How different UK fund managers have fared during the pandemic

Our expert picks out top funds from the ii Super 60 list and analyses performance under extreme stress.

4th June 2020 09:26

by Rebecca O'Keeffe from interactive investor

Our expert picks out top funds from the ii Super 60 list and analyses performance under extreme stress.

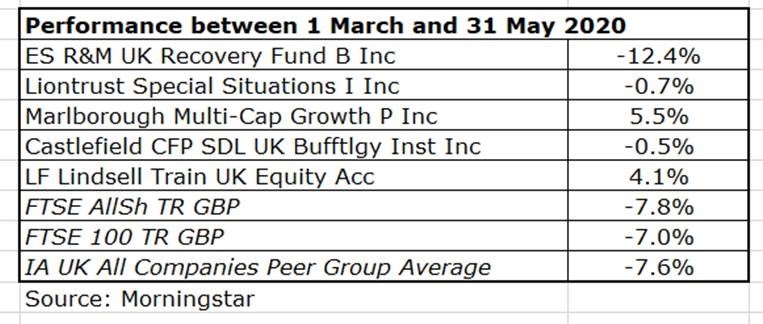

Over the three months from 1 March to 31 May 2020, the UK equity market dropped by between 7% and 8%. Within this period, markets began by extending their February slide into a precipitous fall in March, before beginning a steady rebound.

So how have the professional fund managers performed during this period of extreme stress?

Rebecca O’Keeffe, head of investment at interactive investor, looks at what this has meant for UK Equity interactive investor Super 60 selections:

“We would all have loved to be buyers of the March lows, but anyone with existing holdings would have felt distinctly queasy about adding to positions that were painfully underwater at the time.

“First, the Fidelity Index tracker did exactly what it says on the tin, closely replicating the overall index performance (in this case actually outperforming, down only 6.3% over the period). This is exactly what you would want from a tracker fund – low cost replication of the index.

“Among the active managers, two registered what were exceptional gains under the difficult market conditions. Marlborough Multi-Cap Growth gained 5.5%, and Lindsell Train UK Equity gained 4.1%. How did they manage to generate these excellent returns?

“Marlborough Multi-Cap Growth manager Richard Hallett has been actively repositioning many of his fund’s constituents, adding to holdings where he believed opportunities existed and (according to the latest fund manager notes) ‘backing a number of capital raisings for businesses with strong franchises that are in a position to take market share from their competitors with the help of additional working capital.’

“Early in the crisis, Nick Train looked to be nailing his colours to a distinctly shaky mast when he refused point blank to waver in any way from his underlying strategy and stock selections. Indeed the only significant addition to his stable of high quality UK brands during this period was his investment in Fevertree (LSE:FEVR). Three months on, and Nick has been soundly vindicated in both his approach and his selections. This is what a good fund manager looks like.

"Investors in Liontrust Special Situations and UK Buffettology will be relatively pleased with the resilience demonstrated by their fund managers, with both funds down only marginally during the three-month period. Those invested in R&M UK Recovery Fund will be wondering when the recovery is going to happen, with the fund registering a loss of 12.4% over the period.

“Why has this actively-managed fund underperformed so much? True to its mandate, the fund is naturally biased toward those sectors that would typically lead any “normal” economic recovery, ie energy, materials and industrials, along with consumer discretionary and financials. Unfortunately, our economy is far from anything normal at the minute. The energy sector has been crushed by the collapse in oil prices, financials are staring at the threat of negative interest rates with some horror, and consumer discretionary has become a thing of the past in the face of the Covid lockdown. Were we to secure a vaccine against the virus, R&M UK Recovery might find itself ideally positioned, but for now its lack of healthcare and tech (two key sectors behind many of the successful global growth companies in the world today) has counted against its recent performance.

“Overall, the funds held in our Super 60 UK equity sector reflect in microcosm the general marketplace. Passive funds do exactly what they say, and it is up to investors to decide whether or not to pay a premium to invest in funds run by active managers instead. Many of those funds that are actively managed with a growth bias and unconstrained approach have been able to weather the market turmoil and our choices have largely been getting it right. But for those investors who were hoping for a different market, away from the growth and large cap bias that has dominated the stock market for the past few years, the pandemic has further entrenched performance differentials.”

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.