Here’s how much money you need to retire in 40 UK cities

21st June 2021 14:02

by Marc Shoffman from interactive investor

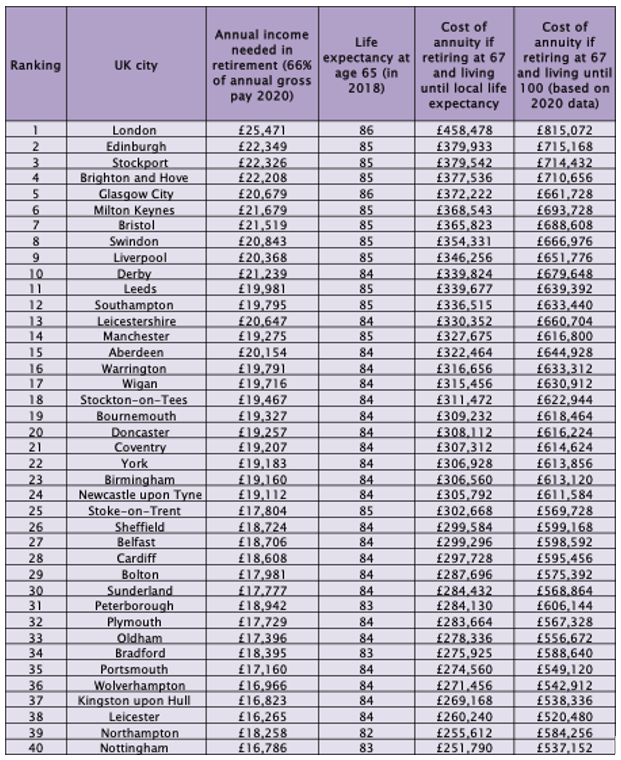

It costs almost twice as much to retire in London than it does in the cheapest UK city for retirees.

Retirees will need a pension pot almost two times larger to spend their golden years in London compared with the cheapest major UK city.

Research by financial adviser Salisbury House Wealth has revealed the size of retirement pot that savers would need to buy an annuity to give them enough of a basic income to live in the largest cities in the UK.

Pensioners in the capital need to have saved £458,478 by the time they are 67 to enjoy a basic income during retirement of £25,471, based on local life expectancy. That compares with just £251,790 needed to retire in Nottingham where you could earn £16,786 per year from an annuity.

- Invest with ii: What is a SIPP? | SIPP Calculator | Best SIPP Investments

The second most expensive UK city for retirees was Edinburgh, with retirees needing to have saved £379,933 to afford a decent enough annuity to maintain a basic living standard, followed by Stockport at £379,542.

- Pensions tax raid: government warned not to tinker

- Don't be shy, ask ii…am I saving enough for a decent retirement?

- Pensions jargon buster

Tim Holmes managing director at Salisbury House Wealth. says people cannot rely alone on the contributions of their employers into their workplace pension and need to start saving into their pensions as early as possible.

He said savers should also increase their contributions in line with salary rises and promotions.

He adds: “The average cost of retirement in the UK varies enormously with a £207,000 disparity between the most and least expensive cities.”

“Everyone should be investing into a pension fund as early as possible and to top up contributions to take advantage of the £40,000 annual allowance.

“Those who don’t save enough into their pension may be forced to work longer or will have to make considerable sacrifices to their lifestyles in order to get by in later life.”

An annuity is just one option open to retirees and they can also choose to remain invested or use drawdown to keep their money in the stock market and make regular withdrawals.

- Pension investors could lose out over Department of Work and Pensions proposals, warns ii

- Are you saving enough for retirement? Our pension calculator can help you find out.

Rebecca O’Connor, head of pensions and savings at interactive investor, says living standards and costs can vary dramatically according to where you live, so it is important to adjust your pension pot target according to where you will be based when you retire.

She says: “The difference between the pension pots required for a decent retirement income in different towns and cities across the UK might also give pause for thought for those who could consider relocating when they give up work.

“According to the interactive investor Great British Retirement Survey 2020, people living in London are more likely to say they are considering relocating when they retire than in any other region. Given the cost of living in London, this is not surprising.”

Source: Salisbury House Wealth

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.