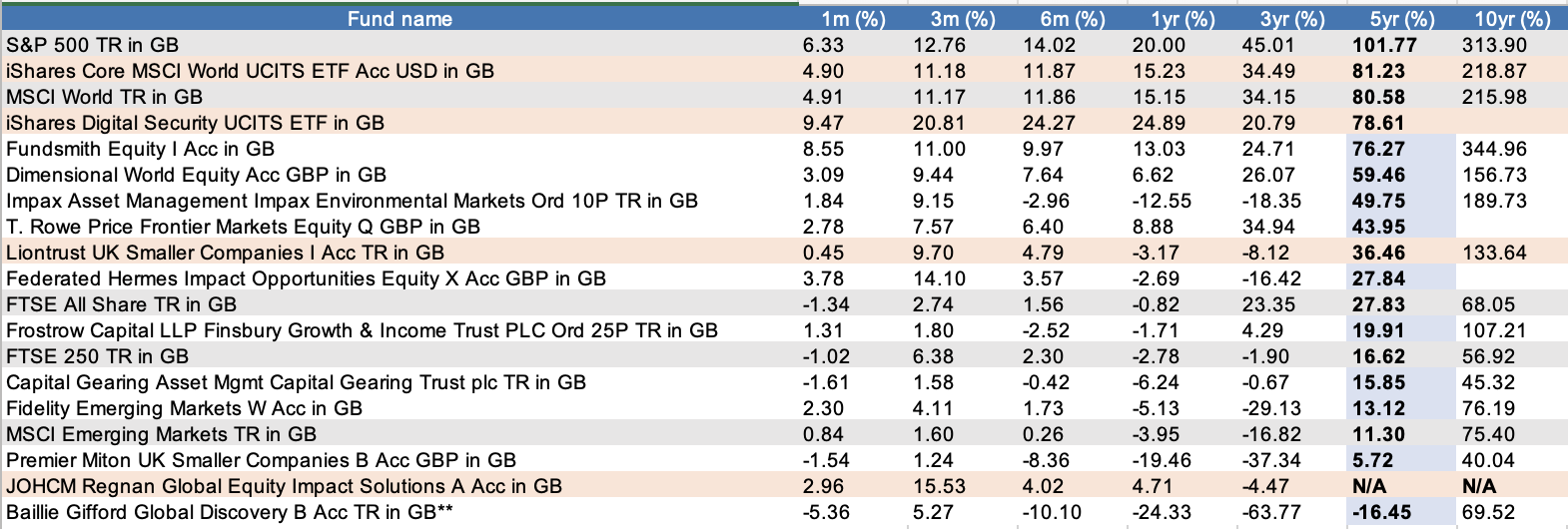

How the 10 funds to buy and hold forever have fared over the past five years

Investors have endured a bumpy ride and the experts’ 10 forever funds have had mixed results, says Jennifer Hill.

19th February 2024 09:45

by Jennifer Hill from interactive investor

Markets have had to digest more than usual over the past five years. The period has seen the Covid-19 pandemic and Russia’s invasion of Ukraine, as well as soaring inflation and sharp reversals in monetary policy from quantitative easing and rock-bottom interest rates to a sustained cycle of rising rates.

It’s a tough period over which to evaluate investment performance but a review of the 10 funds that a range of experts suggested to buy and hold forever in 2019 shows that all bar one have made money for investors.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Below, we take a look at their fortunes and revamp the list, ousting four to make way for promising new candidates.

Fundsmith Equity

None of the 10 funds has beaten world stock markets over the five-year period but Fundsmith Equity, a core recommendation of interactive investor’s Super 60 list, comes close.

This is impressive since the approach prevents the manager from investing in the expensive US technology mega-caps that have driven the market higher. Terry Smith favours high-quality, resilient, global growth companies that are good value, leading him largely into healthcare and consumer stocks.

“His clear, straightforward process of finding easy-to-understand businesses without overpaying for them has proved a successful and resilient approach, with benchmark-beating long term performance,” says Darius McDermott, managing director of FundCalibre, which has the fund on its “Elite” list.

Smith’s ideal holding period is forever – and this fund retains its place among buy-and-hold forever funds.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Core and satellite funds for a £100K ISA portfolio

Dimensional World Equity

The second top performer over five years, Dimensional World Equity uses Dimensional Fund Advisor’s “passive plus” approach of tracking markets with a tilt towards smaller, cheaper and more profitable companies.

A more straightforward portfolio building block is the iShares Core MSCI World ETF USD Acc GBP (LSE:SWDA), which has outperformed the Dimensional fund over all time periods and is a smidgen cheaper at 0.2% versus 0.25% a year.

We are making a swap here given the iShares ETF’s superior performance profile and status as a low-cost pick in interactive investor’s Super 60.

The verdict from our analysts? “A soundly constructed and reasonably representative portfolio with a low fee leaves this fund well positioned to continue its long streak of superior risk-adjusted returns relative to its Morningstar category peers over the long term.”

Impax Environmental Markets

Patrick Thomas, head of ESG investment at Canaccord Genuity Wealth Management, is sticking by Impax Environmental Markets Ord (LSE:IEM) as a means to capitalise on the long-term growth of the green economy.

Poor performance over the past two years can be explained by big-picture macroeconomic factors.

He says: “A lot of recent underperformance has been about what Impax hasn’t owned – ‘Magnificent Seven’ tech stocks last year and energy the year before – and reflective of the market generally punishing small and mid-caps.

“The environmental challenges the world faces have not gone away. Extreme weather events are becoming more prevalent with tropical storms becoming category five hurricanes in a matter of hours.

- Day in the life of a CEO: Impax Asset Management’s Ian Simm

- ISA ideas: alternatives to funds and trusts that are flavour of the month

For Thomas, relatively weak investor sentiment, less challenging market valuations and a strong investment process continue to make this trust an attractive proposition.

T Rowe Price Frontier Markets Equity

Producing middle-of-the-pack performance, the inherently risky T. Rowe Price Frontier Markets Equity fund needs longer to prove its worth.

EQ Investors feels the list lacks a thematic play and suggests adding iShares Digital Security ETF USD Acc (LSE:LOCK), which the frontier fund has made way for.

“It’s a thematic play but also has attributes that a sustainability-focused investor may find appealing – companies held in the portfolio are in general alignment with the transition to a low-carbon economy,” says Tertius Bonnin, an assistant portfolio manager at EQ.

In a world that is becoming increasingly data-focused, digital security is essential. “We like the business models of many software-oriented companies, which typically have a high degree of recurring revenues, high margins and sustainable rates of growth,” adds Bonnin.

Federated Hermes Impact Opportunities Equity

Quilter Cheviot fund research analyst Melissa Scaramellini suggested the Federated Hermes Impact Opportunities Equity fund but removed the fund from coverage shortly afterwards because fund manager Tim Crockford moved employer.

When Crockford set up the Regnan Global Equity Impact Solutions fund at Regnan, part of JO Hambro Capital Management, it added this fund to coverage. It has fared significantly better than the Federated Hermes fund over the past three years, although both have made losses.

Like other funds on the list, the Regnan fund has lagged world stock markets because it doesn’t hold traditional energy or large tech and has a small and mid-cap bias.

Scaramellini says: “It’s also focused on sustainable themes, which have been out of favour, but we retain conviction on a long-term view.”

Finsbury Growth & Income

It’s been a tough time for Nick Train. A mix of his quality-growth style being out of favour and poor performance from some of his stock picks, notably Hargreaves Lansdown (LSE:HL.) and Burberry Group (LSE:BRBY), has led to lacklustre returns for Finsbury Growth & Income Ord (LSE:FGT). In fact, the UK equity income trust has underperformed the FTSE All-Share over five years.

“The problem with having a very concentrated portfolio – the top 10 is more than 80% – is there isn’t room for error,” says Ben Yearsley, co-founder of Fairview Investing.

Train’s strong long-term track record of outperformance means this investment trust retains its place, however.

“Longevity counts in my book,” says Yearsley. “His quality approach helps reduce risk of permanent loss and ensures companies are well set up for the long term.”

- 12 funds to generate £10,000 of income in 2024

- 10 investment trusts for a £10,000 annual income in 2024

Capital Gearing

Capital Gearing Ord (LSE:CGT), a multi-asset investment trust with a capital preservation mandate, has disappointed over the past few years, particularly when viewed against stubbornly high inflation.

“To lose money over the past 12 months is especially galling,” says James Carthew, head of investment companies at QuotedData. He points to two main factors. First, rising interest rates have hit the valuation of longer-dated inflation-linked government bonds to which the trust is exposed.

“In addition, the general widening of investment trust discounts has hit its portfolio of investment companies,” says Carthew.

A core constituent of the Super 60, it remains a long-term buy and hold.

Carthew adds the widening of trust discounts “should rectify itself in time and has created more opportunities for the managers to add value”.

Fidelity Emerging Markets

Fidelity Emerging Markets Ord (LSE:FEML) has been a core holding of Yearsley’s for years. Unfortunately, the last few years have been tough.

He explains: “Emerging markets have been out of favour. China has dragged much of Asia down with it, and this fund suffered due to a reasonable chunk in Russian equities that was written down to zero after madman Putin invaded Ukraine.

“Despite this, I would still stick with the fund. Too much emphasis is placed on shorter-term numbers – especially relevant given the unusual markets we’ve had over the last few years.”

First, Yearsley reckons emerging markets and Asian equities specifically are multi-decade-long themes. Second, the quality-growth bias of the fund is ideally suited to long-term investing. And finally, Fidelity is “excellently resourced”.

Premier Miton UK Smaller Companies

Fortune has not favoured smaller companies in recent years and the Premier Miton UK Smaller Companies fund has suffered more than most. The fund’s underperformance of the FTSE 250 index had us looking for an alternative.

McDermott at FundCalibre suggests Liontrust UK Smaller Companies, which has beaten the Premier Miton fund by more than 30% over five years.

“A clear, well thought-out investment philosophy underpins the Liontrust UK Smaller Companies fund, which has been executed with diligence and skill by managersAnthony Cross and Julian Fosh for many years,” he says.

He adds the emphasis on quality and avoiding cyclical stocks “has worked particularly well with smaller companies, with the fund producing excellent relative and risk-adjusted performance figures”.

- ISA ideas: I’m a beginner investor, where should I put my first £1,000?

- Ian Cowie: ignore the doom-mongers, 32 trusts are in ISA millionaires’ club

Baillie Gifford Global Discovery

Baillie Gifford Global Discovery is bottom of the pack and the only fund of the 10 to have lost investors’ money over the five-year time frame.

The fund invests on a five-to-10-year view and has a bias towards smaller companies operating in industries with the potential for structural change and innovation.

FundCalibre retains it Elite rating on the fund – with an important caveat. “This fund has a place as a long-term holding in a balanced portfolio but is only a ‘buy-and-hold forever’ if it’s actively and consistently rebalanced through the market cycle,” says McDermott.

He adds: “It tends to have outsized outperformance during bull markets and acute losses during risk-off market events. Investors should use these pockets of extreme alpha to take profits.”

Let’s hope those profits are soon forthcoming.

** The history of this unit/share class has been extended, at FE fundinfo's discretion, to give a sense of a longer track record of the fund as a whole. Souce: FE Analytics. Data to 9 February 2024. Past performance is not a guide to future performance.

Key

Original 10 funds - white background

Replacement funds - pink background

Market indices - grey background

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.