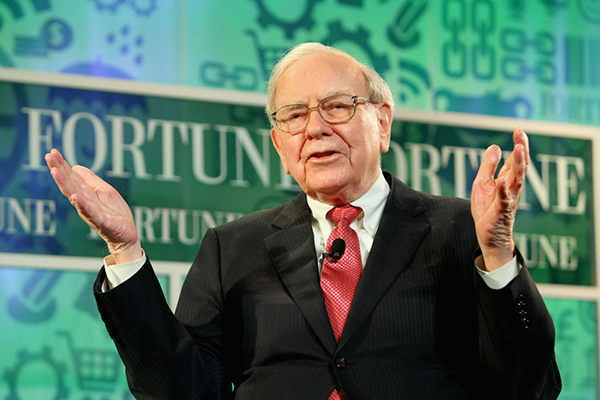

How to invest like the best: Warren Buffett

In this three-part series, David Prosser explains how famous investors made their fortunes and how private investors can adopt their strategies. Second to feature is the Sage of Omaha, Warren Buffett.

17th March 2025 09:04

by David Prosser from interactive investor

Applications to Harvard Business School in 1950 must have been of a remarkably high calibre. One candidate had started a series of successful businesses as a teenager and had just graduated from the prestigious Wharton School of the University of Pennsylvania. Even so, Harvard decided 20-year-old Warren Buffett wasn’t right for its master’s course in economics.

Maybe we should be grateful. Buffett applied to Columbia Business School instead, where he was excited to learn that renowned investor Benjamin Graham – today regarded as the father of the value investment style – was teaching a course.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Graham would have a huge influence on Buffett, who has espoused the principles of value investment ever since and got his start on Wall Street in 1954 at his professor’s Graham-Newman Corporation.

- How to invest like the best: Benjamin Graham

- Three simple rules from the man who inspired Warren Buffett

By 1957, with Graham having retired from active investment, Buffett was ready to go it alone. He left New York and returned to Omaha, Nebraska, where he’d grown up, and used the cash he’d made on Wall Street – around $175,000 – to start three investment partnerships.

‘Price is what you pay, value is what you get’

Right from the start, Buffett’s approach mirrored Graham’s style. “Price is what you pay, value is what you get,” he would subsequently say of his investment philosophy – one of many witticisms seized on by Buffett fans over the years.

Like Graham, Buffett believed the stock market was largely irrational, pricing companies according to investors’ prevailing sentiment, rather than on what they were fundamentally worth. That created opportunities for those who understood the “intrinsic value” of a business, value investors argued.

“Be fearful when others are greedy, but be greedy when others are fearful,” as Buffett put it.

One early example of this approach was Buffett’s investment in the Sanborn Map Company. In 1958, Buffett spotted that the company’s shares were trading at around $45, even though it owned investments worth the equivalent of $65 a share; in other words, the map business itself was valued at minus $20 a share. Buffett quickly bought a 23% stake in the company and worked with other investors to encourage its board to act. Sanborn agreed to sell some of its investments to finance a buyback programme – the Buffett partnerships made a 50% profit in just two years.

Amid his early successes, Buffett remained unassuming and was a prominent figure in the local community. In 1959, he met real estate attorney and investment manager Charlie Munger at a lunch held at the Omaha Club. The two men quickly recognised each other as kindred spirits, with Munger joining the business in 1962. When Munger died last year, a month shy of his 100th birthday, Buffett described him as the “architect” of their success.

Berkshire Hathaway

One of the duo’s first big deals was the acquisition in 1962 of Berkshire Hathaway Inc Class B (NYSE:BRK.B), a struggling textiles company. Buffett and Munger acknowledged the company’s commercial woes in the face of low-cost competition – but pointed to the low price of its stock given its book value and net working capital.

The value approach struck gold again, with shares in the company more than doubling over the next few years.

Even better, Berkshire Hathaway threw off cash with which Buffett could fund other investments. Rather than realising profits, Buffett and Munger opted to keep Berkshire Hathaway; it would become the investment vehicle through which the duo managed their entire investment portfolio. The last textiles assets were sold in 1985, but Berkshire Hathaway remains under Buffett control to this day and currently owns almost 180 companies outright as well as stakes in many more; its current market capitalisation stands just above $1 trillion.

Definition of value investing evolved over time

Along the way, however, Buffett’s approach to value investment has shifted. Initially, he pursued what Graham had dubbed “cigar butt” investing. Mediocre companies often traded cheaply relative to the value of their assets but would get a bounce when they realised some of that value. “The stub might be ugly and soggy, but the bargain purchase would make the puff all free,” Buffett explained.

Munger, however, regarded this strategy as limited in ambition and argued that it would inhibit really meaningful growth at Berkshire Hathaway. Over time, moreover, the data and analysis available to stock market investors has become far more comprehensive, making it much harder to find these underpriced businesses – particularly among the larger companies that Buffett and Graham were attracted to.

- DIY Investor Diary: how I apply Warren Buffett tips to fund investing

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Influenced by Munger, Buffett’s definition of value – or “intrinsic worth” – evolved over time. Increasingly, he looked for large companies with significant competitive advantages – superior technology or outstanding brand value, for example – to hold over the long term. A more opportunistic approach, in any case, is poorly suited to an investor of Berkshire Hathaway’s scale.

Credit: Jaque Silva/NurPhoto via Getty Images

Economic moat

The buy-and-hold philosophy has underpinned Berkshire Hathaway’s investments in companies such as American Express Co (NYSE:AXP), Bank of America Corp (NYSE:BAC), Coca-Cola HBC AG (LSE:CCH) and Apple Inc (NASDAQ:AAPL); indeed, the latter business remains a mainstay of the portfolio. “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes,” he has described this approach. “Our favourite holding period is forever.”

That’s not to say Buffett has abandoned value investment – metrics such as return on equity, debt to equity, profit margins, and the value of tangible and intangible assets, all remain important considerations. But Buffett also looks for an “economic moat” – a competitive advantage that provides the “margin of safety” in an investment that Graham always believed was vital.

It’s an approach that has continued to deliver, even if returns have slowed in recent years. Between 1965 and 1995, Berkshire Hathaway averaged annual returns of around 24%; since then, the figure has been more like 15%. Still, over almost 60 years, Buffett has generated annualised gains of 19.8% for Berkshire Hathaway shareholders, almost twice the 10.2% from the US stock market.

Buffett, who will turn 95 later this year, remains a patient investor. He’s largely avoided technology stocks, on the basis of his advice “never to invest in what you don’t understand”, and Berkshire Hathaway is currently holding cash worth more $334 billion because Buffett hasn’t found opportunities that he believes merit deploying the money.

Still, “Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities,” Buffett insisted in his latest annual letter to investors, published in late February. “Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good businesses.”

How to invest like Warren Buffett

The obvious stock for investors who want to trade in the manner of Buffett is Berkshire Hathaway itself – the Sage of Omaha’s own investment vehicle offers you direct exposure to his principles and practice. The New York Stock Exchange-listed stock certainly isn’t a value play, currently trading at close to its all-time high, but it does offer the economic moat that Buffett favours, in the form of his own intellectual prowess and brand value.

It’s also worth saying that Buffett is a long-time advocate of passive investment, pointing out that identifying mispriced securities has become harder than ever. “In my view, for most people, the best thing to do is to own the S&P 500 index fund,” he has said. There is value in owning large, well-capitalised American companies, Buffett maintains, and he practices what he preaches. Berkshire Hathaway itself has large holdings in the SPDR and Vanguard S&P 500 exchange-traded funds (ETFs).

A variation on that theme, suggests Alex Watts, a fund analyst at interactive investor, could be the VanEck Morningstar Global Wide Moat ETF A USD GBP (LSE:GOGB). “The fund is openly inspired by Buffett’s economic moats concept,” Watts explains. “It leverages Morningstar’s own analyst resource to invest in an index of around 70 global stocks which are deemed to have competitive advantages over peers and trade at attractive valuations compared to Morningstar’s perceived fair value estimates.”

- Five ways fund investors can get Warren Buffett in their ISA

- Where pro fund buyers are investing their ISAs in 2025

Alternatively – or additionally – look for active managers who invest in the same vein as Buffett. “Buffett’s style has become harder to define as it has become more growth-oriented, but it is akin to buying growth stocks when they are out of favour and cheap,” says Ben Yearsley, a director of consultancy Fairview Investing.

“Terry Smith, Fundsmith Equity I Acc, and Nick Train, WS Lindsell Train UK Equity Acc, are managers to consider as ‘growth at a reasonable price’ (GARP) investors. Artemis has a SmartGARP franchise and is currently doing well with its global emerging markets fund. Artemis UK Select and Artemis UK Special Situations are also contenders.”

Watts names Lindsell Train UK Equity, which is on the platform’s Super 60 list of recommended funds. “Train is a renowned stock picker with a distinct and patient approach to quality-growth investing,” Watt explains.

- ISA ideas: most-popular funds, trends and overlooked areas

- ISA fund ideas for investors looking to add spice to portfolios

“He focuses on buying lasting companies of exceptional quality, with attractive returns on capital, and his belief in high-conviction investing means positions can make up near 10% of the fund, or more in the investment trust Finsbury Growth & Income Ord (LSE:FGT).”

As for individual stocks, Berkshire Hathaway’s own portfolio is one potential source of inspiration. Leading holdings today include Apple, American Express, Bank of America, Coca-Cola and Chevron Corp (NYSE:CVX).

In the UK, Richard Hunter, head of markets at interactive investor, suggests Prudential (LSE:PRU), easyJet (LSE:EZJ) and JD Sports Fashion (LSE:JD.). “None of these necessarily pass the economic moat test, but in valuation terms they could fit the bill,” Hunter says. “It is also worth noting that Buffett acquired a minuscule stake, at least in terms of his overall portfolio, in Diageo (LSE:DGE) two years ago, with the stock often being quoted as one which passes many of his investment criteria, despite its more recent challenges.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.