How UK equity income fund investors are heavily exposed to the oil price slump

Well over half of UK Equity Income funds have a holding in Royal Dutch Shell or BP.

9th March 2020 12:44

by Tom Bailey from interactive investor

Well over half of UK Equity Income funds have a holding in Royal Dutch Shell or BP.

Oil prices around the world saw their biggest one-day fall since the 1991 Gulf War today, 9 March. This was due to a mix of fears of global slowdown due to coronavirus and the resulting price war between Saudi Arabia and Russia, two of the world’s biggest producers.

Closer to home, however, this big drop in oil prices presents a potential problem for UK income investors. According to research released by Octopus Investments, investment funds in the IA’s UK Equity Income sector are overly reliant on oil giants Royal Dutch Shell and BP.

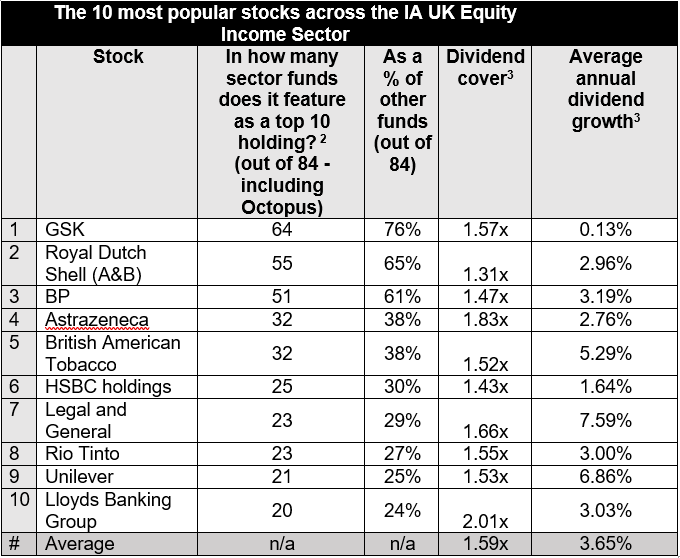

According to the stats, out of the 84 funds in the sector, a total of 55 include Royal Dutch Shell in their top 10 holdings while 51 hold BP. In total 65% of funds have a holding in Royal Dutch Shell and 61% in BP.

The fall in the oil price has seen large declines in the share prices of these companies: since the start of the year, Shell’s shares are down roughly 38% (at the time of writing) and BP’s 32%. As a result, equity income investors will likely have seen significant capital losses.

- 20 high-yielding active fund favourites

Added to that, if oil prices stay low for a prolonged period, the prospect of a dividend cut also arises. As at 31 December 2019, both firms had dividend cover above 1x, with Shell’s at 1.31x and BP’s at 1.47x.

While these levels were above the red-flag figure of 1x, at which point a company is using all of its earnings to fund dividend payments, it was below the preferred figure of 2x. A figure of 2x means a company’s earnings are twice the value of its distributed dividends.

The prevalence of Shell and BP among income-focused funds is part of a broader pattern of over-reliance in the UK equity income sector on a handful of stocks.

GSK, for example was a top 10 holding for 64 out of 84 IA UK equity income funds, while Astrazeneva and British American Tobacco were in the top 10 holdings of 32 funds.

Chris McVey, fund manager for the FP Octopus UK Multi Cap Income fund, notes: “These figures clearly show there is significant concentration risk within the traditional UK equity income sector, the extent of which might come as a surprise to some.”

Other fund managers have also regularly warned about the risk of concentrated dividend payments in the UK market. In December 2019, Robin Geffen, head of global equities at Liontrust, warned that just 10 stocks accounted for 50% of the FTSE All Share index’s yield, making income investor and income funds vulnerable.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.