Here's exactly what it would take to make Renishaw shares a buy

They're not there yet, but do this and financial fortress Renishaw will enter the 'buy' zone.

27th September 2019 15:42

by Richard Beddard from interactive investor

They're not quite there yet, but do this and the financial fortress that is Renishaw will enter the 'buy' zone.

So, Renishaw. Bit of a roller-coaster this one isn't it Richard?

You could say that. I think of it as a two steps forward, one step back share. It's down 39% from its previous high in January 2018. Then it was up 258% from its previous low. I could go on, but you know, watching share prices is not my thing. Traders must love it. It's the kind of share people get excited about.

Go on I'll bite. What's so exciting about it.

Well it's at the forefront of automation. It manufactures tools that use sensors and probes to control machines in factories, and inspect the products they manufacture. It is a world leader in 'metrology' (aka measurement), and the tools can be used in the manufacture of almost anything, from smartphones to bits of planes. It also makes machines that rely heavily on this technology, like additive manufacturing machines (3D printers), Raman microscopes used to detect chemicals including, for example the presence of plastic in water, and robots that do brain surgery.

Perhaps I should also mention, Renishaw (LSE:RSW) is no flash in the pan. It has been in the same business for nearly 50 years, and it has grown but, rather like the share price, revenue, and even more so profit suffer dramatic reversals...

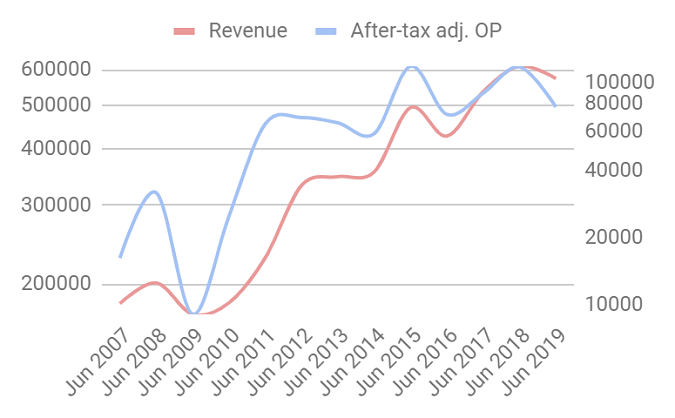

The figures are in thousands, so revenue in 2019 was about £600 million, and adjusted after tax profit was about £77 million. I have plotted the curves on log scales so the ups and downs are proportionate.

Oh dear. Do I detect the impact of operational gearing in that chart?

You do. One of the things I like about Renishaw is it uses its own machines in the manufacturing process, and it sells them around the world through its own sales offices. This gives it a high degree of control over quality and supply, insight into using its own tools, direct contact with customers, and lots of ways it can add value. But it also means it has many factories and sales offices and it employs about 5,000 people. High fixed costs mean that when revenue falls and costs do not, profit gets squeezed.

In 2019, revenue fell 6% but profit fell 34%. It works the other way too of course. Take 2010 and 2011, just after the financial crisis. In 2010, revenue increased 6% and profit increased 180%. In 2011, revenue increased 26% and profit increased 160%. But in 2009, the year of the financial crisis, revenue fell 15% and profit fell a stonking 72%.

Ouch. Bit risky don't you think?

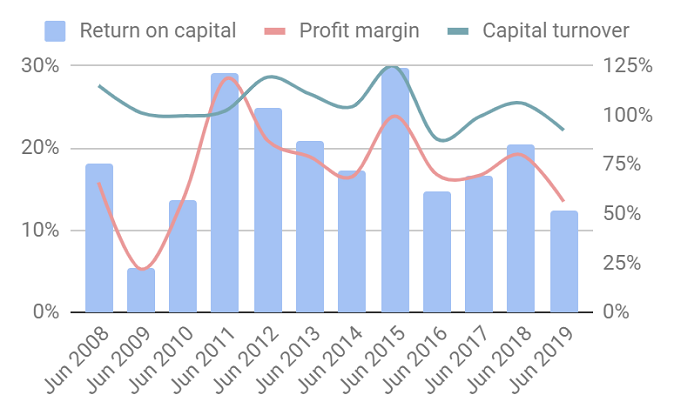

A bit. You can see the impact on profit margins. They're volatile, and in 2009 they fell as low as 5%:

Factories tool up to meet increased demand, but when demand slumps they stop buying equipment. That's what's happening now. Trade frictions between the USA and China, Brexit, and smartphone glut have dampened demand particularly among Far Eastern manufacturers, Renishaw's biggest customers.

In mitigation, though the market is capricious, I think this is to Renishaw's advantage over the long term. Renishaw shoulders some of its costs voluntarily during downturns to bolster competitiveness. Its newish chief executive writes in the annual report that he is:

"... focused on ensuring that we draw maximum benefit from our long-term investments in people, innovation and infrastructure"

And the proof is in the numbers. In 2019, Renishaw increased total R&D engineering costs in the Metrology division by 18%, amounting to 17% of the revenue earned by the division. At the much smaller Healthcare division, it increased total engineering costs by £11%, accounting for 18% of divisional revenue. Both levels are at the upper end of 13-18% investment Renishaw typically makes.

That is an essential part of the appeal of Renishaw. It already has an advantage over rivals in its customer relationships, trained workforce, know-how, and patents. To maintain its lead it must invest to improve these assets. Sacrificing profit now for the future should be a small price to pay.

But could Renishaw suffer another reversal like it did during the financial crisis?

I cannot rule it out, but even if it did it should survive and ultimately prosper, partly because of the value of its intellectual property, and partly because it is a financial fortress. At the year end Renishaw had £107 million of cash, more than a good year's profit, on the balance sheet and only £10 million of borrowings.

Its business model is also changing. This is from the annual report:

"Renishaw has moved in recent years, from primarily being a supplier of products to capital equipment manufacturers, to working closely with end users to solve their complex challenges and deliver solutions and systems that transform their manufacturing capabilities. This is helping to build brand loyalty and opening up new revenue opportunities."

Renishaw's probes and gauges can improve efficiency without requiring manufacturers to replace all their kit so its possible demand will hold up better in recessions than before.

Also, while investment is perhaps most likely to pay-off in Metrology, where Renishaw is established, especially if Renishaw develops additive manufacturing to the point it can be used in mass production as it expects, the Healthcare division offers the potential for new, lucrative and perhaps more stable profit streams.

The Healthcare division only earned 7% of revenue in 2019, but it grew revenue 15% partly due to sales of additive manufacturing machines configured to make dental structures (like bridges) and medical implants. Healthcare's other big products include the neuromate surgical robot, used in brain surgery, and Raman microscopes. These products are taking time to establish commercially because they are so novel, but for the second year running the Healthcare division has made a profit...

You buy the hype don't you Richard.

I'm almost ashamed to say I do.

Go on then...

Scores on doors?

Yep.

Does Renishaw make good money?

Yes, average return on capital is 18%, but profitability is highly sensitive to revenue. Heavy investment and cash payments into its underfunded pension scheme mean Renishaw's average conversion is only about 60%.

Score: 1

What could prevent Renishaw from growing profitably?

Trade frictions and Brexit may hit profit since the company only earns 6% of revenue in the UK. High fixed costs mean profits can be hit hard in a recession, but these challenges will probably only be temporary...

Score: 2

How will it overcome these challenges?

It seems likely demand for precision, automation and efficiency in manufacturing will continue to grow as technology advances, even though the smartphone market is maturing and the automotive market is being disrupted by electric vehicles.

As a world leader, the market is Renishaw's to lose. Fortunately, it is not milking customers for every last fluid-ounce of profit, it is investing to ensure it retains its position. To a degree, the focus on end-users rather than capital equipment manufacturers may mitigate the impact of sluggish demand when the economy slows down and Renishaw seems to be taking sensible actions to reduce the potential for Brexit to derail trade. Its best defence is the quality of its products and services, though.

Score: 2

Will we all benefit?

Renishaw's annual report explains how it strives to meet the needs of employees, customers, suppliers and shareholders. Ninety six per-cent of the 74% of employees who responded to Renishaw's staff engagement survey said they would recommend it as an employer (74% say they would recommend the firm on independent recruitment site Glassdoor). About 8% of employees are in further education or on internal programmes and the company runs a support programme to help staff with their general well being. In 2019, Renishaw reported employee turnover of 5.5%, compared to a national average of 14.4% in the manufacturing sector.

Renishaw communicates well with shareholders, through its annual report, an annual investor day, and webcasts. The newish chief executive, Will Lee joined as a graduate trainee in 1996, and the company's founders, controlling shareholders, remain on the company's board as executive chairman and deputy chairman.

Score: 2

Are the shares cheap?

A share price of just under £35 values the enterprise at £2.6 billion, 34 times adjusted profit. Although Renishaw has warned 2020 will be challenging too, these years may not be typical. A normalised enterprise multiple based on how much profit the company would have earned had it achieved its 13-year average return on capital of 18% is 23 times adjusted profit, which is more reasonable but still not obviously cheap.

Score: -0.7

A score of 6.3 is below my arbitrary level of 7 out of 10, required to recommend the share for long-term investment. It wouldn’t take much of a decline in the share price to bring Renishaw into the buyzone though. In round numbers a fall from £35 to £30 would be more than enough.

Not that I am watching the share price :-)

Richard owns shares in Renishaw.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.