Is this heroic US share a buy?

24th August 2022 09:43

by Rodney Hobson from interactive investor

There is much positive activity taking place at this firm, but our overseas investing expert asks whether the company can be more than a one-product wonder.

Some heroes of the pandemic have been dumped unceremoniously by investors, such can be the brutality of the stock market. The question now is whether the producers of vaccines can be more than a one-product wonder.

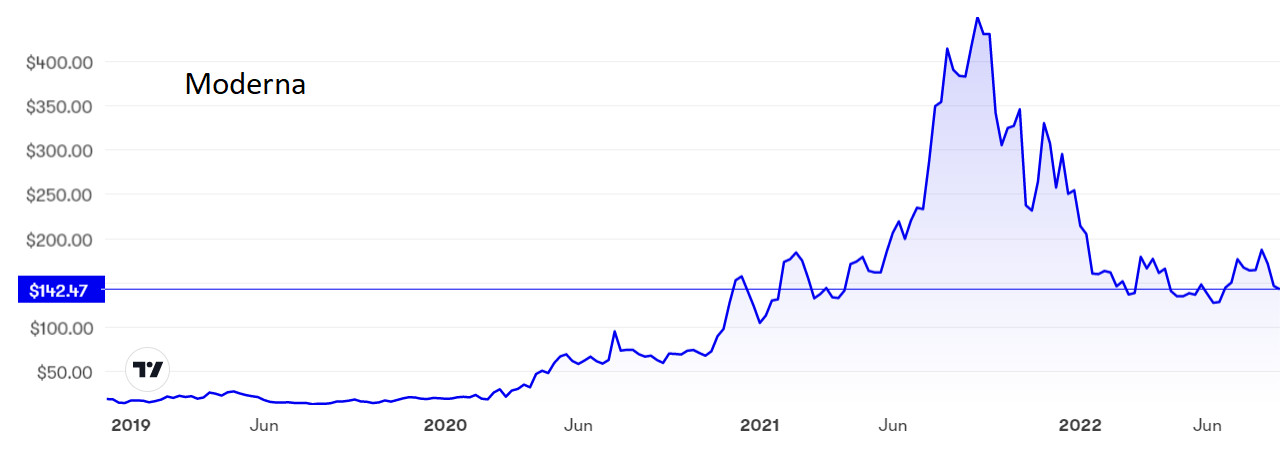

Nobody much noticed Moderna (NASDAQ:MRNA) before February 2020 as the stock languished well below $20. Then Covid-19 struck and the pharmaceutical company came into its own, developing a very effective vaccine with remarkable speed and carving out a niche in a market where many rivals fell short of Moderna’s success.

- Discover more: Buy international shares | Interactive investor Offers | Most-traded US stocks

However, the $450 peak in Moderna shares in September 2021 showed the dangers of being swept along on an emotional bandwagon that far outstrips reality. The shares look far more sensibly priced at a third of that level, having bottomed out at around $130, and a $3 billion share buyback launched earlier this month could help to establish a floor.

Second-quarter figures were a bit mixed. Increased sales from the Covid-19 vaccine pushed revenue 9.1% higher to $4.53 billion but that was a lower figure than was achieved in the first quarter and it translated into lower profits, with net income down 21% year on year at $2.2 billion.

Advanced purchase agreements suggest that revenue will pick up again in the second half as most of the populated world moves towards winter, when the virus is likely to be more active.

Past performance is not a guide to future performance.

Moderna has not stood still since the peak of the pandemic and is coming close to becoming the go-to pharma for Covid-19 vaccines. Its Spikevax vaccine used against earlier strains has been replaced by a new version that is also effective against Omicron. Moderna claims its side effects are similar to the earlier vaccine and are typically mild.

A deal has been agreed for the European Commission to purchase an additional 15 million doses, so that those scheduled for July and August but which were delayed, can be replaced by the new more effective vaccine to be delivered later this year. That means sales may be again a little disappointing in the third quarter before a bumper end to the year.

- Can two lockdown success stocks keep winning?

- Stockwatch: Michael Burry has sold all but one stock - should you own it too?

In the UK, the MHRA, which regulates medical treatments, has authorised use of the vaccine, the first one to tackle two strains of the virus.

Moderna this month announced that it will open its first vaccine manufacturing facility in the southern hemisphere, in Melbourne, Australia. It will be completed in 2024 and will produce 100 million vaccine doses a year for Covid-19, influenza and other diseases. This is in addition to a production facility to be built in the UK, announced earlier.

Despite all this activity, there is a fear that Moderna will prove to be too dependent on its Covid-19 vaccine. Indeed, the new vaccine will, it is claimed, be needed only once a year rather than as a booster given two or three times annually, so sales will be reduced by its own success. By the time it is produced at Melbourne, it is likely that the Indo-Pacific region will have learned to live with Covid and that it will have mutated into a mild disease. The UK facility will not be in production until 2025.

- Scottish Mortgage tops up Moderna, trims Amazon and sticks by Netflix

- Tesla stages second stock split in two years

On the positive side, Spikevax was a new class of inoculation using molecules that teach the body to fight disease rather than giving a small dose of the virus itself. Such treatments can be developed rapidly for other diseases including influenza and for viruses that appear suddenly and spread like wildfire.

Hobson’s choice: the price/earnings ratio is a measly 4.34, demonstrating the extreme caution being shown towards the stock. There is no dividend and it is unlikely that there will be one when so much cash needs to be ploughed back into developing the business. Indeed, one wonders if the share buyback cash could be better spent.

Last November, I warned investors to sell at $245. That advice still stands at just over $140. The risks far outweigh the positives.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.