Housing and investment wealth at risk from coronavirus tax review

Capital gains tax could be used to help pay covid-19 bill

15th July 2020 15:52

by Brean Horne from interactive investor

Capital gains tax could be used to help pay covid-19 bill

Homeowners and investors could end up paying more to help pay off the country's coronavirus bill, according to Government plans to review capital gains tax (CGT).

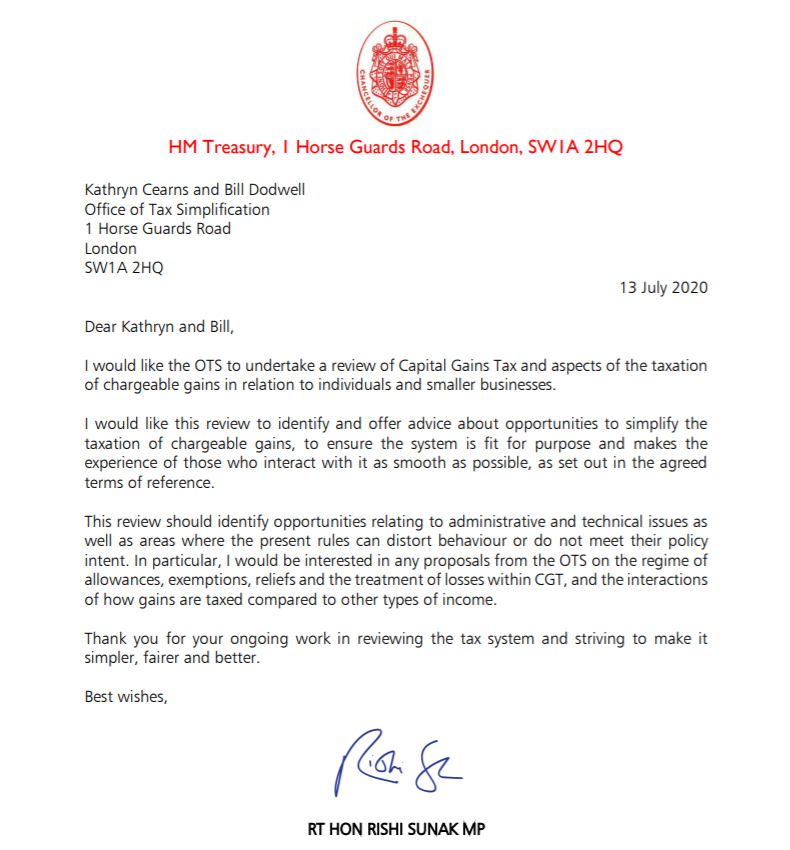

CGT is a tax on the profit made from selling an asset that has increased in value. Chancellor Rishi Sunak has asked the Office of Tax Simplification (OTS) to review it.

The review will assess if the current CGT rates are suitable, as well as whether certain reliefs and exemptions could be simplified or scrapped.

The UK deficit is likely to top £350 billion as a result of the coronavirus crisis.

What is CGT?

The tax is only payable on gains made above your annual tax allowance, which is currently £12,300 a year.

Basic rate taxpayers pay 20% on gains from residential property and 10% from other assets, such as investments.

However, this does not apply to profits made from selling your main home, in almost all cases. This is due to a relief called private residence relief.

This relief is part of the review, meaning it could be altered or even scrapped. This would mean owners of one home getting a tax bill if they sell their property for a big profit.

However, this is unlikely to be changed drastically any time soon as it would clash with another recent Government policy to scrap stamp duty for six months on homes worth up to £500,000.

Higher rate and additional rate taxpayers pay 28% CGT on residential property and 20% on gains from other assets.

Could changing CGT help?

The Government has a huge debt to pay, and taxes will almost certainly have to rise even if CGT is left unchanged.

But there is a risk that it rises quite considerably, according to Nathan Long, senior analyst at Hargreaves Lansdown.

He says:"We would support a comprehensive review of all capital taxes because we’d like them to be simple and fair. Currently capital gains are taxed at a much lower level than income, so there is a risk that in this environment the chancellor will use this as a justification to hike CGT closer to income taxes."

Some experts warn that raising CGT could damage small businesses in the UK.

Graham Boar, partner at UHY Hacker Young, the national accountancy group, says:“Raising headline rates of CGT would deal another blow to business owners, who are already reeling from a cut to Entrepreneurs’ Relief earlier this year. Raising CGT would make building and selling businesses in the UK even less attractive.”

This article was originally published in our sister magazine Moneywise, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.