How our investment trust tips have performed

22nd August 2018 14:29

by Fiona Hamilton from interactive investor

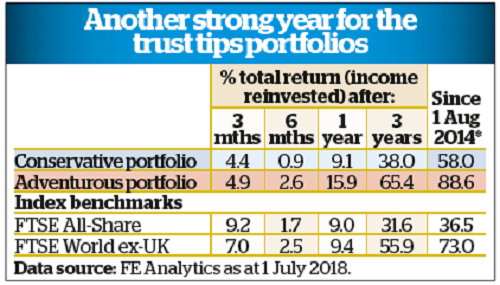

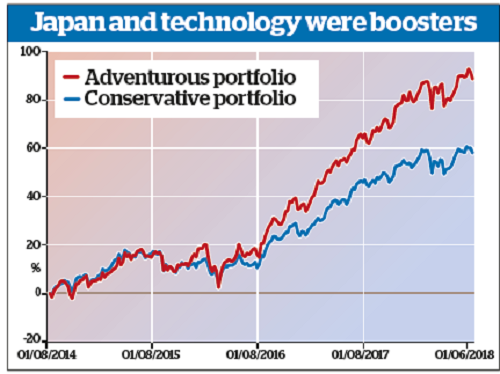

As part of an annual review, Fiona Hamilton reveals how our conservative and adventurous investment trust tips have performed over the past 12 months.

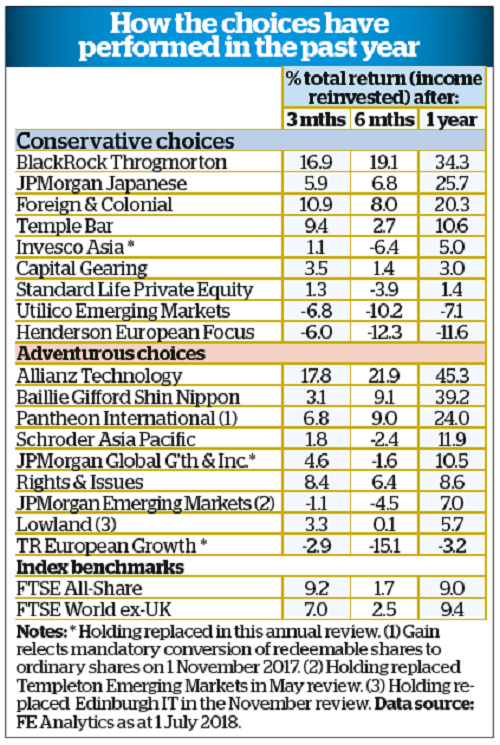

Our star selections over the year to 1 July 2018 were Baillie Gifford Shin Nippon (BGS) and Allianz Technology Trust (ATT). Both have been held since the portfolios launched, achieving share price gains of 200% and 188% respectively over that period.

Helped by steady issuance of new shares, BGS's premium to net asset value (NAV) is down from its early-March peak of 13.9%, to 5.5%. Although this restrained its six month returns, they were still the best of any Japan trust, helping to justify its demanding rating. Meanwhile ATT boasts the best NAV and share price returns in the technology sector over one, three and five years.

The redeemable shares of Pantheon International were also a constituent of the adventurous portfolio since launch, until their conversion into ordinary shares last November. The consequent reduction in the discount to NAV gave their share price performance a welcome boost, as has the more recent recovery in the dollar.

TR European Growth (TRG) joined our adventurous portfolio in January 2017, gaining 57.7% in its first year as impressive long-term NAV returns were rewarded by a sharp contraction in its discount. Disappointingly, its portfolio of very small companies has recently suffered from several uncharacteristically poor picks by manager Ollie Beckett.

We have replaced TRG in our adventurous portfolio, but retained Henderson European Focus in the conservative one. The latter's poor NAV returns since mid-2017 have been attributable to manager John Bennett's cautious positioning. This has recently begun to pay off, which will hopefully at least stop the deterioration in the shares' rating.

Among other conservative portfolio holdings, BlackRock Throgmorton's (THRG) recent strength has been driven by impressive NAV total returns plus a tightening discount, following moves to differentiate it from BlackRock Smaller Companies. JPMorgan Japanese (JFJ) has also proved rewarding thanks to very creditable NAV returns.

Foreign & Colonial's (FRCL) 150th anniversary celebrations have helped publicise its durability and progressive dividend policy, bolstering shareholder demand sufficiently to almost eliminate its discount and considerably enhance its share price returns. Its name is now F&C.

JPMorgan Global Growth & Income (JPGI) has performed strongly in the global equity income sector since joining our roster in May 2017, and has been rewarded with a 3% premium. The similarly highly rated Monks (MNKS) replaces it in the adventurous portfolio.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.