Ian Cowie: by far the biggest question facing investors now

Three pro investors who’ve seen it all before, discuss the integrity of this stock market rally.

29th April 2020 10:00

by Ian Cowie from interactive investor

Three pro investors who’ve seen it all before, discuss the integrity of this stock market rally.

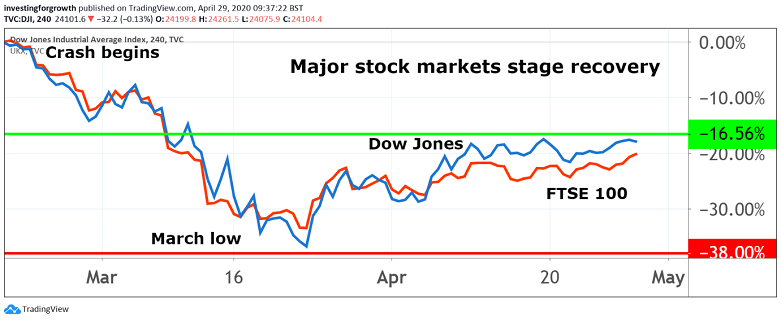

V-shaped recovery or dead-cat bounce? That’s the fundamental question facing investors after the longest bull market in history ended two months ago, wiping a third off global valuations, before bouncing back to recoup most of that loss in the last month.

The upward trend continued this week with the FTSE 100 and Dow Jones indices both hitting a seven-week high, lifted by hopes that the coronavirus crisis might have peaked.

Source: TradingView Past performance is not a guide to future performance

But Britain’s prime minister Boris Johnson rather rained on that parade by refusing to say when restrictions on work and play will be lifted, while America’s president Donald Trump also poured cold water on hopes of a quick cure by explaining his remarks about the efficacy of bleach had been “sarcastic”.

No wonder some of the most experienced and influential money managers in the world struggle to express the scale of uncertainty confronting investors seeking income and capital preservation, let alone growth. Job Curtis, fund manager of the £1.5 billion City of London (LSE:CTY)(stock market ticker: CTY), which began trading in 1891, told me:

“The Covid-19 bear market is the worst in my career - which began in 1983 - for dividend suspensions and cancellations which have been widespread.”

A similar view is shared by Paul Niven, fund manager of the £4 billion F&C Investment Trust (LSE:FCIT), founded in 1868. He pointed out:

“The scale of the economic downturn will represent the sharpest contraction across many developed economies for more than 100 years.”

Candidly - and chillingly - Niven admitted that FCIT had taken a “relatively sanguine view on the global economy”, which he now describes as “clearly misplaced”. He added:

“Having had incrementally positive newsflow over the past month, markets now face the uneasy prospect of dealing with the downturn. Expectations have adjusted sharply; reality may well still bite.”

- You can read all of Ian Cowie's article for interactive investorhere

- Jonathan Davis podcast: investment trust resilience and dividends

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Caution was also emphasised by Craig Baker, chairman of the investment committee at the £2.7 billion Alliance Trust (LSE:ATST), founded in 1888. He told me: “If markets simply continue to bounce back from here, it will be by far the shortest bear market in history.

“Although I am confident in the long-term strategy of investing in equities, it’s quite possible that markets have got too far ahead of the economic reality too quickly. It’s highly likely that volatility will continue and that we will see further sharp falls in the months ahead as the impact of the crisis on the real economy becomes apparent.”

Crikey. Well you can’t accuse these guys of simply talking their own books or banging on to drum up sales.

More positively, from this DIY investor’s point of view, these experts’ candour about current uncertainty demonstrates their determination to preserve shareholders’ capital and income while aiming to grow both over the medium to long term.

How very different from the dreary norm elsewhere in the financial services industry, where all the emphasis is on gathering assets in the short-term to boost fund managers’ fees.

Better still, given the great longevity of these trusts - all survived the Great Depression and both World Wars among many other crises - they can put our present problems in perspective, often with surprisingly reassuring results.

For example, Curtis told me: “The most severe bear market of the last 50 years for UK equities occurred between 1972 and 1974, when there was a 73% fall over 23 months.

“But from its low in December 1974, the market doubled over the next three months.”

- Job Curtis interview: Finding dividend opportunities and reliable income

- Job Curtis discusses Lloyds Bank shares

- Job Curtis: Stocks I’m buying for City of London Investment Trust

For comparison, the dotcom bubble bear market of 2000 to 2003 lasted three years and had a peak to trough fall of 51% in the FTSE 100 index.

The global financial crisis two-year bear market of 2007 to 2009 had a peak to trough fall of 44%.

The current Covid-19 bear market had a fall of 34% to its low on 23 March in only five weeks. Since that low point there has been a rise of more than 17%.

Curtis added: “The speed of the Covid-19 bear market so far resembles the October 1987 crash where share prices fell sharply, after which they recovered. It is too early to say if the lows have been reached in the Covid-19 bear market given the huge impact of lockdowns on the UK and overseas economies.

“But investment trusts that have built up revenue reserves over the years are able to continue growing their dividends and City of London’s chairman indicated to the market at the start of this month that we intend to do so.”

That would be CTY’s 54th consecutive year of increasing the income it pays to investors. Here and now, ATST has just confirmed its 53rd consecutive year of rising dividends and FCIT has done so for 49 years.

For anyone, like me, exercising pension freedom with a view to funding retirement from investment income, those facts form the basis of cautious optimism. While history rarely repeats itself, it often rhymes.

Ian Cowie is a freelance contributor and not a direct employee of interactive investor.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.