Here’s why UK shares will pay lower dividends in 2022

Drilling down into the dividend data shows the recovery has been uneven. We explain why.

24th January 2022 10:58

by Kyle Caldwell from interactive investor

Drilling down into the dividend data shows the recovery has been uneven. We explain why.

UK dividends staged a recovery in 2021, but the outlook for the next 12 months is less rosy with overall payouts forecast to fall, according to Link Group’s dividend monitor.

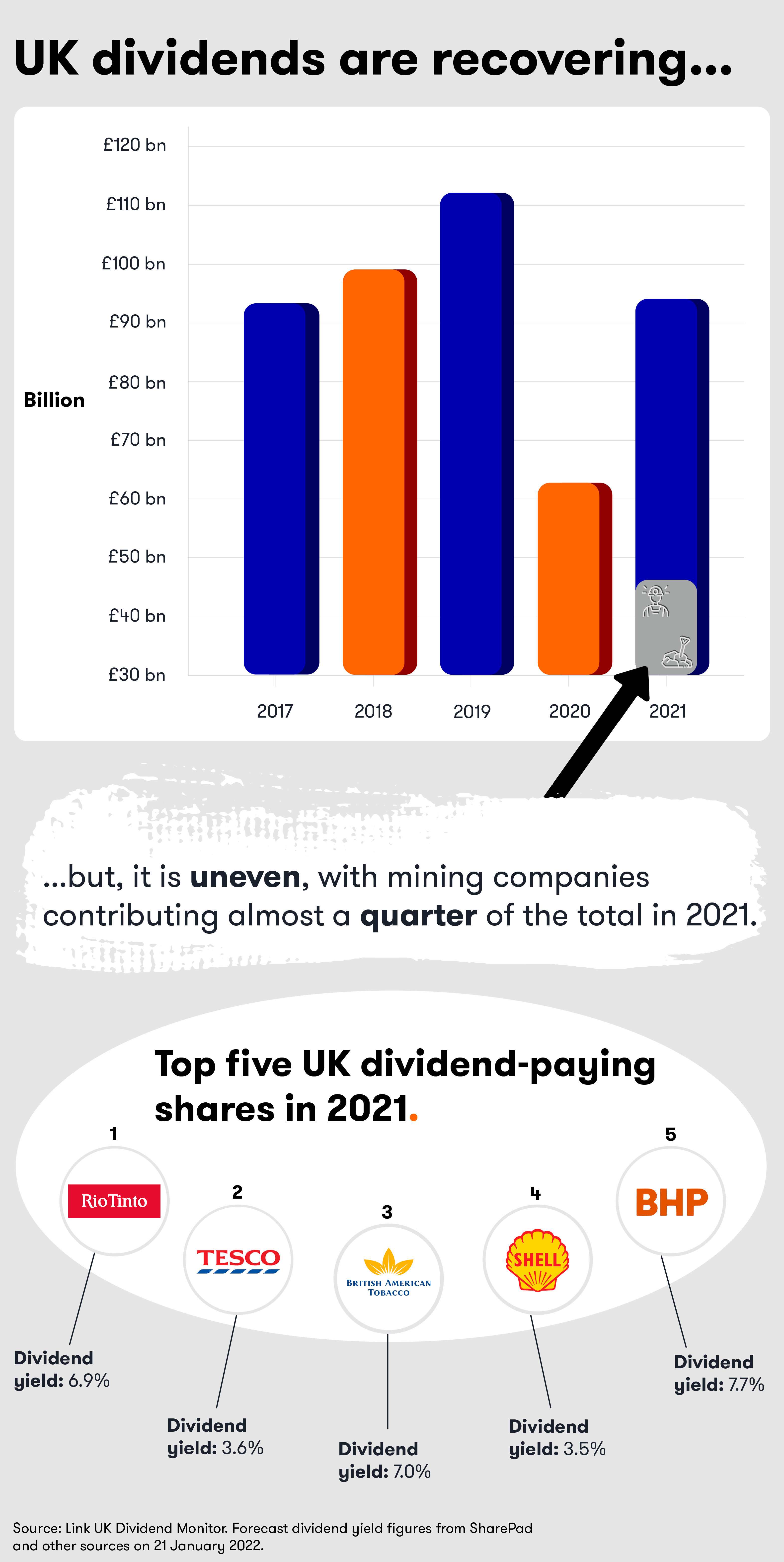

In 2021, UK dividends rose by 46.1% to £94.1 billion, taking the total close to 2017 levels, as companies restarted paying dividends to shareholders having paused or cancelled payouts during the Covid-19 pandemic. In 2020, UK dividend payments stood at £61.9 billion, falling 44% from their pre-pandemic levels in 2019.

However, drilling down into the data shows the recovery has been uneven. Various sectors hit hard by the pandemic have continued to cut dividend payouts – including airlines, leisure and travel. Oil dividends were also lower because reductions in 2020 spilled over into 2021. Telecoms was the other main casualty, following BT (LSE:BT.A)’s dividend cut. In addition, typically defensive sectors, such as food, basic consumer goods and pharma, kept payouts flat.

The big dividend winner was mining companies. Link Group notes that the sector had a heavy influence on overall dividend growth. Mining companies contributed £21 billion of dividends. In 2020, the sector delivered dividends of £8 billion.

The report notes: “It was a very unbalanced year with excessive dependence on mining companies, whose booming profits meant payouts were three times larger than the long-term average. Together they accounted for almost a quarter of the UK total last year, and were by far the biggest contributor to the year’s increase in dividends overall.”

- Funds and trusts four professionals are buying and selling: Q1 2022

- Bull and bear points for major equity markets at start of 2022

- Where to invest in Q1 2022? Four experts have their say

The second most significant driver of growth was banks restoring their payouts, having last year been given the green light to do so by the regulator. In 2020, when the pandemic hit, banks were told to stop paying dividends.

The industrials sector also help drive dividend growth, although the report notes that its payouts remain a quarter below pre-Covid 19 levels.

Special dividends hit a record high of £16.9 billion – three times higher than their normal level. Mining companies were again the big influence, accounting for £6 billion.

Underlying payouts, which strip out special dividends, rose more modestly, up 21.9% to £77.2 billion.

Link Group has forecast UK dividends are set to fall 7% to £87.5 billion in 2022. It excepts a more even recovery to play out, with most sectors delivering growth.

The firm cautions that mining companies “can neither sustain this pace of increase nor likely repeat special dividends of this size”. It also expects special dividends to fall from their record peak.

Link Group, however, has forecast underlying growth of 5%, bringing dividends on this measure to £81 billion in 2022.

Mining company dividends fluctuate depending on the performance of the iron ore price. Therefore, the sector is not a reliable dividend payer.

In an interview with interactive investor in November, Laura Foll, co-manager of Lowland (LSE:LWI) Investment Trust, noted that she expects “mining dividend to come down” in 2022. Foll said: “Mining companies have very strict dividend payout ratios, so if their earnings come down, then the dividends will likely follow.”

- Laura Foll: the UK bank shares I have been buying

- Laura Foll: three cheap sectors and my dividend prediction for 2022

BHP (LSE:BHP)’s delisting from the FTSE 100 will also have an impact on the amount of dividends miners' pay this year. The company was the overall fifth biggest dividend payer in 2021. It will be deleted from the FTSE 100 at the end of January after shareholders approved plans to simplify the firm’s structure under a main listing in Sydney. The top four dividend payers in 2021 were: Rio Tinto (LSE:RIO), Tesco (LSE:TSCO), British American Tobacco (LSE:BATS) and Royal Dutch Shell (LSE:RDSB).

Link Group’s report adds: “Mining profits soared on the back of booming commodity prices and cost efficiencies secured after the last commodity crash. Miners declared special dividends rather than drive expectations for future regular dividends too high.”

In 2022, Link Group expects UK equities to yield 3.5%. Ian Stokes, managing director at Link Group, says:“The recovery in UK dividends is not complete, but the easiest part of the catch-up is now behind us. 2022 faces a number of headwinds in the form of Omicron disruption, inflation, and tax hikes and that adds uncertainty to our forecast.

- Watch our latest fund manager interviews by subscribing for free to the ii YouTube channel

- Top-performing fund, investment trust and ETF data: January 2022

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

“As the pandemic continues, it would be easy to take a knife to our expectations for dividends for the coming year. We are, however, cautiously optimistic that most sectors can deliver growth.

“Banks and oil companies should be the main engines of progress in 2022. Mining companies can neither sustain this pace of increases nor likely repeat special dividends of this size. We are hopeful that their regular dividends are supported, however, given relatively firm commodity prices.

“The proposed imminent departure of BHP from London will help restore some balance to the UK index. The dominance of big mining groups has overshadowed the income-generating capacity of the broader market and left UK payouts too heavily dependent on a single, highly cyclical sector.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.