How our Dogs of the Footsie beat FTSE 100

6th June 2018 16:34

by David Budworth from interactive investor

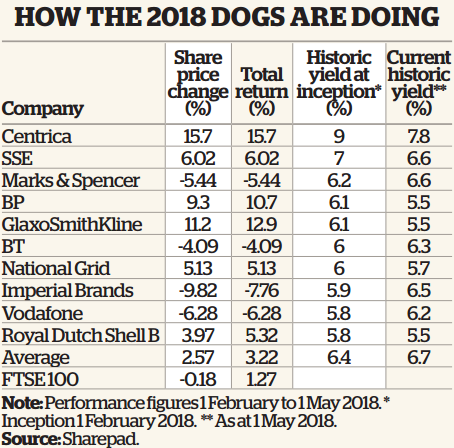

Our 2018 Dogs of the Footsie are proving their pedigree once again. As at 1 May, the portfolio of unloved companies that we lined up in February was ahead of the index in a quite volatile quarter, even though some of the Dogs have failed to keep up with the pack.

The Dogs strategy involves investing equal sums in the 10 FTSE 100 shares with the highest historic dividend yields, based on past dividend payments; these can obtained using a screening tool such as our website.

Over the 17 years we have been running the portfolio, the strategy has consistently proved its worth.

Last year the collapse of Carillion meant it didn't come up trumps, but the Dogs have beaten the FTSE 100 over three, five and 10 years, as well as the full 17-year life of the portfolio.

The first quarterly update for the 2018 portfolio of unloved companies shows that so far it is living up to expectations.

Overall, the Dogs recorded a 2.6% rise in share price terms between February and May, compared with a loss of 0.2% for the FTSE 100.

On a total return basis - taking account of dividend payments - the Dogs were up 3.2%, ahead of the 1.3% achieved by the index as a whole.

Past performance is not a guide to future performance

Boost from utilities

The first quarter's star performer was the utility giant Centrica, with a total return of 15.7%.

The UK's biggest household energy supplier and owner of British Gas has been going through a tough patch recently.

A profit warning in November sent the stock to an 18-year low; thousands of jobs were also slashed amid concerns that government plans to cap energy bills will impact operations.

However, Centrica's share price plunge has helped to swell the company's dividend yield to more than 7%.

Even with its ongoing troubles, this has clearly proved too tempting for some investors, helping to push Centrica's share price significantly higher.

The two other utilities in the Dogs portfolio, SSE and National Grid, also did well.

They delivered a share price return of 6% and 5% respectively, despite regulator Ofgem announcing that companies running the UK's electricity and gas networks could face a 'significantly lower range of returns' as part of a proposed new regulatory regime.

Following a consultation, Ofgem will finalise its proposals on future price controls this summer. The utility sector used to be thought of as dull and lower-risk, but not at the moment.

GlaxoSmithKline, the pharmaceuticals colossus, had a strong quarter as well. The Brentford-based multinational managed an 11.2% share price return as it continues to restructure.

Our Dogs portfolio also benefited from a revival in the fortunes of energy stocks, thanks to a sustained surge upwards in the oil price towards $75 a barrel.

BP was up an impressive 9.3% over the quarter, while Royal Dutch Shell B climbed nearly 4% in share price terms.

It wasn't all good news, however. Tobacco company Imperial Brands was the portfolio's biggest howler, with a 9.8% share price loss. BT Group, Vodafone Group and Marks & Spencer Group were also down over the portfolio's first quarter.

Starters for 10

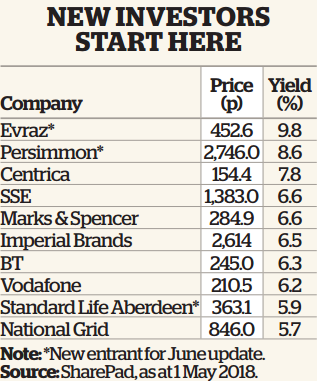

The Dogs strategy counts on investors buying and holding the 10 highest-yielding shares for 12 months - but it can be started at any time. Those who want to invest now could use the companies shown in the box, which are the current top 10.

Anyone starting a Dogs portfolio now will find some interesting new entrants that weren't amongst the highest yielders back in February, EVRAZ being the prime example.

The Russian miner and steelmaker resumed paying dividends last year, after previously suspending payments as weak steel prices and sanctions hit Russian steel producers hard.

Past performance is not a guide to future performance

The company's chief financial officer also said earlier this year that the company aims to pay dividends this year.

That was before the Salisbury poisoning led to renewed sanctions against Russian companies and president Trump imposed higher US tariffs on steel and aluminium.

However, under the rules of the Dogs strategy, only companies that have officially announced a dividend cut should be excluded. As things stand it joins our canine pack.

Alongside it, Persimmon, the UK housebuilder at the centre of a row about executive pay, returns to the portfolio.

The financial services giant Standard Life Aberdeen also makes the cut. These replace BP, Royal Dutch Shell and GlaxoSmithKline, which have dropped out of the top 10 highest yielders thanks to their strong performance since February.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.