Ian Cowie: pick for my son remains a great ‘buy and forget’ option

1st September 2022 10:01

by Ian Cowie from interactive investor

Our columnist explains the enduring appeal of an investment trust he bought 20 years ago on behalf of his son.

As storm clouds gather over the global economy - and Britain feels uncomfortably exposed to various headwinds - many investors may seek proof of an investment trust’s ability to deliver good returns in bad times.

So, can you name the only investment trust out of 17 rivals in the Association of Investment Companies (AIC) ‘global’ sector that delivered top three total returns over the last decade, five and one-year periods? When you think about it, that’s quite a hat-trick.

Better still, it’s one of only three global investment trusts that managed to avoid losing money during the last difficult year, when the sector average fell by nearly 25%. Nor are today’s troubles anything terribly new for this trust, because it has survived two world wars and the Great Depression among many other setbacks.

- Find out about: Free regular investing | Interactive investor Offers | ii Super 60 Investments

Yes, you guessed, it is F&C Investment Trust (LSE:FCIT), which is also in the news because its resilience despite economic setbacks so far means that it will join the FTSE 100 index of Britain’s biggest businesses later this month. The global trust, with total assets of £5.5 billion, is also close to my wallet because I bought shares in it 20 years ago for my son, Joe, to get him interested in the stock market.

With the usual caveats about the risk of losing money, I continue to suggest FCIT be considered by other relatives today, if they ask for an idea about where to begin investing.

For the avoidance of doubt, FCIT isn’t only for beginners; it’s also an excellent one-stop-shop for anyone who wants an investment they can file and forget.

One reason is that no other investment trust has such a long track record of successfully diminishing risk by diversification, or spreading investors’ money over a wide range of companies, countries and currencies.

There is a modest dividend yield of just under 1.5% and even more modest ongoing charges of 0.5%.

- 11 investment trusts aiming to take advantage of stock market falls

- Top investors name reasons for investors to be cheerful

- Four investment trust turnaround stories the pros are backing

- Battle of the big three multi-manager trusts: who comes out on top?

More positively, this global portfolio of shares in 450 businesses active in a wide range of different commercial activities gives investors of all sizes the same exposure to income and growth wherever they happen to arise.

But F&C’s shrewd manager Paul Niven is also brave enough to look through current financial fashions and buy low today in pursuit of better returns tomorrow.

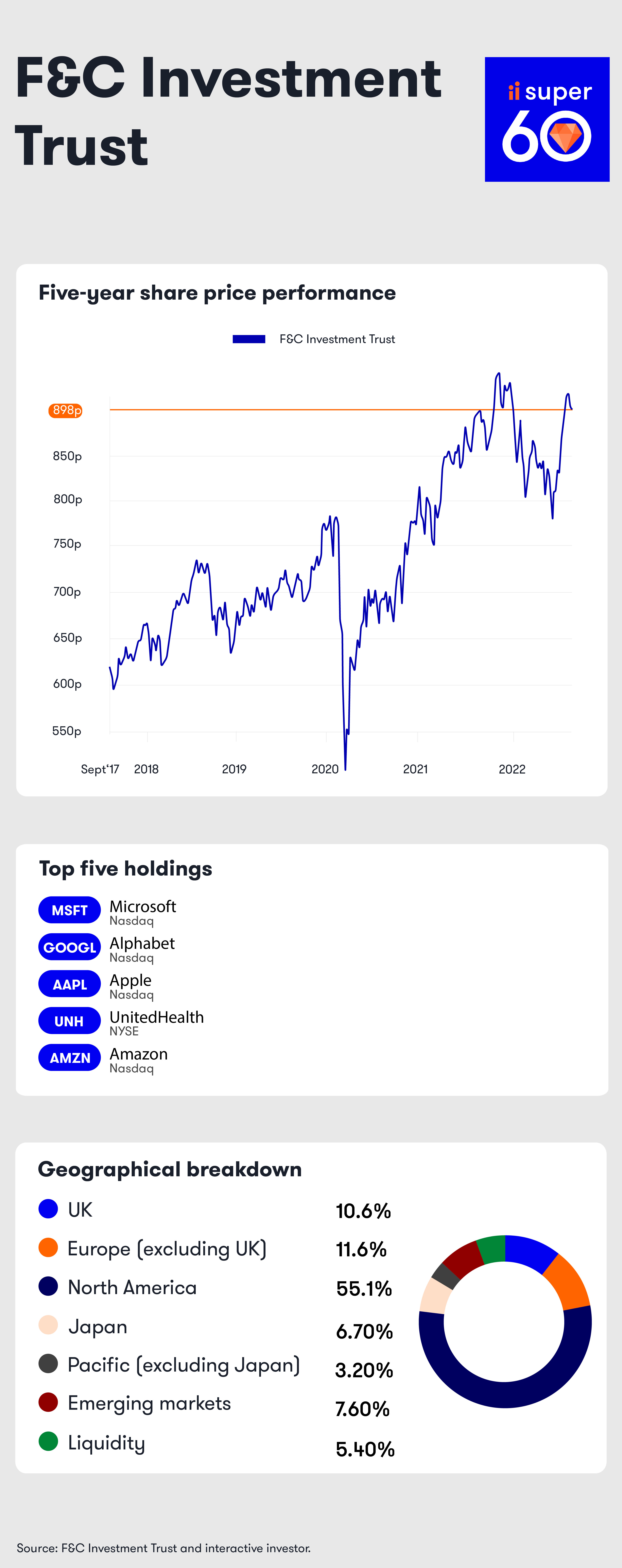

For example, while it is no surprise to see America accounts for half this fund’s geographical asset allocation, British shares comprise another 14% of assets. That is more than twice our country’s percentage of the MSCI All Countries World index. Perhaps equally surprisingly, nearly 7% of FCIT’s assets are in Japan, which fell from favour with international investors long ago.

While we wait to see how that turns out, it is instructive to consider how Niven avoided the worst of the ‘jam tomorrow’ stocks that have recently soured for others who bought growth at any price. Instead, FCIT focused on profitable technology companies, such as Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL), which remain in its top three holdings. By contrast, the electric car-maker Tesla (NASDAQ:TSLA) is nowhere to be seen.

But technology - including other top 10 holdings Alphabet (NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN) - does account for nearly 16% of FCIT’s portfolio, followed by 13% for financial services, almost as much again for healthcare, and nearly 10% in consumer cyclicals.

This approach enabled FCIT to deliver total returns of 257% over the last decade, 59% over the last five years, and to remain marginally positive with returns of 2.1% over the last year, according to independent statisticians Morningstar. Over each of those periods, that placed FCIT respectively third, third and second in its sector.

No prizes for guessing who came first over the last decade and five-year periods. Scottish Mortgage (LSE:SMT), the flamboyant fund whose top 10 holdings do include Tesla, shot the lights out with total returns over those periods of 555% and 94% before it plunged to a loss of 40% over the last year. While Scottish Mortgage shareholders can only hope for a return to form, F&C shareholders can rest easy on a tried-and-tested foundation of profitable companies.

Most other investment trusts offer more focused strategies for income or growth but FCIT offers a globally diversified mixture of both, based on the premise that the world will become a wealthier place over time. Despite short-term setbacks, there is a long history of that happening and I expect normal service will be resumed eventually.

Ian Cowie is a freelance contributor and not a direct employee of interactive investor.

Ian Cowie is a shareholder in Apple (AAPL) as part of a diversified portfolio of investment companies and other shares.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.