Here's why AIM-listed Bushveld Minerals shares can double again

9th November 2018 12:56

by Rajan Dhall from interactive investor

Financial markets analyst Rajan Dhall picks out the day's key oil industry news and runs the numbers to see what this miner's share price might do next.

Oil market round-up

In an already busy week, last night, at around the same time as the FOMC rate decision, a story broke that shocked energy markets worldwide.

Saudi Arabia is reported to be looking into what life would be like if OPEC ceased to exist. This is massive news, as it was just recently that the cartel agreed production cuts to stem the price decline which had seen spot WTI trade as low as $26 per barrel. Saudi, along with Russia, has been instrumental in reducing global oil output after the boom in shale production in the States.

It may take some time for markets to react to the Saudi story but keep a close eye on this. If Saudi is unhappy with the OPEC situation, prices could fall even more because they would want a higher production share as an individual entity, and maybe they feel they could take on America independently.

Now it seems that Donald Trump has got his way again with a carefully planned sanction play on Iran. When the US president first announced sanctions, WTI prices rose in anticipation of strong action. He then later softened the blow and scored some political points by including exemptions; China and India along with a few others being able to maintain imports from Iran.

Lastly, the strong dollar has really hampered commodities this week with the US Dollar Index (DXY) climbing to 96.88 today, nearer a possible retest of the recent 97.20 high seen on 31 October.

Markets are now pricing in another Fed rate hike for December with the FFR (Feds Funds Rate) implying an 84% chance, which has helped the DXY move around 1.28% from the lows of 95.68 seen this week.

Weekly Spot WTI Chart

Source: TradingView Past performance is not a guide to future performance

Bushveld Minerals

Bushveld Minerals is an AIM-listed vanadium production company with a market cap of £443 million. It has benefited greatly from a rising vanadium price, supported by China's new high-strength rebar standard which came into effect on 1 November 2018.

Bushveld shares have now risen over 400% since the lows of this year with the share price today hitting a high of 42.3p.

Today, we got confirmation that the unofficial 16-day stoppage at the Vametco vanadium plant and seven days of unplanned maintenance, meant ferro-vanadium production was down 14.6% in the third quarter versus the second quarter at 537mtV (metric tonnes of vanadium).

Because of the stoppages, Vametco's 2018 production guidance has been revised lower from 2,850-3,000 mtV to between 2,600 mtV and 2,650 mtV.

However, there's lots to like following the acquisition in September of Sojitz's interest in Vametco for $20 million, increasing Bushveld’s effective interest to 74%.

SP Angel analyst John Meyer thinks the share price could reach 87p in time, more than double the current price, underpinned by supply and demand characteristics of vanadium.

"The few primary producers in the market appear wholly incapable of expanding to meet demand in the next two years with so much by-product, slag, production removed from the market," writes Meyer, who also expects production costs to fall, assuming no further unplanned stoppages.

"We are struggling to see how the market may supply demand for vanadium in the next two years and we feel vanadium prices should settle at a higher price level than previously envisaged for the longer term."

Bushveld chief Fortune Mojapelo said: "With the completion of most of the corporate action aimed at maximising Bushveld's ownership of Bushveld Vametco, the company can accordingly now focus on ensuring maximised production output and efficiencies at Vametco.

"Accordingly, we are pleased to have commenced with Phase 3 of our expansion plan, which will increase capacity at Vametco to 5,000 mtV per annum. Phase 3 will also benefit from advancement of the Brits vanadium project, which has yielded encouraging drilling results".

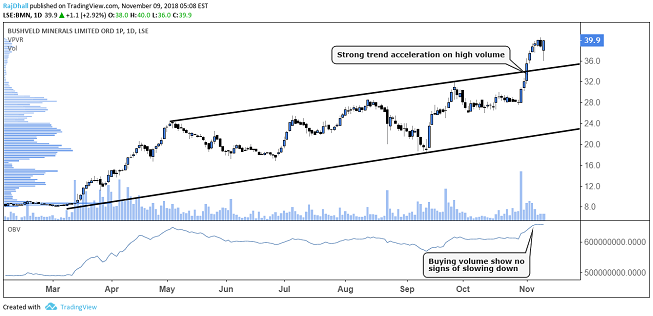

Chart analysis

The chart below shows clearly that Bushveld is in a bullish phase.

Interestingly, this has been supported by particularly high volumes. The OBV (on balance volume) indicator at the bottom measure's changes in volume in relation to price changes. It shows that even though the price continues to rise there is no slowdown in buying pressure.

In other stocks, we often see a point where the OBV readings fall as prices get too high. Keep an eye on strong buying volume on retracement as it seems that a 'buy the dip' policy is firmly in place.

In terms of support levels, the breakout point from the trendline could be significant. Prices often drift back to retest trendlines once they are broken, and use them as support. Any possible retreat could also struggle to break below the psychological 30p area.

Source: TradingView Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.