority.

More specifically, I worry about 8.6% of SMT’s assets being invested in the electric carmaker Tesla (NASDAQ:TSLA) plus another 13% in the Chinese digital giants Tencent (SEHK:700) and Alibaba (NYSE:BABA). That geographical allocation could prove costly if the American president Donald Trump follows through on threats he issued last Sunday.

He warned that China should face consequences if it was “knowingly responsible” for the coronavirus pandemic and said: “It could have been stopped in China before it started and it wasn’t, and the whole world is suffering because of it.

“If it was a mistake, a mistake is a mistake. But if they were knowingly responsible, then sure there should be consequences.”

That confounds the confidence I expressed about the Asian economy in this space earlier this month. There is a real risk that Trump will seek to punish China, especially as he prepares to contest the US presidential election on 3 November.

So I had better apologise now to anyone who followed me into the region. All I can offer in explanation is the economist John Maynard Keyes’ observation: “When the facts change, I change my mind.”

More positively, Ben Rogoff - who has managed Polar Capital Technology since 2006 - holds less than 8% of its assets in Alibaba and Tencent, with Microsoft (NASDAQ:MSFT) accounting for 10%, Apple (NASDAQ:AAPL) 6.9% and Google’s parent Alphabet another 6.8%. If there is to be a renewed trade war between both the biggest economies in the world, this shareholder draws some comfort from PCT allocating 71% of assets to America and only 15% to Asia excluding Japan.

- Ian Cowie: three trusts built to survive war and recession

- Tech investing: Polar Capital tells you how to do it successfully

- ii view: Alibaba pumping billions into cloud boom

Meanwhile, Walter Price - who has managed Allianz Technology since 2007 - holds 85% of assets in America, with only 2.8% in what Allianz describes as “Far East”. Price’s biggest holdings are Microsoft (4.7%); Amazon (NASDAQ:AMZN) (4.3%) and Netflix (NASDAQ:NFLX) (4.2%).

Interestingly, Price’s top 10 also includes lesser-known names such as CrowdStrike (NASDAQ:CRWD), MongoDB (NASDAQ:MDB) and Lam Research (NASDAQ:LRCX), which may explain ATT’s recent underperformance, compared to PCT. The latter’s second half of its top 10 is dominated by mega-cap stocks - or companies with very large stock market capitalisations - such as Facebook (NASDAQ:FB), Amazon and Samsung (LSE:SMSN).

Size is no guarantee of safety, but familiarity is a form of comfort in times of extreme uncertainty. Some 83% of PCT is allocated to companies valued at more than $10 billion, with only 16% of the fund in medium-sized stocks valued between $1 billion and $10 billion. By contrast, ATT has 70% in mega-caps and 22% in mid-caps.

Coming down from the clouds, when I transferred PCT shares into my self-invested personal pension (SIPP) in September 2013, they were priced at £4.33 each. They trade at £17.44 now.

That’s 3.6% higher than their net asset value (NAV) compared to a tiny premium of only 0.9% at ATT and a discount of 2.2% at SMT. All three trusts’ valuations look reasonable to me, given the exposure they provide to one of the most dynamic parts of the economy and their robust performance during this pandemic. The coronavirus crisis is a tragic threat to global health and wealth but it’s an ill wind that blows no good.

Ian Cowie holds shares in AAPL and PCT.

Ian Cowie is a freelance contributor and not a direct employee of interactive investor.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.