How does your pension compare with your neighbour?

21st September 2022 11:02

by Alice Guy from interactive investor

Alice Guy looks at how your pension compares with the average-sized pot and how much you need to join the top 1% club.

We Brits are a nosy lot, and every other programme on TV seems to be a reality show. We love to veg out on the sofa watching how others buy homes, bake cakes, bicker in the middle of the jungle and even date and get married.

But when it’s come to pension wealth, it’s hard to know how others are doing financially and how our pension compares to those around us.

- Read about: Free regular investing | Opening a Stocks & Shares ISA | Cashback Offers

How much is an average pension?

So, how much is average when it comes to pension wealth and how does your pension pot compare?

According to the ONS wealth and assets survey, the average private pension investor achieves a pension pot worth around £190,000 by 65-years-old. But the figures vary hugely between individuals depending on a vast range of factors.

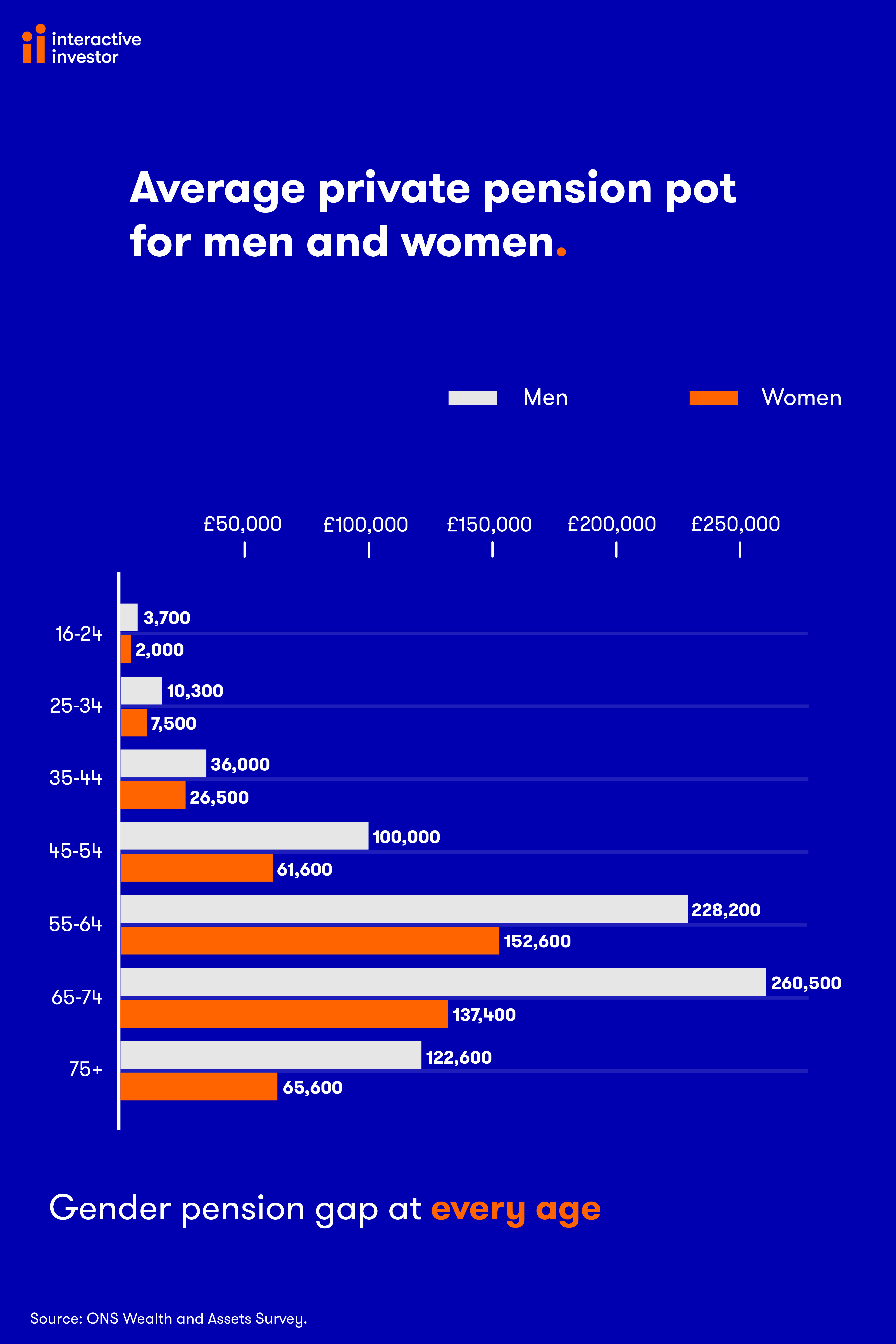

The average private pension for retired men is £260,500, whereas for women it is £137,400 – women often struggle to make up for lower career earnings and more time spent caring for relatives.

The gender pension gap begins at a young age, with average private pensions for women already 27% lower than for men between 25 and 34 years old. That pension gap grows with age. The average woman retires with a private pension worth 47% less than the average man.

Those gender pension differences are also true for defined benefit pensions. The average man retires with a pension worth 37% more than the average woman.

Am I rich?

To be a member of the exclusive top-1%-club, you’ll need a pension pot worth £1 million or more, according to data by Opinium from interactive investor’s latest ‘Show Me My Money’ report.

If you’re over 55, then there are twice as many pension savers with a £1 million pot. Having a pension pot worth more than £1 million would only put you in the top 2%.

But women with a pension pot worth over £1 million are as rare as hen’s teeth. Our report sample found no women with pension pots worth over £1 million: the highest woman’s pension was between £701,000 to £800,000. That figure may grow in the years to come as more women work in senior roles.

For those of us who are a long way off a £1 million pension pot, how much would you need to reach the top 25%? Well, ONS figures show that having a pension pot of £481,900 between ages 65-69 would put you in the top 25% of private pension investors.

If you’re older and already retired, then average pension pot sizes have started to dwindle. If you’re 70-74 years old, then a pension pot of £351,800 would put you in the top 25%.

Golden oldies

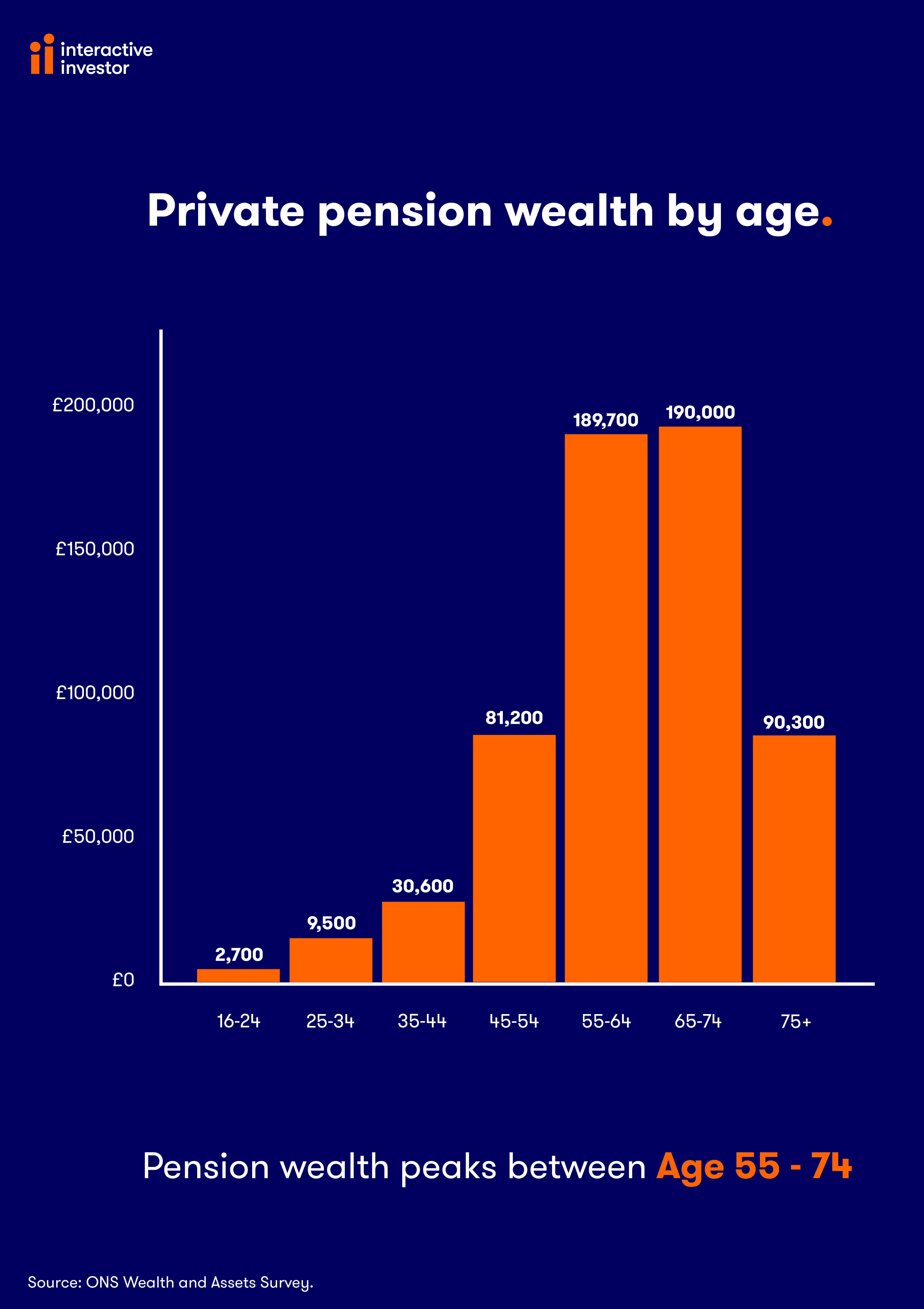

By far the biggest factor in building pension wealth is our age, proving the well-known saying that time in the market is more important than timing the market.

But the speed of accelerating pension wealth with age is striking, the size of average pension pots more than doubling between our late 30s and late 40s and more than doubling again by our late 50s.

The average private pension wealth between 35 and 44 years old is £30,600, climbing to £81,200 at 45-54 years old and £189,700 at 55-64 years old. Pension wealth peaks at £190,000 for 65–74-year-olds, before declining for those in older age, averaging £90,300 for those who are 75 or older.

The sharp increase in pension wealth shows that many more of us prioritise our pensions as we hit our 40s and 50s, no doubt having more money to spare as our pay increases and our kids gradually fly the nest, leaving us with more disposable income.

If we’re in our 30s or 40s with a small pension pot, it’s encouraging that so many of us are in the same boat and it’s possible to significantly increase our pension wealth in middle age. The average pension pot for a 40-year-old is only £30,000 and we still have time to build up a decent-sized pot before we retire.

In fact, if you had an average-sized pension pot of £30,000 at aged 40 and added £500 every month until the age of 65, your pension pot could grow to a not-too-shabby £402,000 (£286,000 in today’s money). Those calculations assume growth of 5% per year and average inflation of 2%.

Wealth divide

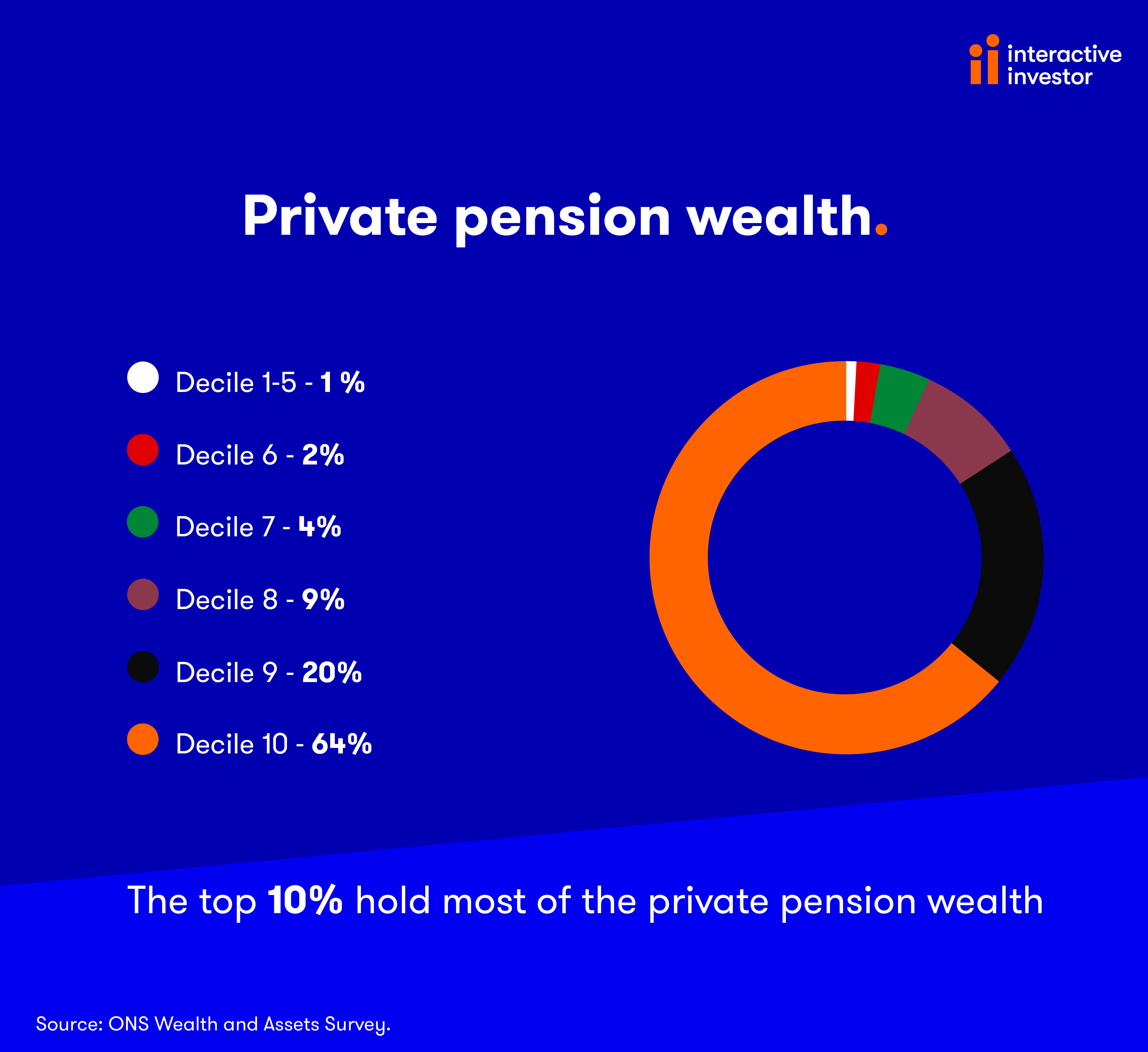

The so-called Pareto distribution is a concept that predicts that 80% of the wealth is usually held by 20% of the population. It’s based on the work of Paris-born engineer Vilfredo Pareto, who found in 1906 that 80% of Italy’s wealth was owned by about 20% of its population.

Now over 100 years later, it seems that it’s much the same with pension wealth today. In fact, an astonishing 84% of total pension wealth is owned by the top 20% and 64% is owned by the top 10% in the UK today.

The only consolation is that the top 20% is not static in the case of pension wealth, and more of us will join that top 20% as we move towards middle age and have more money spare to invest in our pensions.

Defined benefit versus defined contribution

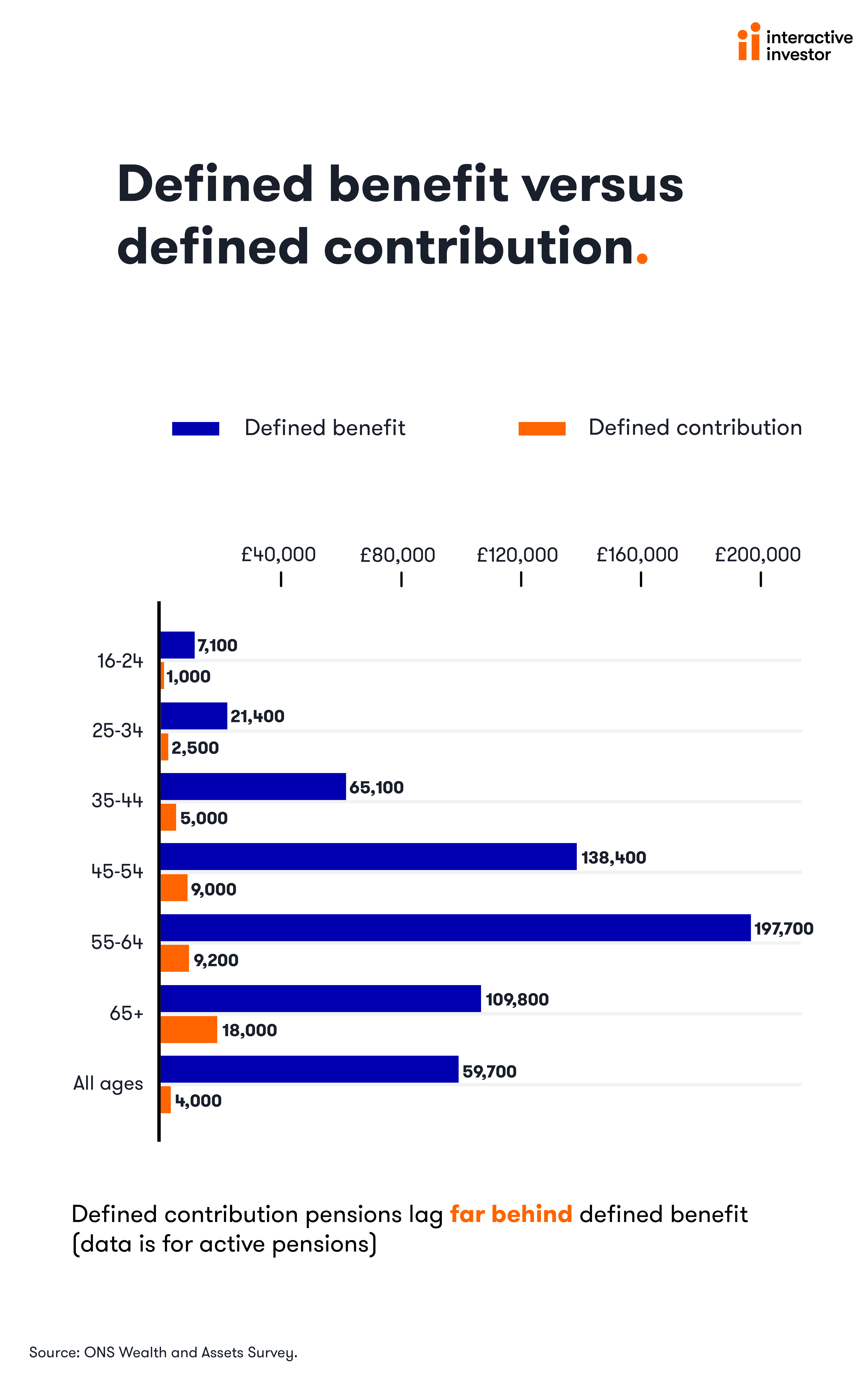

Speaking of the wealth divide, another stark difference in pension wealth is between those with defined benefit and defined contribution pensions.

When I started work in 1999, generous defined benefit pension schemes were already vanishingly rare in the private sector. They were still available with some larger employers, but such schemes were increasingly closed to new employees over the next few years.

It’s a trend that has continued. A recent report by The Pensions Regulator revealed that only 10% of defined benefit pension schemes in the private sector are now open to new members (open defined benefit pensions are more common in sectors such as education and charity).

For those who are lucky enough to still have defined benefit pensions, there’s a huge contrast between the value of those funds and those with workplace defined contribution pensions. Those with active defined benefit pensions have an average pension value of £197,900 by their mid-60s whereas those with active defined contribution workplace pots have a minuscule average pension pot of £9,200 at the same age.

The tiny average pension for those with defined contribution pots is partly because these pension schemes were less common for older employees. Some employees never had a workplace pension before pension auto-enrolment began in 2012 and others used defined contribution pensions to supplement generous defined benefit pensions.

- FIRE movement exposed: is it really possible to retire at 40?

- Dividend investing: three tips for a comfortable retirement income

The good news is that with more younger workers than ever enrolled in workplace pensions, we’re likely to see average pension pots improve in the years to come. And hopefully more of us than ever before will enter retirement with a decent-sized pension pot and be able to look forward to a comfortable retirement.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.