How to teach your bored teenager about investing

TikTok videos are an unreliable source of financial advice for young people. How can parents dp better?

29th July 2021 11:42

by Moira O'Neill from interactive investor

One-minute TikTok videos are an unreliable source of financial advice for young people. How can parents do better?

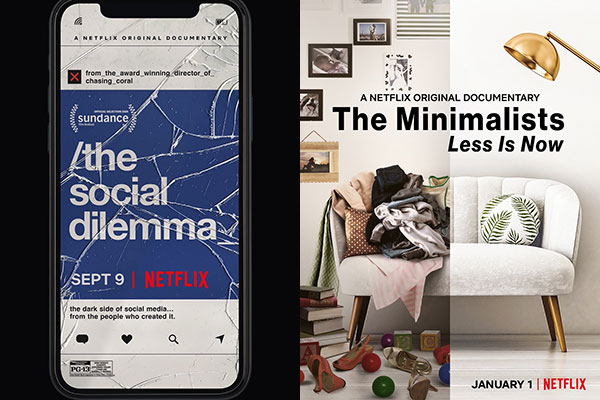

Picture credit: The Social Dilemma (Netflix)

“My skin is dead good. I think it must be a combination of being in love and Lucozade,” said the fictional socially awkward teenager Adrian Mole back in 1981.

The social media-enabled teenagers of 2021 have filters to fix their skin problems. But arguably they have a bigger issue: glued to their screens over the long summer holidays, teens are likely to come across a “finfluencer” — the growing cadre of novice financial advisers touting snappy one-minute video investment tips on channels such as YouTube, Instagram and TikTok.

Darren Collins, (pictured) a teacher at The Sittingbourne School in Kent and winner of the 2020 Interactive Investor Personal Finance Teacher of the Year Award, warns: “I have one student who wants to be a financial adviser. He is actually teaching his parents some of the things he’s learnt from my classes. And yet for every student like him, I have several other kids — and it’s often the smart ones — who have got obsessed with the cryptocurrency dogecoin, because they saw it advertised on TikTok.”

TikTok changed its policies on branded content in May, prohibiting influencers from publishing commercial posts with financial and investment brands. It is hoped this will mark the end of finfluencers pushing dubious investments.

The hope is that TikTok’s systems are robust enough to detect and weed out content that falls foul of its revised policy. But the ban may also end up preventing informed and useful financial content from bona fide firms and experts from reaching the masses.

With social media likely to remain something of a Wild West, I’m planning to teach the teen in my family four lessons this summer, structured around three tactics:

- Have a dinner conversation (hopefully a few). As a nation, families don’t talk about money enough. And the obvious place to grab a teen’s attention, away from their friends and messy room, is over dinner.

- Insist she watches some selected investment-related screen time that’s longer than 60 seconds and more beneficial. It will be something to discuss over dinner too.

- Pay her to do something extra — for £4.62 an hour, the minimum wage for the 16-17 age group.

If she completes all four lessons below, in addition to payment, I promise not to ask her to tidy her room for the rest of the holiday and to take her out for a meal of her choice before she returns to school.

Here are the lesson plans:

Lesson 1: FINFLUENCERS

Conversation 1: On TikTok the hashtag #FinTok has been viewed more than 420m times. Have you seen any #FinTok videos? Would you take money advice from social media?

Conversation 2: How can you avoid bad content on social media?

- Having a large number of followers doesn’t automatically mean finfluencers are worth listening to. Look for evidence — background, experience and qualifications.

- Be suspicious of anyone earning money from touting products, investments or strategies. If the finfluencer really has a strategy to beat the market, why are they on social media telling everyone about it?

- Don’t believe the “get rich quick” stories. It is possible to make huge returns on a small investment, but it’s rare.

Screen time: The Social Dilemma (Netflix), in which tech experts sound the alarm on the dangerous human impact of social networking.

Pay her to: Research finfluencers and find the good and the bad. Look behind the headlines at the finfluencers’ motivations and what they are promoting.

To start, try:

@calltoleap with 800,000 TikTok followers is a teacher called Steve who achieved financial freedom aged 33. Why does he feel the need to flog trading coaching (at $1,657 a year for his premium package)? Some of his videos seem sensible but should you tread carefully?

@lookingafteryourpennies is Charlotte Jessop, a former teacher who looks geeky and has some great tips. How is she earning money? Can you find the disclaimers?

Lesson 2: CRYPTOCURRENCY

Conversation 1: Almost half (45 per cent) of 18- to 29-year-olds are getting their first taste of investing through high-risk cryptocurrencies, according to research for interactive investor by Opinium in June. A fifth have invested in bitcoin at some point, with half of these turning to debt (including credit cards and student loans) to fund it. Why is this dangerous?

Conversation 2: Elon Musk, (pictured below), the Tesla chief executive, is fond of bitcoin but has also highlighted the cryptocurrency’s environmental impact. It consumes as much electricity as a medium-sized European country.

Screen time: Explained: Cryptocurrency (Netflix). A quick and excellent introduction from 2018 on how blockchain technology is changing our world. Narrated by Christian Slater, with a mix of animation, archive news footage and humour.

Pay her to: Watch Bitcoin — The End of Money As We Know It (2015) on YouTube. An award-winning documentary.

Lesson 3: SENSIBLE INVESTING

Conversation starter 1: How is your Junior Isa invested? What are the other things you can invest in apart from crypto? Explain UK and overseas shares and collective investments. Since January 1 2020, younger investors on the interactive investor platform have beaten older investors in performance terms and they are also the group that holds most investment trusts — the oldest type of collective investment.

Conversation starter 2: Using investments to change the world. There’s £2.6 trillion held in UK pensions, according to the Make My Money Matter campaign. This money is invested to build our savings for the future. But from fossil fuels to tobacco, exploitation to extraction, these investments may often contradict our values. What matters to you more: improving the environment or society?

Screen time: Becoming Warren Buffett (2017) is £3.49 to rent on Amazon Prime and is a great introduction to long-term investing. My teen watched it in last year’s summer school so I’m also going to offer Rogue Trader (1999), a good one for older teens who want to learn about the dark side of investing (and can cope with the violence).

Pay her to: Read the Financial Times’ award-winning teenager essays on investing and, for additional money, the classic money and investing book Rich Dad, Poor Dad by Robert Kiyosaki.

Picture credit: Netflix

Lesson 4: FRUGAL LIVING AND FINANCIAL INDEPENDENCE

Conversation starter 1: What would you buy with £100? Is it something you want or something you need?

Conversation starter 2: How can we save money as a family?

Screen time: The Trader (2018) on Netflix. Set in rural Georgia, where potatoes are currency, it follows a travelling trader as he sells used items to the wretchedly poor.

Pay her to: Watch The Minimalists: less is now (2021) on Netflix, an interesting documentary on how our lives can be better with less.

I’m hoping that she thanks me for putting her through these lessons. But if she doesn’t immediately, I’m sure she will in future when she reaps the rewards of considerably more than £4.62 an hour.

Moira O’Neill is head of personal finance at interactive investor, the author of Finance at 40 and a former winner of the Wincott Personal Finance Journalist of the Year.

This article was written for the Financial Times and published there on 23 July 2021.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.