HSBC profits dive: is there any hope?

Its shares are heading in the wrong direction after these Q1 results. Our head of markets explains why.

28th April 2020 09:13

by Richard Hunter from interactive investor

Its shares are heading in the wrong direction after these Q1 results. Our head of markets explains why.

The writing was on the wall when the US banks reported first-quarter earnings two weeks ago, and HSBC (LSE:HSBA) has fallen into the same unfortunate trap.

Sharply lower earnings due largely to the pandemic and markedly higher credit loss impairments are fast becoming par for the course given the global economic backdrop.

For HSBC, this has manifested in a pre-tax profit decline of 48% and a rise in impairments to $3 billion, up from a previous figure of $585 million.

Revenues and Net Interest Margins have fallen, and the Return on Tangible Equity figure has slumped to 4.2% from 10.6%.

By geography the Asian unit, still providing the lion’s share of business, reported adjusted profits of $3.7 billion, although 27% shy of the equivalent period last year.

- ii view: Deutsche Bank issues a surprise update

- Chart of the week: FTSE 100 could do something spectacular very soon

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Challenges remain legion. Historically low interest rates will continue to pressure margins, the pandemic is already resulting in lower customer and more general economic activity, credit losses will inevitably follow and, from an investment perspective, the lack of a dividend payment for the immediate future leaves investors with little to go for.

Even within the numbers showing lending and deposit growth, there is an element of credit lines being drawn down by corporate customers being translated into cash balances, as individual companies look to shore up their own capital and cashflow requirements.

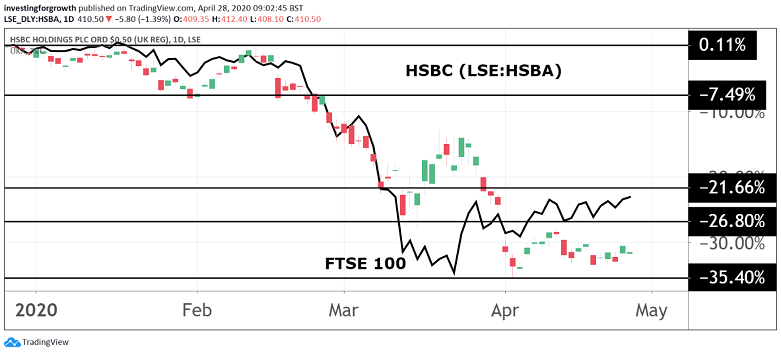

Source: TradingView Past performance is not a guide to future performance

If there are glimmers of hope at the moment, these tend to be in those areas where HSBC has some control of its own destiny.

Operating expenditure has been reduced by 5%, the general financial strength of the bank has resulted in a slight improvement to its capital buffer, which currently stands at 14.6% (previously 14.3%), while a slight tailwind has come in the form of Net Interest Income, up 1.9% in the period.

Further out, the bank may benefit from lifting some of the measures it has introduced to help customers in certain regions, on the form of mortgage assistance, payment holidays and the waiving of certain fees and charges, as customers repay the faith and help being offered to them.

From a broader perspective, the banks are certainly in a stronger position to withstand this onslaught than they were leading up to and during the financial crisis of just over a decade ago.

Equally, HSBC may be well placed to be one of the initial beneficiaries as Asian economies in general begin to stage something of an economic recovery, given its large exposure to the region.

In the meantime, however, much heavy lifting is required. The nearer-term outlook for the banks is sombre and the HSBC share price has fallen 26% in the last three months alone.

Even prior to the pandemic, HSBC had been facing some significant challenges arising from the US/China trade dispute, political unrest in Hong Kong and uncertainty arising from the UK’s exit from the EU.

As such, the shares have dropped 37% over the last year, as compared to a 21% decline for the wider FTSE 100 index, with the market consensus of the shares as a “sell” remaining intact, reflecting that, if there is value to be found in the sector, investors believe it to be elsewhere.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.