How healthcare and biotech investment trusts can revive portfolios

Healthcare and biotechnology trusts have not been immune to the stock market ravages of the coronavirus …

5th May 2020 10:48

by David Prosser from interactive investor

Healthcare and biotechnology trusts have not been immune to the stock market ravages of the coronavirus pandemic, but have fared better than others. Looking beyond the crisis, the sector will be propelled forwards by strong tailwinds, argues David Prosser.

The Covid-19 crisis could hardly be a starker reminder that the things so many of us take for granted are more fragile than we realise. That includes good health – and our assumption that most ills can be avoided or quickly treated courtesy of a trip to the GP. That most people barely give a second thought to illnesses and diseases that once did so much damage is a tribute to the remarkable achievements of scientists, healthcare providers and drug developers.

In meeting this basic but inexorable need – the imperative to keep almost eight billion people alive and healthy – the healthcare industry has invariably bucked the ups and downs of the economic cycle, with consistent and fast-paced rates of growth. And that is why investment trusts specialising in healthcare and biotechnology have been able to deliver such outsized returns for their investors.

- Investment Trust Awards 2020: the winners

- Winners of the investment trust monthly savings medals revealed

- Interview: International Biotechnology Trust’s Ailsa Craig

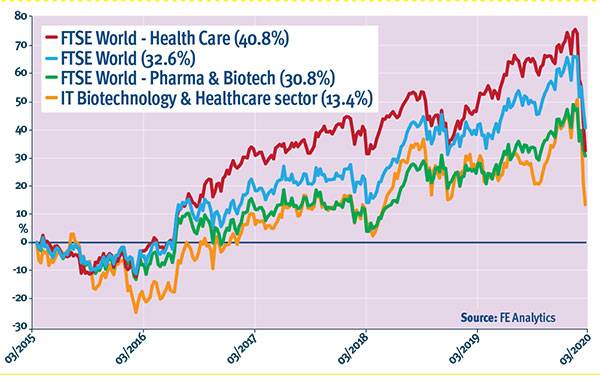

The figures speak for themselves. Over the 10 years to the end of 2019, biotechnology and healthcare investment trusts outperformed every other sector of the closed-ended fund industry by a remarkable margin. The typical such investment trust delivered a share price return of 491% over that period, getting on for 2.5 times the 198% gain recorded by the average trust and miles ahead of the 379% delivered by the next best sector, UK smaller companies.

To see why, consider the tailwinds in their favour. These include global demographic trends: not only worldwide population growth but also the ageing profile of wealthy consumers in most advanced economies, who spend more on healthcare than their younger counterparts, including on chronic, long-term conditions. They include economic drivers, particularly the increasing purchasing power of the fast-growing middle classes in developing economies, including India and China. And they include the potential of exciting new technology-powered advances in almost every area of healthcare, from gene therapy to tele-medicine.

Looking forward, there is every reason to hope these favourable conditions will persist. The healthcare team at consultancy Deloitte believes healthcare spending worldwide will increase at an average annual rate of 5% between 2019 and 2023, up from 2.7% between 2014 and 2018. It predicts worldwide prescription drug sales will grow even more quickly, at a rate of 7% a year until 2024.

Biotech and healthcare trusts look undervalued

Defensive qualities

Moreover, despite the potential for volatility in certain parts of the industry – particularly among small biotech businesses highly exposed to the fortunes or otherwise of small numbers of products – healthcare has many defensive qualities. Demand across much of the industry is highly inelastic: spending is non-discretionary and therefore more isolated from broader economic trends.

“The next 10 years for biotechnology will be extremely exciting,” says David Pinniger, the manager of Polar Capital Global Healthcare (PCGH). “The emergence of new technology approaches – areas like gene therapy and gene editing – will over the next five to 10 years be successful in creating new medicines that come to market and treat a lot of patients with serious life-threatening diseases.”

Naturally, this doesn’t mean the sector escapes negative sentiment or is immune to market volatility. The positive returns of recent years now look a long way off amid the havoc on the financial markets wreaked by Covid-19. Just a few short weeks ago, shares in many healthcare investment trusts traded at premiums to the value of the underlying assets; now, almost every trust in the sector sits on a discount – a double-digit discount in many cases.

Still, healthcare and biotechnology funds have held up better than most during the crisis. Between the end of January and 13 March, the average fund in the sector lost 10.3% in total return terms, compared to around 16% across investment trusts as a whole. Only seven of around 45 investment trust sectors limited their losses more effectively and most of them were invested in alternative assets and had reduced stock market exposure.

Where does the sector go from here? Well in the short-term, there will undoubtedly be volatility, particularly in the context of Covid-19. Take the example of the Anglo-French diagnostics business Novacyt, whose shares rose 1,085% over the first six weeks of the year as it dawned on the markets that a test it had developed for the Covid-19 coronavirus was likely to sell rather well. Alternative Investment Market-listed Novacyt subsequently halved in price as investors took profits, but then began climbing back up towards its previous peak in March as the US Food & Drugs Administration approved its testing kits.

Funds with holdings in other businesses that play a leading role in the fight against Covid-19 (see below) are likely to experience similar benefits. Worldwide Healthcare Trust (WWH), for example, has a holding in the Chinese vaccines specialist CanSino Biologics, and has high hopes that the company will play a leading role in developing a Covid-19 vaccine.

Beyond the coronavirus pandemic, the other short-term factor likely to impact sentiment in the sector this year is November’s US presidential election. Uncertainty about the future of US healthcare, with the Democrats potentially offering radical reforms that might hit profitability in the sector, is a concern – although the exit from the race of Bernie Sanders, the most radical contender, has reduced that risk.

Carl Harald Janson, the manager of International Biotechnology Trust (IBT), says: “We expect the biotech sector will trade sideways until the market has gained more certainty regarding the outcome of the election. [Democrat contender Joe] Biden is considered a more moderate candidate and is less likely to introduce any fundamental changes to the US healthcare system.”

How the larger biotech and healthcare trusts have performed

| Trust | Total assets (£m) | Discount/premium (%) | Gearing (%) | Share price total return (%) | ||

|---|---|---|---|---|---|---|

| 1 year | 5 years | 10 years | ||||

| BB Healthcare | 544 | 0.6 | 8 | -15.6 | n/a | n/a |

| Biotech Growth | 391 | -18.9 | 13 | 2.0 | -13.2 | 313.8 |

| International Biotechnology | 229 | -17.5 | 0 | -17.2 | -2.7 | 314.1 |

| Polar Capital Global Healthcare | 273 | -13.6 | 12 | -19.5 | 0.9 | - |

| RTW Venture | 212 | -11.1 | 0 | - | - | - |

| Syncona | 1,319 | -9.5 | 0 | -26.7 | 57.6 | - |

| Worldwide Healthcare | 1,518 | -13.4 | 9 | -14.5 | 19.4 | 277.7 |

Source: AIC, as at 23 March 2020.

Positive fundamentals

Thereafter – and assuming the world manages to get on top of the Covid-19 crisis – analysts and fund managers expect the health and biotech sector to begin to normalise, with longer-term value drivers returning to the fore.

“Our focus remains on the positive fundamentals of the industry – its near-term defensive qualities and long-term growth prospects driven by innovation and societal secular demand,” says Trevor Polischuk of OrbiMed Advisors, which manages Worldwide Healthcare.

In which case, investors who share this enthusiasm for the long-term potential of healthcare need to consider where best to secure their exposure to the industry. Indeed, for those convinced by the sector’s potential, now could be an ideal moment to take the plunge – or even to increase holdings – given valuation opportunities created by the recent market panic.

Simon Elliott, research analyst at Winterflood Investment Trusts, picks out Worldwide Healthcare as one of his favoured trusts in the sector. The trust has a relatively defensive profile, with a 30% allocation to higher-risk (but potentially higher-growth) biotech companies, held alongside a broader exposure to healthcare stocks.

“The managers’ active approach means there will be periods of underperformance, such as the final quarter of 2018 when overweight allocations to biotechnology and emerging markets detracted,” Elliott says. “But the fund benefits greatly from the large specialist team at OrbiMed, which makes it an attractive option for investors looking for specialist exposure to the healthcare sector.”

In recent times, Worldwide Healthcare shares have typically traded at a small premium to the value of the underlying portfolio, but the market rout in February and March saw the trust slip to a 13% discount by late March.

Alan Brierley, an investment trust analyst at Investec, is also a fan of Worldwide Healthcare, but also suggests a newer entrant to the sector as a second buy recommendation for investors seeking specialist healthcare exposure.

Launched in late 2016, BB Healthcare Trust (BBH) operates with a much more concentrated portfolio – around 35 holdings compared to Worldwide Health’s 70 or so – which might be considered high-risk. But Brierley argues that the quality of the management team at BB Healthcare, run by a specialist group at Bellevue Asset Management, compensates for the inevitable periods of divergent performance.

“BB Healthcare has a clear investment philosophy and process, and this high conviction approach results in a distinct and concentrated portfolio which bears no resemblance to the [MSCI World Healthcare index] benchmark,” Brierley says. “44% of the portfolio is not even included in the benchmark.”

Credit shock

Another possibility, suggests Mick Gilligan, a partner at Killik, is International Biotechnology Trust. “Many of the underlying holdings are in a net cash position and well capitalised to withstand a credit shock,” Gilligan says of the fund. “It trades on a 15% discount to net asset value [recently rising to 17.5%] and offers a 4% yield, paid from capital.”

International Biotechnology’s portfolio numbers around 80 stocks, dominated by US-listed companies. Notably, its leading holdings include Gilead, a pharma company best known for anti-viral treatments it has developed for patients suffering from HIV; there are now high hopes that Gilead’s Remdesivir drug could be used to treat Covid-19, which has seen the company’s stock price soar.

At Stifel, meanwhile, analyst Anthony Stern offers one more recommendation. Stifel recently raised its rating of Polar Capital Global Healthcare from neutral to positive, with Stern pointing out that the fund changed tack two years ago and is now well-placed to benefit from two key structural themes in healthcare.

“The first theme is that some of the major healthcare companies are facing competitive pressures, so it is vital for an investor to avoid those unable to respond,” Stern says. “The other theme is technology disruption: until recently, the healthcare industry has not been significantly disrupted by technology, but the managers believe this is about to change as robotics, tele-medicine and new treatments become more rapidly adopted.”

The other factor in Polar Capital Global Healthcare’s favour is that the trust is scheduled to wind up in 2025; as such, the discount at which its shares currently trade relative to the underlying assets will naturally begin to close. And with that discount now standing at a record high of almost 14%, the boost will potentially be significant.

There are three other trusts in this sector, all of which are more narrowly focused on the higher risk biotech end of the healthcare sector. The best known is Biotech Growth Trust (BIOG), which delivered a much-improved performance last year after a period of underperformance, and is managed by OrbiMed, the same firm behind Worldwide Healthcare. Its shares currently trade on a wider discount than any other trust in the sector.

Pure biotech focus

Alternatively, Syncona (SYNC) offers exposure to a much more concentrated portfolio, largely comprising unquoted businesses. While its recent performance has been poor as its previously high premium to NAV evaporated, it currently has very significant assets in cash following the sale last year of Blue Earth Diagnostics, one of its star holdings. Stefan Hamil, an analyst at Syncona’s house broker, Numis Securities, thinks “there are several more multi-billion dollar winners in this portfolio”, but other analysts are more cautious.

Finally, it is early days for RTW Venture (RTW), which only launched in October. With a brief to back bioscience start-ups, the trust was disappointed to raise only £12 million during its IPO amid nervousness about unquoted equity following the Woodford Investment Management collapse. A previous private placement of £92 million enabled the trust to achieve critical mass.

- Stay up to date on investment trust news: sign up for our newsletter

Cashing in on the coronavirus?

The healthcare industry, despite its reputation at times of putting profits over patients, is rapidly mobilising its efforts to aid in the global effort to combat the Covid-19 pandemic,” says Trevor Polischuk of OrbiMed Advisors. That will drive the performance of businesses engaged in several different types of activity.

These include testing, where there has been huge global demand for the kits initially developed by the World Health Organisation and the Centers for Disease Control and Prevention, which depend on components from Germany’s Qiagen and the US giant Danaher, as well as for new diagnostics such as Novacyt’s product. Global healthcare companies such as Roche, Hologic and Thermo Fisher, which maintain large infectious disease testing platforms, have also benefited.

Then there is the holy grail: a vaccine that would thwart the spread of Covid-19 on a worldwide basis. At least a dozen programmes, often approaching the challenge from different angles, are under way globally. They include initiatives from big pharma, such as Pfizer as well as work by smaller biotechs such as Moderna in the US and CanSino Biologics.

In addition, there is the possibility of developing treatments for Covid-19, with anti-virals in the spotlight. California-based Gilead Sciences is a world leader in this field while Japan’s Takeda has high hopes for products coming out of Shire, the British company it bought last year. Japan’s Chugai is also a contender, with its anti-inflammatory drug, Actemra, seen as potentially valuable for patients suffering from severe lung dysfunction because of the virus.

Investment trusts with holdings in such businesses will naturally benefit from their successes, though Polischuk is anxious that investors do not become fixated on tactical opportunities at the expense of more sustainable trends – not least since innovation will be hit and miss, and the opportunity to profit may be time-limited. “We are cautious on the sustainability of commercial opportunity that the coronavirus may offer the biopharma players,” he warns.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.