Having a big cash position helps us sleep at night

20th March 2023 15:08

by Douglas Chadwick from ii contributor

Saltydog Investor points out that money market funds are a safer place to park cash than low-risk government bond funds.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At Saltydog Investor we encourage private investors to actively manage their investments. When you know that stock markets can go down by 30%, 40%, or even more in a year, then it does not make sense to idly sit by and watch your wealth disappear. Remember that if your investments go down by 50%, then they have to go up by 100% to get back to where they started.

We also live in an ever-changing world. Sectors of the market that do well one year may struggle the next. Why would you choose to stick with an investment when the tide turns instead of moving into more lucrative waters?

- Invest with ii: Money Markets| Free Regular Investing| Open a Stocks & Shares ISA

When it comes to managing risk there are a couple of things for fund investors to keep in mind.

Funds inherently offer more diversification than buying individual company shares. However, it is important to understand that in most cases diversification is within a fairly limited part of the market. Most funds are classified into one of the Investment Association (IA) sectors, and to qualify they must stick to the sector rules.

So, for example, if a fund is in the UK All Companies sector, then it must “invest at least 80% of its assets in UK equities which have a primary objective of achieving capital growth”. That is great, because as an investor we know what it is invested in. But, from the fund manager's point of view, it means that even when conditions for the sector look terrible, the maximum amount of cash that the fund can hold is limited to 20%. The rest must be invested in UK equities, regardless of their performance.

In our view, it helps to hold funds from a range of different sectors and to move between sectors as conditions change. We also believe that there are times when it makes sense to hold cash or invest in the money market funds. Although the value of cash is eroded by inflation - a particular problem at the moment - you are still better off holding cash than investing in something that is losing value.

This has just been highlighted by the failure of some US banks, which has generated plenty of column inches over the past week or so. Their deposits had grown rapidly and so they invested large amounts in long-duration government bonds. On the face of it, that was not particularly reckless. It certainly was nothing like investing in subprime mortgage-backed securities, which was the cause of the 2008 Global Financial Crisis.

- Why investors aren’t worried about a repeat of the 2008 bank crash

- 10 things to know about money market funds versus cash savings

US government bonds have a very high credit rating because they are guaranteed by the American government. Therefore, they are as safe as houses. If they are held to maturity, you will almost definitely get your money back and you will earn some interest on the way. The problem is that if you have to sell them before maturity you may have to sell them at a loss, and those losses can be significant, particularly if interest rates rise. That is what happened to the Silvergate (NYSE:SI), Silicon Valley (NASDAQ:SIVB), and Signature Bank (NASDAQ:SBNY) US banks. Their customers wanted their money, and when the banks went to sell their bonds they were not worth what they paid for them.

Last year, we saw just how volatile the funds investing in UK government bonds can be. The UK Gilts sector went down by 24% and the UK Index-Linked Gilts sector lost 35%.

In our demonstration portfolios, we currently have a significant amount either in cash or the Royal London Short Term Money Market fund. In the Ocean Liner portfolio, it is more than 50% of the overall value, and in the Tugboat portfolio it is just above 75%.

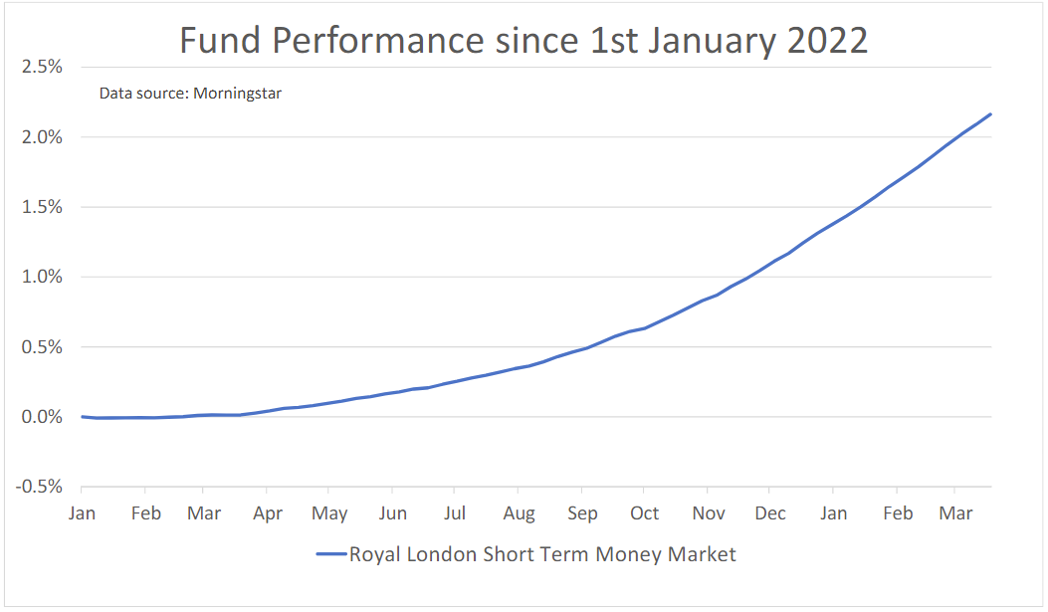

The money market funds invest in short-term debt instruments, cash, and cash equivalents. They are not quite as safe as cash, because there is always the possibility that the bank or government issuing the debt could default, however they are considered extremely low risk. Up until fairly recently, interest rates have been so low that it would have been hard to cover the costs of holding the fund and any transaction costs, but that all changed last year as the Bank of England base rate started to rise.

The fund has now started to go up in value and, if it continues at its current rate, could give an annual return of over 3.5%. That level of return is hardly going to set the world alight, however after a fortnight where the FTSE 100 has gone down by 7.7%, it helps us sleep at night knowing that it is currently our largest holding.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.