How it’s possible to justify this stock market rally

There are lots of reasons why stock markets should be in freefall, but a strong case for the rally too.

16th June 2020 15:21

by Graeme Evans from interactive investor

There are lots of reasons why stock markets should be in freefall, but this analyst makes a strong case in for the rally too.

With a resurgent FTSE 100 index still flying in the face of grim economic news, there are plenty of investors who argue the recovery for global equities has been a case of “Too Far Too Fast”.

As UBS points out in a note today, the bulk of the evidence around the degree of economic disruption from Covid-19 still lies in the future rather than the past.

We heard this morning that the number of workers on UK payrolls dived more than 600,000 between March and May, with those claiming work-related benefits up 126% to 2.8 million. But with the government's wage support schemes not due to end until October, there's still very little visibility about just how severe the unemployment toll will be.

And yet the FTSE 100 index was more than 2% higher today on the back of more economic stimulus from central banks on both sides of the Atlantic. And as noted by UBS, markets are being driven by the continuation of the TINA effect — There Is No Alternative — where shares have remained attractive due to poor returns on cash and government bonds.

This has contributed to equity valuations returning towards long-term median levels, with the FTSE 100 up 25% since its March low and Europe's Stoxx 600 index above the Swiss bank's year-end target. This incorporates a 25% bounce in earnings per share in 2021 after a 33% fall this year, as well as a forward price/earnings (PE) multiple of 16x.

- FTSE rebound: big winners in a sea of blue

- Tom Slater interview: Scottish Mortgage’s lockdown winners and new trends

- Richard Beddard gives this top AIM share the thumbs up

- The fund I sold after a 22% rally

One theory supporting higher multiples from here onwards is that a fresh cycle, driven by fiscal policy and corporate restructuring, is a plausible alternative to a post Covid-19 equity market that mirrors the low interest rates trends seen between 2017 and 2019.

The rally so far has been cyclical rather than driven by value. Should that change, UBS notes that a period of strength for value stocks over growth tends to mean a better period for European equities relative to the US.

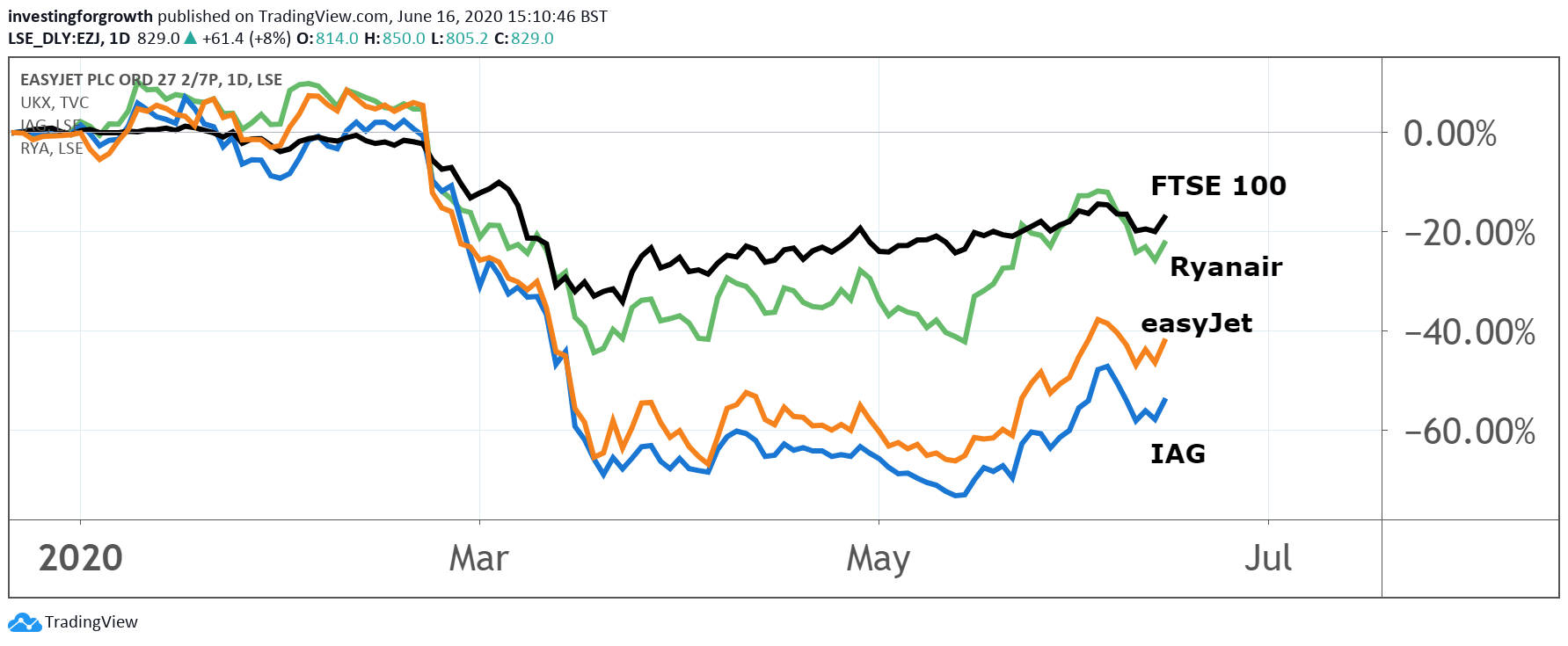

The market rotation into cyclicals has been one of the factors helping airline stocks in recent weeks, even though the EU-wide sector is still down nearly 30% in the year to date.

More countries relaxing restrictions around travel and companies gaining additional sources of liquidity have helped the recovery, although this can't hide the fact that the industry is heading for the most challenging summer season in decades.

In a separate note, UBS remains upbeat about a recovery for the London-listed trio of BA owner International Consolidated Airlines Group (LSE:IAG), Ryanair (LSE:RYA) and easyJet (LSE:EZJ).

Source: TradingView. Past performance is not a guide to future performance.

They all merit ‘buy’ recommendations, with the bank's European fare tracker software continuing to show the low-cost pair of Ryanair and easyJet performing positively in terms of Q3 pricing.

The note added: “We think initial traffic recovery will favour the low-cost airlines more than the network operators given the low-cost are regional and cater more for the leisure market.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.