How Terry Smith is investing as markets crash

23rd May 2022 11:31

by Sam Benstead from interactive investor

The veteran stock picker has been doubling down on his technology bet rather than retreating to ‘defensive stocks’.

It has been an eventful start to the year for stock markets. The S&P 500 is close to a 20% drop from highs, the definition of a bear market, while global shares have also fallen steeply. In contrast, British stocks have held up well, buoyed by their high weighting to mining and oil firms, as well as reliable consumer staples.

Deutsche Bank’s head of global fundamental credit strategy Jim Reid notes that it is the sixth largest non-recession correction in post-Second World War history for the US stock market.

This should be a prime time for active managers to show their worth, perhaps by shifting portfolios out of expensive shares and into cheaper ones to profit from rising interest rates and inflation.

Professional investors globally are taking this approach: they now hold more cash than at any point since 9/11, are “underweight” shares, and hold the least in technology stocks since 2006, according to Bank of America's fund manager survey this month.

But star stock picker Terry Smith is taking a different path. The Fundsmith Equity manager has been moving his portfolio out of healthcare, which is considered a “defensive” sector, and is buying technology stocks at cheaper valuations after share price drops.

- Terry Smith on Warren Buffett and how to find good companies

- Six things we learnt at Fundsmith’s annual shareholders’ meeting

- Terry Smith continues tech buying spree as shares drop

His giant £25.5 billion fund, a member of the interactive investor Super 60 list, added creative software giant Adobe and Alphabet (Google) shares for the first time this year, following on from his first purchase of Amazon (NASDAQ:AMZN) stock last summer. He also revealed another new holding last month in Mettler Toledo, a manufacturer of scales and analytical instruments.

Smith is not a dedicated technology investor, but pledges to “buy good companies” – those that have loyal customers, high profit margins and reliable growth. He says he refuses to overpay for such companies, tending to use periods of market weakness to initiate positions.

Smith is required to tell the American financial watchdog, the Securities and Exchange Commission (SEC), which US shares he owns every quarter. These are known as “F13” filings and give insight into what a fund manager is doing that is not revealed in regular monthly factsheets.

Smith’s latest filing, covering the first three months of the year, showed that he has sold the majority of his shares in healthcare firm Johnson & Johnson and added to two new holdings in Adobe and Mettler Toledo.

- Terry Smith buys Alphabet for Fundsmith

- Terry Smith on why Fundsmith Equity fell slightly short in 2021

Between the end of 2021 and 31 March 2022, Smith sold nearly seven million J&J shares. His investment in the firm went from $1.2 billion (£960 million) to $42 million (£33 million), according to filings released last week.

With the extra cash, Smith bought 1.9 million Adobe shares, worth $876 million (£702 million), as well as 412,603 shares of Mettler Toledo, worth $566 million (£453 million).

This made them roughly 3% and 2% positions, as of the end of March.

Addressing investors in March, Smith said the fund would “definitely have a torrid period if markets react to bond yields going up” – but he made it clear that he would not change his investment approach of buying expensive but high-quality companies.

He said: “Bad businesses do not become good ones. We are never going to own banks or energy stocks. Good business can keep competitors out and are worth paying for.”

- Nick Train: The Richard Hunter Interview Podcast

- Video: The Richard Hunter Interview: Lindsell, Train…and Bullock

- What’s gone wrong at Lindsell Train?

This year, Fundsmith Equity has fallen 19% compared with a 13% drop for the average global investor and 10% drop for the MSCI World index.

Smith’s biggest position is Microsoft, followed by Idexx Laboratories and Estee Lauder, according to his recent SEC filing.

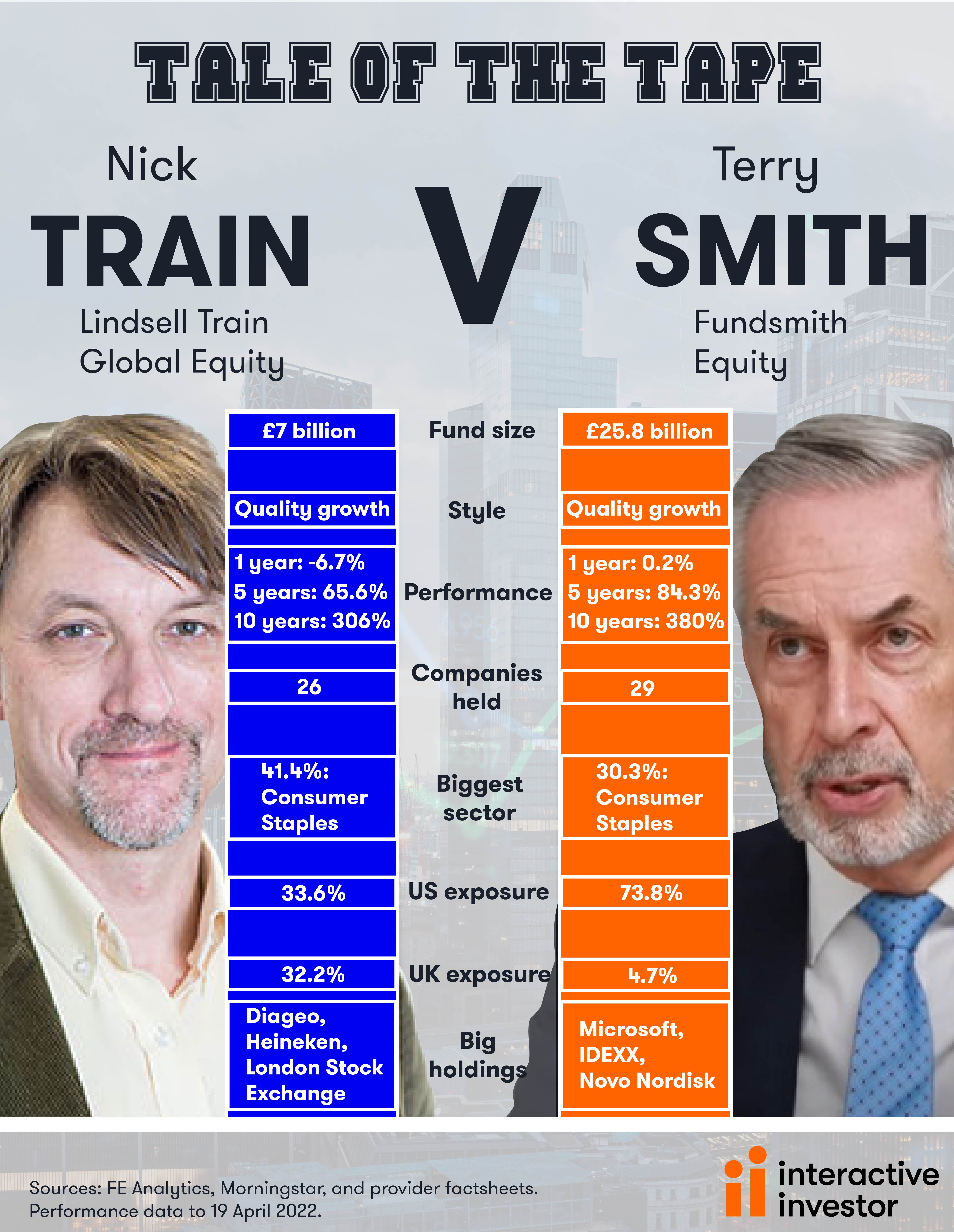

Other fund managers that focus on high-quality growth stocks are going through a tough period, including Nick Train. The Lindsell Train Global Equity fund is down 11% year-to-date.

Train, who rarely trades, recently added the first new holding in three years to the global strategy – credit scoring firm Fair Isaac Corporation. The stock was introduced following the recent sale of Pearson (LSE:PSON).

Over one, three, five and 10 years, Smith's Fundsmith Equity has been the better performer.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.