A hedge fund icon’s steadfast stance on the US dollar

5th May 2023 09:17

by Russell Burns from Finimize

Stanley Druckenmiller, one of the most successful investors of the last few decades, says his top trade right now is to bet against the US dollar. I’ve looked at why he’s backing that stance so strongly, which other opportunities he’s investing in, and how you could copy some of his tricks.

Druckenmiller is short the US dollar and is cautious on US stocks, despite still holding a $2 billion US stock portfolio.

Lower interest rates, the weaponization of the US dollar, and expectations for a hard landing in the US are the reasons behind his bearish stance.

There are numerous ways to short the US dollar, but choosing which currency to trade against it is the key decision.

Stanley Druckenmiller, one of the most successful investors of the last few decades, recently said that his top trade right now is to bet against the US dollar. I’ve taken a look at why he’s backing that stance so strongly, which other opportunities he’s investing in, and how you could copy some of his tricks if you agree with his conviction.

Who is Druckenmiller?

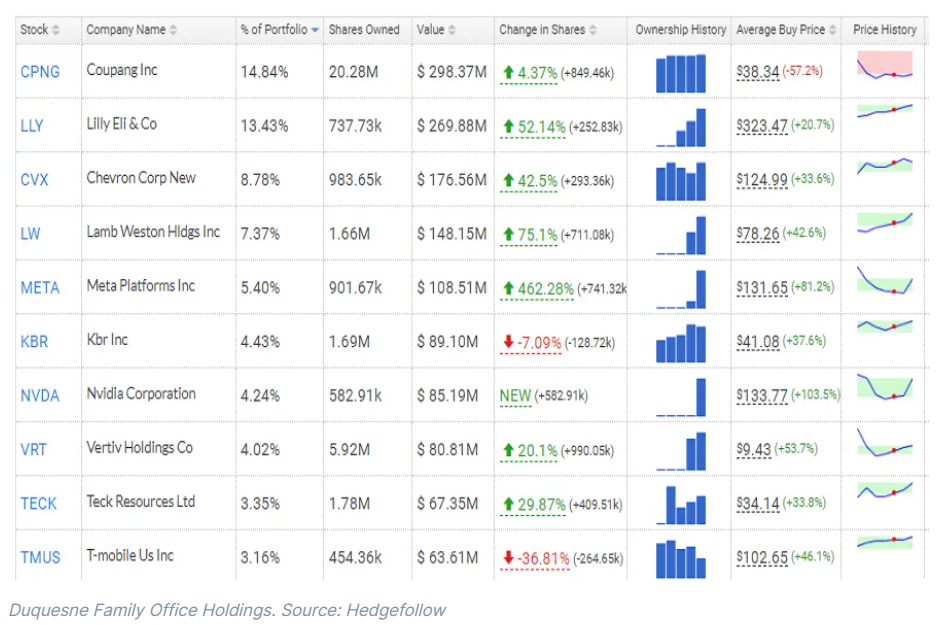

Druckenmiller has an enviable track record: his hedge fund Duquesne Capital Management racked up an average annual return of 30% between 1986 and 2010. Like many other successful hedge fund managers, he eventually decided to stop running external client money, converting Duquesne Capital Management into a family office back in 2010. And while exactly how much Druckenmiller manages now is unknown, his $2 billion US stock portfolio makes it clear that it’s a pretty sizeable chunk of change.

What is Druckenmiller’s view on stocks?

Druckenmiller said late last year that stocks won’t go anywhere fast over the next ten years, and he reiterated that view at the end of last month. Instead, he’s expecting a hard landing for the US economy, so is steering clear of old economy stocks and small to mid-sized companies – after all, their business models are less stable than their bigger counterparts.

Duquesne family office owns around $2 billion of US stocks.

As for recent trades, Duquesne took advantage of the weak stock market to add to almost all of its holdings in the last quarter of 2022. NVIDIA Corp (NASDAQ:NVDA) looks to be the best call from that shopping spree so far, showing a 103% return at the moment.

Druckenmiller’s style is to back conviction with big trades – and one other hefty purchase from that period caught my eye. Duquesne increased its holding of Eli Lilly and Co (NYSE:LLY) by around 50% to hit the $270 million mark, meaning the pharmaceutical company now sits as the firm’s second-biggest holding and makes up close to 14% of Duquesne’s total US portfolio. That might be for good reason: phase-three testing just indicated that Eli Lilly’s new weight loss drug Tirzepatide is the most successful offering in this hot new area of medicine, with over 80% of trialists losing at least 5% of their body fat. Now, the stock has already rallied, but future estimates are still being revised upward and its medium-term growth looks pretty impressive.

Why is Druckenmiller betting against the US dollar?

Even the best investors let a few trades slip here and there, and Druckenmiller said last year’s US dollar rally was the “biggest miss” of his career. At the time, his skepticism about the country’s leaders prevented him from being bullish about the greenback.

Druckenmiller’s only high conviction trade right now – a time that he sees as the most unpredictable period of his career – is to bet against the US dollar. See, even though it’s already down close to 10% since November 2022, Druckenmiller thinks the currency has further to fall for two reasons.

For one, interest rate cuts. Druckenmiller expects to see lower interest rates in the US as the economy slows, which could weaken the currency. And the market seems to agree, already pricing in nearly 100 basis points of interest rate cuts by April 2024.

And for another, a rise in non-dollar trade agreements. The US dollar’s world trade dominance irks many nations, with China, Brazil, India, and Russia all making moves to try to increase trade in non-US currencies. That’s a long-term threat, and it’s not the only one: Druckenmiller also highlighted that many countries are concerned about the weaponization of the dollar. Remember, the Russian central bank has had nearly $300 billion of assets frozen as punishment for the country’s invasion of Ukraine.

Now, it’s likely that Druckenmiller started betting against – or “shorting” – the US dollar long before his latest admission. The fact that he was skeptical of last year’s rally may mean he was on the lookout for slowing momentum – and personally, I find it hard to believe that an all-star investor like him would have missed the opportunity.

How can you bet against the dollar like Druckenmiller?

To short any currency, you have to take the opposite position – “going long” – on at least one other currency. Foreign exchange markets are the biggest and most liquid in the world, offering decent value and low commissions. And given its global nature, you can trade major currencies like the US dollar, euro, Japanese yen, and the Swiss franc 24 hours a day, five days a week. Typically, you’d trade through specialist foreign exchange brokers. But when you do that, trading on margin – that’s when you use leverage – is normal practice, so you’ll need to manage your overall exposure very carefully.

You can also trade currencies using exchange-traded funds (ETFs). They’re not as efficient as trading with a broker so you’ll usually pay more on fees, charges, and spreads, but they’re a simple way to get the job done. The Invesco DB US Dollar Index Bearish Fund replicates the performance of shorting the greenback against a basket of six major world currencies.

Now, the hard part is deciding which currency you want to trade against the US dollar. While considering this, bear in mind that foreign exchange rates are heavily influenced by macroeconomic factors like interest rates and geopolitical risks.

When it comes to Europe, the European Central Bank is expected to keep raising interest rates in a bid to tame inflation. Those expectations have helped the euro rally nearly 10% against the US dollar since last November. And if you think that trend will continue, you could consider buying the Invesco CurrencyShares Euro Trust. It tracks the movement of the euro and US dollar, moving higher when the euro rises against the US dollar.

You could also consider using the Japanese yen: the Bank of Japan is expected to tweak its yield curve control, which would buoy up the country’s currency. The Invesco CurrencyShares Japanese Yen Trust rises in value if the Japanese yen moves higher against the US dollar.

Russell Burns is an analyst at finimize

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.