Here’s what investors are getting wrong about tech stocks

29th April 2023 16:01

by Paul Allison from Finimize

Tech stocks have been doing something strange lately: they’ve been rallying on bad economic news. But tech stocks aren’t defensive, so hiding out in this sector is a risky ploy, if you ask me. I’ll give you four reasons why.

Recently, technology stocks have been labeled defensive as they’ve rallied with worsening economic news.

But investors seem to be focused only on the reward – the potential for better valuations due to lower interest rates – and are ignoring the risks – that tech stocks might underperform a recession-driven correction.

So consider some actual defensive investments (like stocks from the consumer staples or healthcare sectors) and keep your eye on the long-term prize. Remember, focus on stocks you’re prepared to buy more of if, or when, they fall.

Tech stocks have been doing something strange lately: they’ve been rallying on bad economic news. That odd behavior is because investors increasingly expect a flagging economy to lead the Federal Reserve (the Fed) to cut interest rates, a move that’d boost the valuations of those firms. But tech stocks aren’t defensive ones, so hiding out in this sector, focusing only on those rate cut hopes, is a risky ploy, if you ask me. I’ll give you four reasons why:

1. The good stuff’s already priced in.

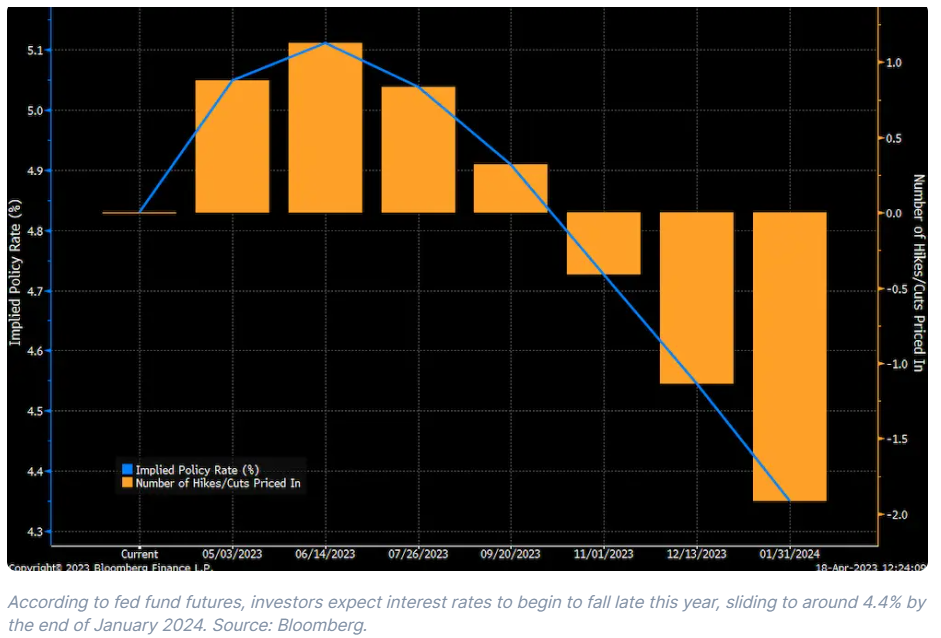

Investors are already factoring in some cuts to interest rates, as you can see from this fed funds futures chart. They see cuts beginning late this year, dropping the key rate to around 4.4% by January.

And, if the fed fund futures are pricing in rate cuts, you can assume that investors are already taking those into account when it comes to valuing tech shares. Let’s face it, the Nasdaq’s up 20% this year and sitting just 20% shy of its all-time highs. And that might seem like a big gap from its highs, but keep in mind, the 2021 peak now looks to have been something of a bubble. So, right now, it’s 20% short of a fairly over-inflated pitch.

Investing is about risk and reward, but in the short term, the market tends to focus only on one or the other – risk or reward. Back in January, when the Nasdaq was languishing, we could’ve said it was pricing in some bad outcomes (higher interest rates, a likely recession, et cetera) and keenly focusing on the risk. But now we could say it’s keenly focused on reward, and mostly ignoring the risks. And when the market isn’t pricing in something bad, but there’s a chance it might happen, it’s best to watch out.

2. Tech spending growth isn’t a certainty.

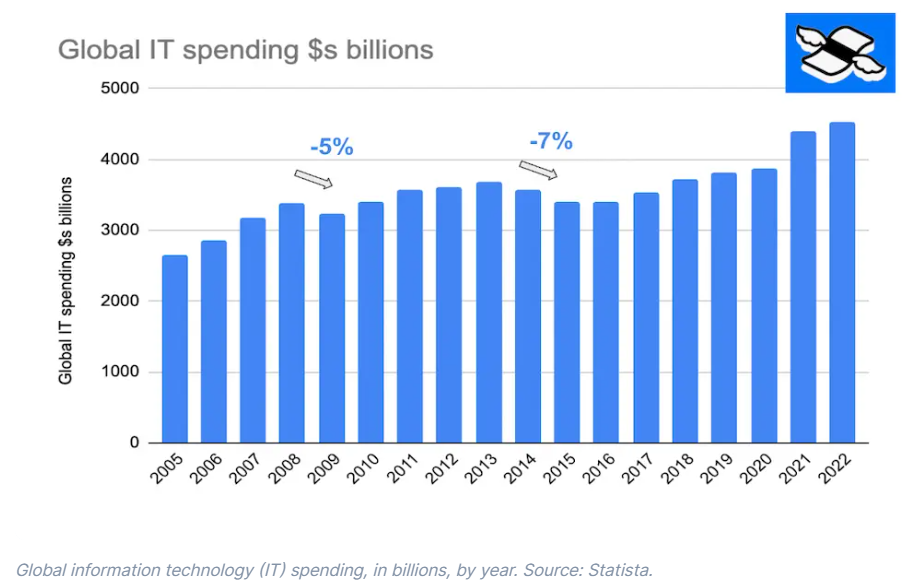

There’s this narrative out there lately that tech stocks are defensive – and it should have you lifting an eyebrow. Defensive stocks are those that tend to outperform in a falling market – say, during a recession. That’s not tech stocks. This chart shows global technology spending going back to 2005. You’ll notice it dipped by around 5% during the financial crisis in 2008-09 and by 7% between 2013-15 when European banks were in crisis and the region was flirting with recession.

Now, compare that to the global economy’s performance. In 2009, the global economy shrank by about 1% (and the US economy slipped by 4%). In 2013-15, the global economy avoided a recession, but Europe’s economy saw two years of decline. The point is that tech spending tends to fall – and rise – by even more than economic growth. And that’s not defensive.

3. Tech profits might not hold up in a downturn.

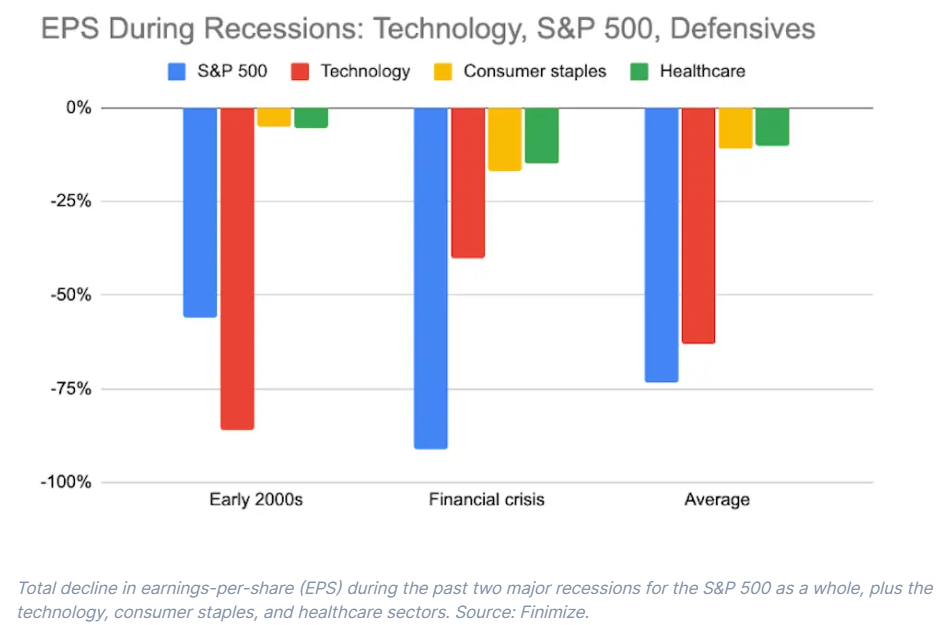

Tech profits are a little harder to assess, and we only really have two solid recessions from this century (excluding the European banking crisis years and the short-lived Covid recession) to draw comparisons from – the dotcom bust of the early 2000s and the so-called great recession of 2008-09. Now, both were crisis-like in nature, and followed periods of particular excess – a tech bubble in 1999, and a housing bubble (and subsequent financial crisis) in the 2000s – so they’re not perfect comparisons. That said, there are tinges of both in today’s environment: technology stocks arguably experienced something like a bubble in 2021, and we’ve recently experienced a mini banking crisis, and so they’re not ridiculous comparisons either.

This chart shows the total peak-to-trough drop in earnings-per-share (EPS) for the technology sector (red bars), alongside the S&P 500 index (blue), and two defensive sectors: consumer staples (yellow), and healthcare (green). Taking the average of the two recessions, the technology sector performed better than the overall market, but far worse than the classic defensive sectors.

So you could argue that technology profit might fare better than the overall market in a recession, and that might be true. But take another look at the first chart of global spending on technology. Spending has been very strong over the past few years, and that might mean any cut to tech spending will be deep, perhaps more akin to the cuts of the early 2000s than those of the financial crisis recession.

But whatever the shape of the next recession, the technology sector isn’t defensive – especially compared to actual defensive sectors – and that’s clear from its profit performance.

4. And tech stock prices, well, you can probably guess.

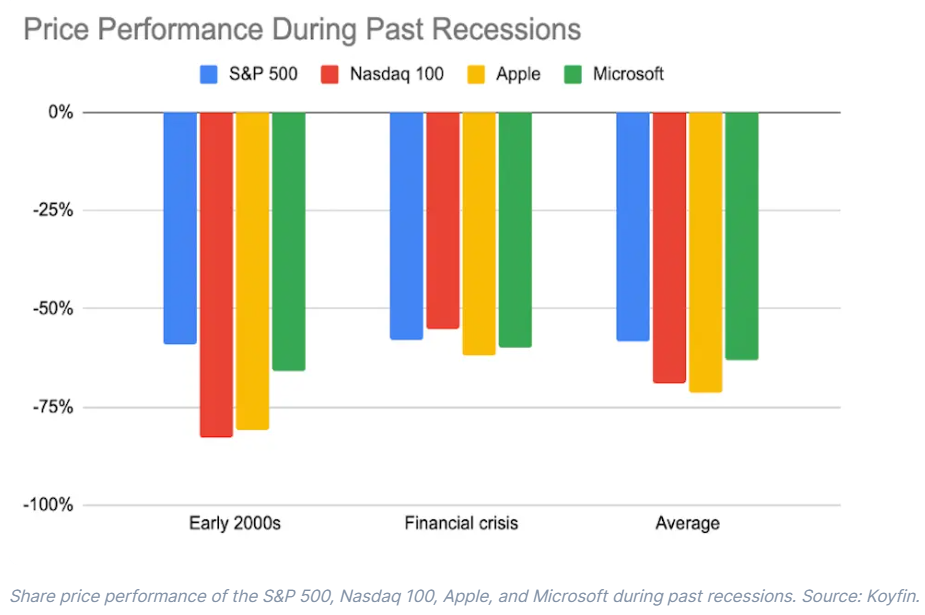

Stock prices are where the rubber meets the road, and here the evidence is a little more conclusive: tech stocks have underperformed in past recession-driven market falls. This chart shows how the tech sector (in red, using the Nasdaq 100 as a proxy), the broader S&P 500 (blue), and two tech giants Apple (yellow) and Microsoft (green) performed during the two recessions. Using the average, tech stocks have performed more poorly than the overall S&P 500. Again, that’s not defensive.

What’s the conclusion, then?

Well, we don’t actually know whether a recession’s going to happen, but if it does, it’s likely tech stocks – especially given their curiously high starting point – will underperform the market. And that makes them anything but ideal defensive investments. So, if you’re a tech investor, I’d say you’ve got three solid choices.

First, you can stay focused on the long view and ignore any near-term recession concerns. That’s a perfectly reasonable choice: time in the market is better than timing the market, after all.

Second, you could balance out your portfolio with some actual defensive stocks. The iShares S&P 500 Consumer Staples Sector ETF or the iShares S&P 500 Healthcare Sector ETF are two funds you might consider for broad exposure.

Third, when analyzing tech shares in the future, remember to consider this very important question: if this stock falls, are you prepared to buy more? Now that question’s a good one at any time, but it’s particularly relevant when a recession’s afoot. See, if you narrow your focus just to stocks you want to hold for the long haul and buy even more of when they fall, you’re essentially bulletproofing your stock selection process and your portfolio. And that can only boost your returns in the end.

Paul Allison is a senior analyst at finimize

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.