How my core/satellite fund ISA portfolio fared, and changes in 2025

Sam Benstead assesses how his hypothetical portfolio performed over the past 12 months.

25th February 2025 10:24

by Sam Benstead from interactive investor

A year ago, I proposed a core/satellite portfolio template. Split 70/30, the bulk of the portfolio was in funds that I hoped could deliver steady growth in a range of market conditions, while the remainder was in more adventurous strategies to add a little kick.

In total, I selected five core funds and six satellite funds. Overall, 10% was in bonds with 80% in equities, 5% in commodities and 5% in property. You can read about why I chose the funds I did here.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

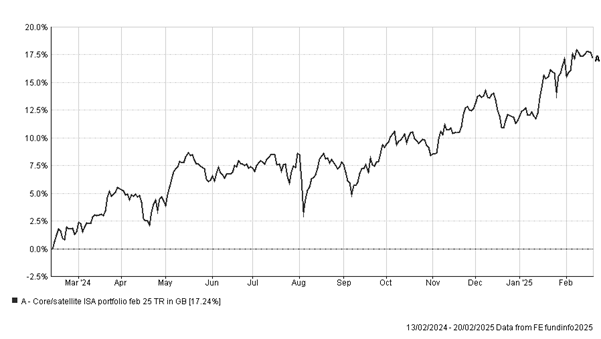

Just over a year on, the overall portfolio is up just over 17% - this came from a 15% gain in the core portfolio and a 21.9% gain in the satellite portfolio. My £100,000 pot grew to just over £117,000, according to data from FE Analytics.

Here’s how the different parts of the portfolio performed.

| Core | |||

| Fund | Starting allocation | Return since 13/2/24 (%) | Sum today |

| Vanguard LifeStrategy 100% Equity | £30,000 | 20.03 | £36,009.00 |

| Fundsmith Equity | £10,000 | 7.35 | £10,735.00 |

| Artemis Income | £10,000 | 25.45 | £12,545.00 |

| Jupiter Strategic Bond | £10,000 | 2.37 | £10,237.00 |

| JPMorgan Emerging Markets | £10,000 | 10.34 | £11,034.00 |

| Portfolio | £70,000 | 15.00 | £80,560.00 |

| Satellite | |||

| Fund | Starting allocation | Return since 13/2/24 (%) | Sum today |

| Henderson Smaller Companies | £5,000 | 6.87 | £5,343.50 |

| TR Property | £5,000 | 1.94 | £5,097.00 |

| Fidelity China Special Situations | £5,000 | 47.57 | £7,378.50 |

| Scottish Mortgage | £5,000 | 42.51 | £7,125.50 |

| Artemis US Smaller Companies | £5,000 | 18.81 | £5,940.50 |

| WisdomTree Enhanced Commodity Ucits ETF | £5,000 | 13.42 | £5,671.00 |

| Portfolio | £30,000 | 21.9 | £36,556.00 |

Source: FE Analytics, 14/2/24 to 21/2/25. This calculation assumed no dealing or platform fees, but real-world returns would have to account for these. Fund returns include fees paid to the fund group. Past performance is no guide to future performance.

For reference, the MSCI World index rose 22% in this period, the FTSE All-Share index rose 18.9%, and the IA Mixed Investment 40-85% Shares rose 12.3%.

The best-performing funds were Fidelity China Special Situations (47.6% gain), Scottish Mortgage (42.5% gain) and Artemis Income (25.5% gain), while the worst performers were TR Property (1.9%), Jupiter Strategic Bond (2.4%), and Henderson Smaller Companies (6.9%).

Encouragingly, there were no negative returns, and my categorisations of core/satellite funds held up, with core funds being more “Steady Eddie” and satellite funds providing more punch.

- ISA ideas: around the world in 10 funds in 2025

- Why the pound’s decline can be a shrewd investor’s gain

My winners benefited from themes such as the continued rise of AI-linked shares, which boosted Scottish Mortgage, the recovery of Chinese shares after a difficult run, and the strong performance of the large-cap UK equities owned by Artemis Income.

Less positively, bonds languished as inflation began to rise again, and Fundsmith Equity suffered due to its lack of exposure to US tech firms.

Overall, I’m happy with the returns. The portfolio rose steadily over the 12 months, as shown in the chart below, and delivered a return well above the 3% inflation rate.

Past performance is no guide to future performance.

But would I make any changes for the next 12 months? A year is a short time in investment and I want to avoid any knee-jerk reactions.

However, one fund that definitely requires some attention is Fundsmith Equity, which lagged its benchmark badly and has now chalked up four consecutive calendar years of underperformance versus the MSCI World index.

The fund has just 11.4% in tech shares, instead preferring healthcare and consumer staple firms, such as Novo Nordisk AS ADR (NYSE:NVO) and L'Oreal SA (EURONEXT:OR). This means that if tech shares tumble, the fund could outperform.

However, I think that if you are looking for a core fund that could hedge you against falls in tech shares, there may be more effective ways of achieving this result. One is an equal-weighted US tracker fund, which allocates the same amount to each of the S&P 500 firms, rather than being driven by how large the companies are. Therefore, out goes Terry Smith, in goes Invesco S&P 500 Equal Weight UCITS ETF Acc (SPEX).

- Active or passive: the ultimate guide to investing your ISA

- What are the cheapest ways to track global markets?

- Ian Cowie: my forever fund went up despite tech wobble

While bonds struggled over the past 12 months, they are in a portfolio as a balance to equity-market risk. This means that in an environment of falling stock prices, which may be sparked by a recession, bonds could be rising in value as investors are drawn to their fixed income and inverse correlation to interest rates. Therefore, Jupiter Strategic Bond holds on to its place.

Another fund that could do well if interest rates fall faster than expected is TR Property. For this FTSE 250 investment trust, which offers exposure to the UK and European commercial property market, lower interest rates could lead to greater property valuations, as well as giving the income from this “alternative” sector a relative boost compared with bond yields.

Of the satellite positions, I’m happy to keep high-flyers Scottish Mortgage and Fidelity China Special Situations because I know that I’ll rebalance the portfolio and re-set their allocations to 5% again, rather than letting them become too large.

There’s still an investment case for UK and US smaller companies, and commodities over diversification, meaning that I’m happy to leave my satellite portfolio as it is.

£100,000 portfolio for the next 12 months

| Core | Satellite | |||

| Fund | Starting allocation | Fund | Starting allocation | |

| Vanguard LifeStrategy 100% Equity | £30,000 | Henderson Smaller Companies | £5,000 | |

| Invesco S&P 500 Equal Weight UCITS ETF Acc | £10,000 | TR Property | £5,000 | |

| Artemis Income | £10,000 | Fidelity China Special Situations | £5,000 | |

| Jupiter Strategic Bond | £10,000 | Scottish Mortgage | £5,000 | |

| JPMorgan Emerging Markets | £10,000 | Artemis US Smaller Companies | £5,000 | |

| Portfolio size | £70,000 | WisdomTree Enhanced Commodity Ucits ETF | £5,000 | |

| Portfolio size | £30,000 |

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.