Here's when these five cannabis high-flyers will be worth buying

19th December 2018 11:47

by Rodney Hobson from interactive investor

Leading industry commentator, accomplished author and new interactive investor columnist Rodney Hobson studies these fashionable drug stocks for 'buy' signals.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stockmarket. He is qualified as a representative under the Financial Services Act.

Cannabis is coming out of the shadows in what could be a riches to rags to riches story. After decades of controversy, cannabis can once again be mentioned in polite conversation.

It has been used to relieve pain for 5,000 years and its heyday came in the 19th century when it was smoked to relieve neuralgia and sciatica, prevent epileptic fits and relieve headaches. It reputedly had a royal stamp of approval in the UK with Queen Victoria reportedly taking it to ease her period pains.

The arrival of aspirin and purified morphine in the 1890s, followed by antidepressants and other tranquilisers in the 20th century sounded the death knell of cannabis, which fell into disrepute because of its mindbending properties.

There is, however, more to cannabis than tetrahydrocannabinol, the psychedelic extract that led to governments banning it. To date more than 100 cannabinoids, the chemical compounds derived from the cannabis plant, have been identified. Possible medicinal uses include treatment of chronic pain, multiple sclerosis, epilepsy, Parkinson's disease, schizophrenia, arthritis and more. There are even indications that it could shrink tumours.

Based on pre-clinical evidence, there are more than 37 disorders that could benefit from treatment with cannabis oil. That's a big range of potential uses. These are early days and much more research and clinical trials are needed but just a few successes will open up a treasure trove for producers.

As medical use moves forwards, recreational use of cannabis is gaining acceptance: Canada has ended 90 years of prohibition, as have 10 US states. The potential market can be counted in billions of dollars.

However, this is a pricy business to get into. Pharmaceutical companies always face extensive trials for new drugs and many fail at the last hurdle.

Any successes have to pay for not only their own development but also for the cost of developing the failures. Since it has been illegal to grow cannabis in most Western countries it may be necessary to buy land and ramp up cultivation under strict security. Production facilities maintaining the highest standards of cleanliness must be built, or vegetable processing plants adapted.

Most cannabis stocks are spending faster than they are earning, so unless the company you invest in is taken over you are likely to see your shareholding diluted or be asked to stump up more cash in a rights issue.

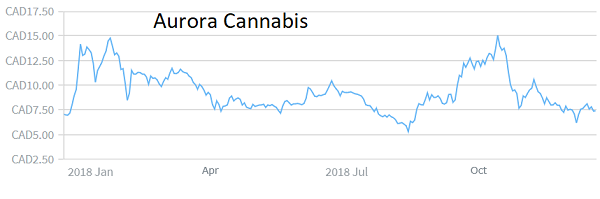

Aurora Cannabis for example, has been funding rapid expansion by issuing new shares. This year alone it has spent a total of $3.6 billion (£2.85 billion) on acquisitions such as Ontario-based MedReleaf, which produces up to 140,000 kilograms of cannabis products a year and is switching vegetable growing to cannabis, and Saskatchewan-based CanniMed Therapeutics, which grows cannabis plants, has potential for processing cannabis oil and is developing alternative products.

It has also bought production capacity in South America, bought out its Mexican partner and set up a joint venture in Denmark. Aurora now has operations in more than 20 countries on five continents.

This explains why Aurora, despite its advancements, has seen its share price halve on the Toronto Stock Exchange since peaking at C$15 in October.

Source: interactive investor (*) Past performance is not a guide to future performance

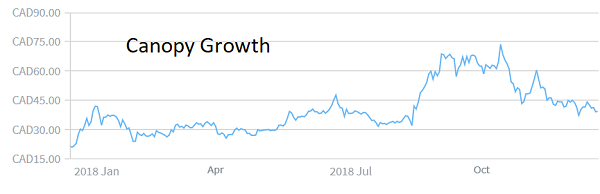

Canopy Growth has similarly fallen from top side of C$70 to less than C$40; OrganiGram from C$8.20 to under C$5. All three share prices have been highly volatile and earlier in the year were lower than they are now so they could well slip further.

Source: interactive investor (*) Past performance is not a guide to future performance

The story is worse for The Green Organic Dutchman, down from C$8.80 to a new low of C$2.68, and at VIVO whose shares has been on a steady slide on the Toronto Venture Exchange since January, losing more than 80% of their value.

Hobson's Choice: Avoid for the time being. This volatile sector will one day soar away but in the meantime shareholders are more likely to be pumping in additional money rather than collecting dividends.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.