How UK bank shares like Lloyds are reacting to emergency rate cut

Record low UK interest rates are normally bad for banks, so why was Lloyds up 4% today.

11th March 2020 12:16

by Graeme Evans from interactive investor

Record low UK interest rates are normally bad for banks, so why was Lloyds up 4% today.

Emergency moves by the Bank of England to support the UK economy in the face of coronavirus helped shore up Lloyds Banking Group and shares in other London-listed lenders today.

The measures, unveiled at 7am by the Bank's Monetary Policy Committee (MPC), include a half point cut in interest rates to a record low of 0.25% and the freeing up of an additional £190 billion for banks to lend.

These are clearly extraordinary times for the banking sector, with the Bank's support able to cushion the blow to margins from such a dramatic interest rate cut.

This was reflected in the share price movements this morning as Lloyds Banking Group (LSE:LLOY) opened 4% higher, albeit from its lowest starting point since 2013. The stock, which is widely held by UK investors, has tumbled 30% so far in 2020 amid growing fears about how coronavirus might impact economic activity and impairment figures.

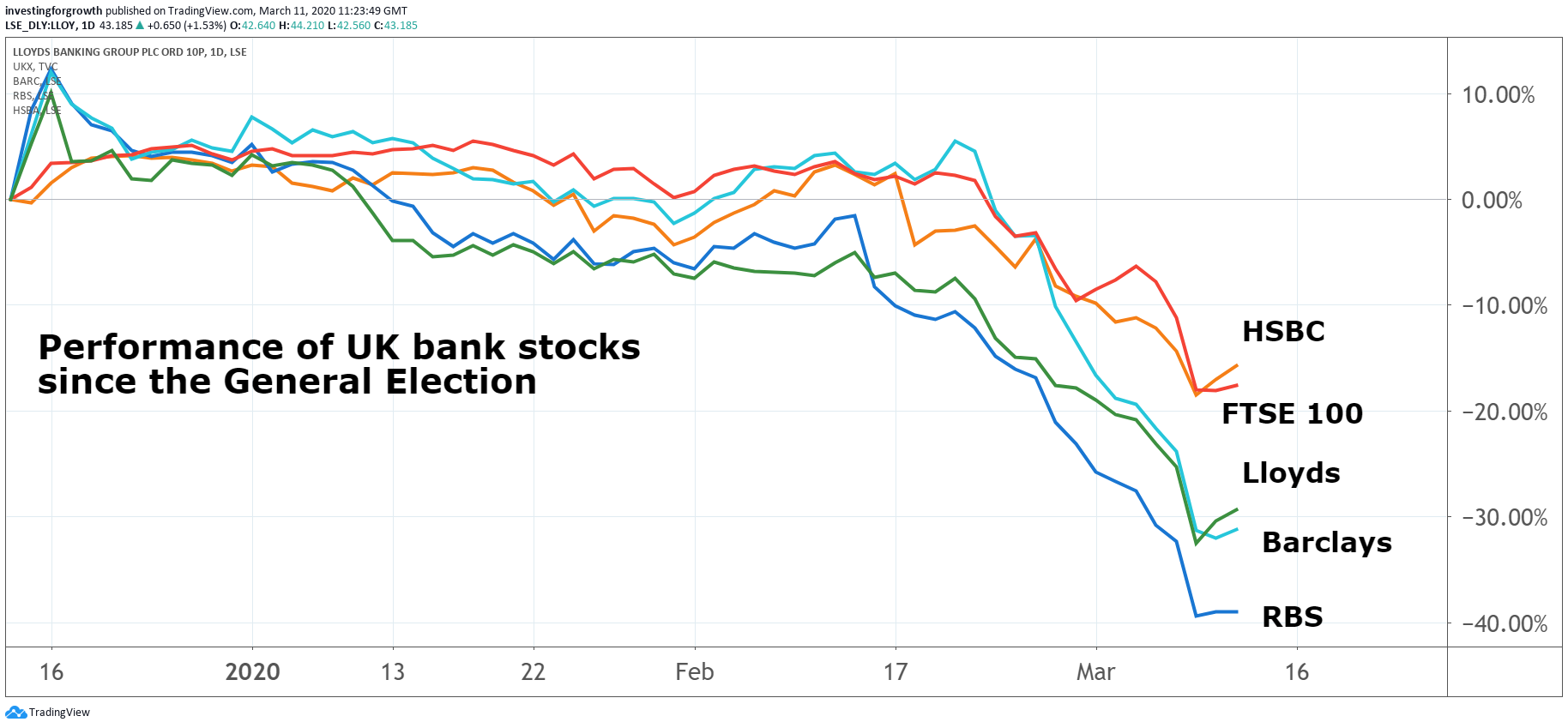

The stock later settled at 2% higher at 43.4p, while Barclays (LSE:BARC) was 1.4% stronger at 118.5p and Virgin Money UK (LSE:VMUK) improved 3% to 119p. The Royal Bank of Scotland (LSE:RBS), which has been the worst hit of the UK banks in 2020 after falling 40% so far, was little changed at 142p.

Source: TradingView Past performance is not a guide to future performance

Housebuilding stocks also benefited from the efforts to support mortgage lending, with Persimmon (LSE:PSN) 4% higher at 2557p and Barratt Developments (LSE:BDEV) up 2% to 682.8p.

Bank of England governor Mark Carney said that the overall package of measures unveiled today could be worth 1% or more in terms of GDP growth. His successor from next week, Andrew Bailey, added that banks now had no excuse not to treat customers fairly.

This follows the release of the countercyclical capital buffer in order to support up to £190 billion of bank lending — equivalent to 13 times banks’ net lending to businesses in 2019.

The buffer had been due to rise from 1% to 2% by December in order to safeguard against excess credit growth. In downturns, however, the regime is supposed to reduce the risk that the supply of credit will be constrained by regulatory capital requirements.

A new Term Funding scheme will also enable banks and building societies to lend at close to the base rate, even as their deposit rates are much lower following the rate cut. The moves should meet demand for short-term credit from households and for working capital from companies.

- Nick Train interview: Three big ideas

- Lloyds Bank shares: A top fund manager’s view

- Be first to watch the rest of our video series with star fund manager Nick Train by clicking here and subscribing to our YouTube channel

Analysts at UBS said markets should approve of the structure of the Bank's package of measures, given that they are aimed at the main anticipated pinch points of supply chains, credit provision, and corporate and consumer confidence.

They said the UK's economic prospects had been “underpinned and improved” by the actions.

UBS added: “As the MPC suggests in its statement, the Covid-19 impact – while potentially very large and sharp – is expected to be temporary, and the ability of the economy to reaccelerate once the coming headwinds start to abate will clearly be strengthened by the support provided by the MPC, and likely the Government, today.”

Today's developments have left banking analysts scrambling to reassess how the various measures will impact on industry balance sheets. However, with coronavirus still spreading it's virtually impossible to get a grip on the sector's current risk premium.

UBS said that eurozone banks trading at just 6 times 2020 earnings and with a yield of around 8% were an obviously attractive entry point to the sector. “Timing an increase in exposure, however, is the harder question.”

In terms of UK banks, Lloyds and Barclays look to be the most attractive based on dividend yields of 8% and forward price/earnings multiples of 6.4 times and 5.2 times respectively.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.