How to become a superforecaster and beat Wall Street at its own game

The average expert’s predictions are only slightly more accurate than random guesswork. Here’s how to improve your predictive powers and make better investing decisions.

24th January 2025 08:55

by Reda Farran from Finimize

- To be a superforecaster, start by defining what you actually want to forecast and then break the problem down into its component parts

- Next, find the right balance between the cold, objective “outside view” and the more emotion-led “inside view”

- And finally, be willing to both adjust your forecast when new information arises and admit when you’ve gone wrong.

At the start of last year, Wall Street's crystal-ball gazers expected the stock market to slow down after a wild AI-fueled rally the year before. And they expected Treasuries to perform well as the Federal Reserve shifted from hiking interest rates to cutting them. But stocks continued to surge instead, while bonds slumped. The truth is, the pros on Wall Street have a terrible forecasting record, and you can beat them at their own game by following five simple steps inspired by Philip Tetlock’s best-selling book Superforecasting.

Step 1: Define what you’re trying to forecast

To get started, imagine you come across a headline that says: “Markets are significantly overvalued and are about to crash”.

First things first, you need to understand what “markets are about to crash” actually means. Which markets are we talking about? What size drop counts as a “crash” and over what amount of time? To assess the accuracy of this statement, you first need to define what exactly has been predicted. So in this case, you might decide to rephrase your question as: “What’s the probability that the S&P 500 will be down by more than 10% in one year’s time?”

Step 2: Break the situation down

To work out the probability of this problem, you need to recognize that it’s made up of a couple of parts. By simplifying the question into smaller, more manageable bits, you can pretty quickly formulate a surprisingly accurate forecast.

There are two parts to the original statement: “markets are significantly overvalued” and “are about to crash”. So that gives you two elements to analyze: the probability that stocks are “about to crash”, and the probability that stocks crash when they’re “significantly overvalued”.

Step 3: Strike the right balance between inside and outside views

Tetlock discovered that superforecasters see things in two ways – by “inside” views and “outside” views.

They start by posing an outside-view question – meaning, they aim to remove all emotions and look only at cold, hard data. They want to gauge how often outcomes of this sort happen in situations of this sort by looking at the facts. Going back to the market example, you could look at how often (in percentage terms) the S&P 500 has lost more than 10% over a one-year period. The answer: only 15% of the time since 1996.

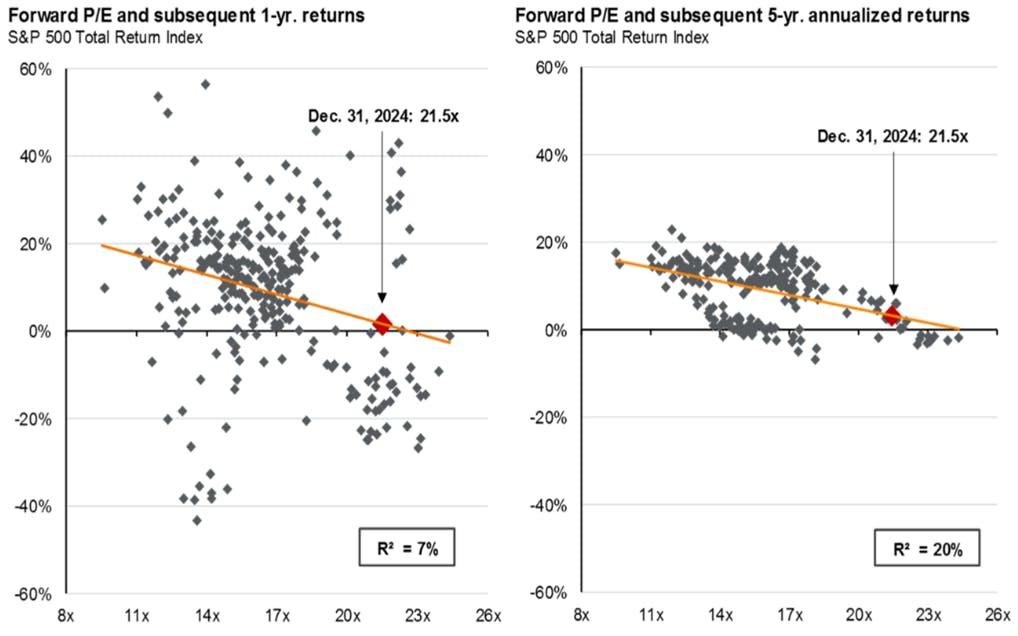

The trouble is, this case ignores important information that makes this situation somehow unique. A unique factor, in this instance, might be how high stock valuations are right now. If you take those valuations into account by looking at the relationship between forward price-to-earnings (P/E) ratios and subsequent one-year returns, the probability of a 10% loss increases to 30%.

Forward price-to-earnings (P/E) ratios and subsequent returns of the S&P 500 Index. Source: JPMorgan.

It does bear pointing out, however, that the relationship is weak and stocks ended up much higher almost as many times as they ended up lower. So an estimated accuracy range for the “outside view” probability is actually around 15% to 30%.

Now, of course, no situation can be fully summarized by a number. Looking at the potential impact on the economy if Russia pulls the plug on European gas, or if the Federal Reserve changes its tone about interest rates, requires judgment. This part of the analysis – using your own opinion to assess the specifics of the particular case – is what Tetlock calls the “inside view”.

But there are two problems with the inside view. First, it’s prone to biases, since it depends on the main market narrative and is driven by factors like the dominant news stories. Second, the human brain is naturally biased to the inside view: it’s often filled with engaging details and it’s easier to make a good story out of.

To diminish those biases, Tetlock explains that it’s important to use your “outside view” as your main anchor and use your “inside view” to adjust it. In the example of how likely it is that stocks will crash, the 15% to 30% probability is your outside view, so even if your inside view assessment is quite bearish, it’s unlikely you’re going to give an emotionally driven overestimate. The probability, then, could be 30% or 40%, but it’s unlikely to be as high as 80% or 90%, as the original headline suggested.

One of the reasons why market commentators have predicted so many crashes that never materialized is that they’ve overweighted their emotionally driven inside view over the cold, hard outside view. Using the outside view as an anchor would’ve fixed that.

Step 4: Update your forecast frequently

Tetlock found that “superforecasters” update their forecasts much more frequently than regular forecasters do. In other words, when the facts change, they change their forecasts.

For example, whatever your original probability was regarding the likelihood of a recession across Europe, you might want to adjust it now that we know that Russia can pull the plug on European gas and trigger a downturn in the region.

The best forecasters aren‘t married to their view. They’re willing to significantly alter their forecasts – even when it means contradicting their previous theses. That’s part of what makes investors like George Soros and Ray Dalio so successful: they constantly look for ways they could be wrong and focus more on making money than being right.

Step 5: Learn from your mistakes

According to Tetlock, one quality above all others can help make you a superforecaster. You might guess that it’s intelligence, but you’d be wrong. In fact, this one quality is three times more powerful than intellect: it’s a relentless commitment to updating your beliefs and focusing on self-improvement. That means spending time analyzing your failures and successes alike, focusing on what you got right (or wrong), and what you might’ve done differently.

So if you’re keeping score of your trades and constantly trying to figure out what you could have done better, congratulations – you’re already on the right track.

Reda Farran is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.