How Halfords shares took post-crash rally past 170%

One of the worst hit by the crash, Halfords is among a bunch of retailers that are hot property again.

6th May 2020 13:24

by Graeme Evans from interactive investor

One of the worst hit by the crash, Halfords is among a bunch of retailers that are hot property again.

A “materially undervalued” Halfords (LSE:HFD) confounded the City today with figures showing how it has benefited from Britons using the lockdown to reignite their passion for cycling.

April's 23% slide in like-for-like sales was much better than analysts had feared, particularly with a third of stores closed and the rest only operating as click-and-collect outlets.

Halfords also upgraded profit forecasts for the year to 4 April, thanks to robust trading in the early days of the lockdown. This means results in July will see profits at the upper end of its targeted £50 million to £55 million, having warned on 25 March it may miss the lower figure.

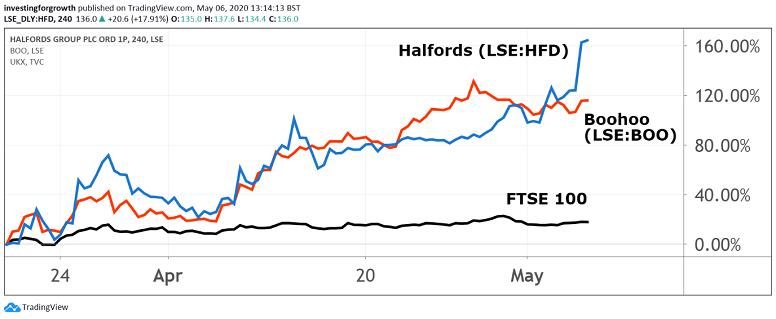

Shares jumped 17% to 135p, placing Halfords alongside Boohoo (LSE:BOO) as among the retail sector's strongest performers during the Covid-19 lockdown. Its shares have surged a remarkable 177% since they bottomed in March at 49.4p, having earlier fallen from 163p in mid-February.

Source: TradingView. Past performance is not a guide to future performance

Despite the rally, Investec analyst Kate Calvert said the retailer was still materially undervalued on 7.2 times 2021 earnings, with the market failing to appreciate Halfords' strong market position and cash generation.

She said:

“We expect Halfords to emerge in good shape and believe the recovery story is very much intact.”

Calvert has upped her profits forecast for 2021 by 76%, believing that the impact of recent acquisitions, a new web platform and the needs-driven nature of the Halfords offer will mean the company recovers relatively quickly following the lockdown.

The group, whose stores have stayed open as a provider of essential products and services, has benefited from a resurgence in cycling as people explore alternatives to public transport and look for ways to stay healthy.

In motoring, essential categories such as batteries did well but this failed to offset the impact of a significant reduction in car journeys over the period.

Cycling accounts for around 40% of Halfords' business, with Peel Hunt estimating that like-for-like sales in this category were likely to have been flat during April.

They added:

“We do not see the strong performance in cycling slowing much. There will be some drag forward of summer bike sales, but we aren't going to be playing or watching any team sports and cycling is an affordable, social distancing friendly form of exercise.”

The broker added that shares were still “fabulously cheap”, particularly given that recent fundamental changes to the business have been postponed rather than cancelled.

Considerable uncertainty still remains over the outlook, however, with Halfords “taking all necessary measures to preserve cash". It has already announced the suspension of its dividend in order to save £24 million in the current financial year, while it is also seeking rent relief from landlords and reducing capital expenditure from £40-60 million to £10-15 million.

Card Factory was another retail stock on the front foot early today after a big jump in online sales prompted it to establish a second fulfilment centre in Wakefield, West Yorkshire.

The web is still only a small part of the group, however, with 90% of staff currently furloughed due to the closure of all shops. Investors, who have grown used to a steady stream of income from Card Factory (LSE:CARD) over recent years, will be looking closely at this Sunday's guidance from Boris Johnson about how the retail sector will re-emerge from the lockdown.

With no dividend payment for the year to January, Card Factory shares fell to a low of 22p in mid-March from 144p at the start of the year. They traded as high as 43p today before slipping back to 38.65p at midday.

Ted Baker (LSE:TED) is another retail stock struggling to recover, with the value of the fashion business little changed in recent weeks. A turbulent year means shares are at just 138.8p, compared with 1,564p last May.

In contrast, investors appear confident in the ability of Boohoo and ASOS (LSE:ASC) to soak up the money that would have otherwise been spent by shoppers on the high street. Boohoo shares are now higher than before the crisis - up another 5% today at 328.7p - while ASOS has also had a strong April after its shares doubled in value.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.