How you can own three great businesses for the price of one

29th June 2022 11:09

by Rodney Hobson from interactive investor

This household name has a plan to “unleash growth” but it doesn’t appear to have been priced in by the market. Our overseas investing expert nearly spat out his Cornflakes when he found out.

Every time shares in food group Kellogg Co (NYSE:K) look set to snap and crackle, they seem to go pop. This is, however, a solid company with products in wide demand that seems to slip under the radar of most private investors. It is well worth a look.

Founded more than 100 years ago, Kellogg is best known for its breakfast cereals including the eponymous cornflakes, Special K and Rice Krispies, but it has added other brands in recent years, including Pringles crisps. It also produces cookies and cream crackers. Products are manufactured and sold around the globe, although North America still accounts for more than half of revenue.

Kellogg has coped particularly well with the challenges of inflation and disruption to supple chains that have affected companies across the globe. The most recent results, for the first quarter of 2022, show organic net sales up 4.2% compared with the same quarter last year and adjusted operating profits 13.3% higher.

Earnings growth guidance for the full year edged up from 1% to possibly as high as 2%, not fantastic but at least positive.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Why I’m seriously tempted to buy this stock at this price

The big question now is what impact this month’s surprise decision to split the company into three separate parts by the end of next year will have. The new standalone entities will be global snacks, with $11.4 billion in sales, North American cereals with $2.4 billion and the newer and much smaller plant-based alternatives to meat, where sales are only $350 million but the potential is enormous.

These will each have separate stock market listings unless, as is quite possible, a buyer can be found for the plant-based business.

The split can be seen as the logical conclusion of a policy, begun 10 years ago with the purchase of Pringles, to focus on faster growing lines and ditch slower growing products. This was largely completed just as the pandemic struck. Normal business has now been resumed.

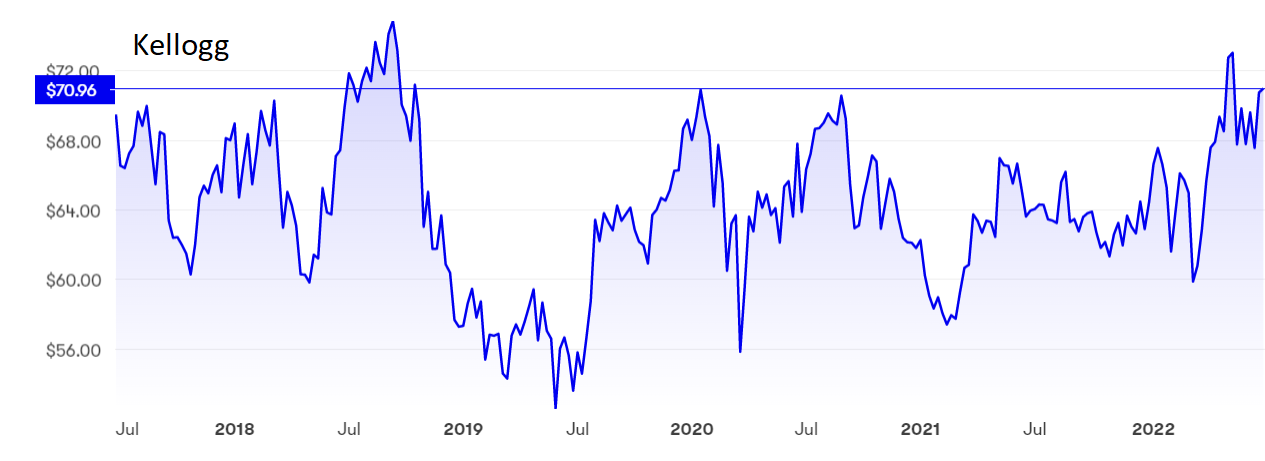

Source: interactive investor. Past performance is not a guide to future performance.

Kellogg chief executive officer Steve Cahillane, who has been at the helm for five years, believes the split will “unleash growth”. He does not seem to have decided yet which part will continue with the Kellogg name but presumably the highly valuable brand name will remain with the cereals business that the founder W K Kellogg was associated with.

Cahillane, though, will stay with the snacks business, which is where his expertise lies and which is currently showing the strongest growth.

The market’s reaction to the planned three-way split has been fairly muted, with the shares edging only fractionally higher. This could admittedly be a pointless and expansive distraction. Just because splitting up large companies has become a theme of activist investors seeking to create value does not mean that the process works.

- The investments that will keep growing – even during a recession

- US stocks enter bear market, but there’s a silver lining for funds

One positive factor is the possibility that the plant-based arm, small now but with great opportunities for growth in the right hands, could be sold off. Kellogg is not desperate to sell so it can demand a premium price. Even if this side is floated, it is likely to be a takeover target fairly quickly.

The shares currently stand at around $70, the same level they were at five years ago. Since then they have been as low as $51. On the upside, they have twice pushed towards $74, but $70 does seem to bring out sellers, so there is no guarantee that the shares will provide capital gains any time soon. However, the price/earnings ratio is undemanding at 15.75 while the yield at 3.28% is reasonably attractive for a company of this quality, so the next share price movement should be upwards.

Hobson’s choice: Buy up to the recent peak of $73. Even if the shares fail to break through the ceiling there is the dividend as compensation and the downside looks limited.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.