Green is the new black for trust investors

This year, money will be ploughed into sustainable projects bringing many investment opportunities.

11th June 2021 16:08

This year, money will be ploughed into sustainable projects, giving rise to an array of investment opportunities.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Policymakers have arguably kept their heads in the sand over the threat from global warming, but 2021 seemingly marked a watershed moment. Looking for ways to stimulate economies in the wake of the Covid-19 pandemic, policymakers have responded with the promise of an unprecedented influx of fiscal stimulus, one of the focuses of which is the sustainability of the infrastructure of developed economies.

One of the largest investment opportunities appears to be in renewable energy, both via the conventional renewable sectors and through more unconventional routes. While the renewable infrastructure and environmental sectors represent the most obvious beneficiaries in the investment trust space, there are also opportunities outside these sectors, be they through regional strategies tapping into their own opportunities or through the enormous need for resources that the shift to a more environmentally sustainable society will require.

Seeing green

On 31 March 2021, President Biden finally proposed his long-expected infrastructure stimulus bill, a monumental $2.3 trillion investment targeting initiatives ranging from rebuilding the road network to upgrading hospitals for veterans. If passed, much of the stimulus will be invested across a host of traditional infrastructure projects, and at least 10% of it will be directed to explicitly renewable projects.

This 10% represents only those projects which are explicitly focussed on ‘renewable’ initiatives: $100 billion to upgrade electric grids, $16 billion to clean up oil and gas wells and mines, $174 billion to invest in electric vehicles and related infrastructure, and $46 billion in procuring clean energy manufacturing. More important is the direction of travel that this signals as a starting point. While this bill is yet to be debated by Congress, where one can expect the Republican opposition to attempt to water it down, the commitment of the Biden administration to renewable energy is clear, given that the president intends to cut fossil fuel subsidies by $47 billion as part of the funding for this package. Across other aspects of the bill there are numerous other inputs designed to further stimulate ‘green’ investment, such as the proposed investments in renewable energy R&D and semiconductor manufacturing.

Across the pond there is also a substantial, albeit significantly smaller, amount of euros primed to support renewable infrastructure and the broader carbon-reducing industries. As part of the EU’s post-pandemic rebound, it has finally approved the €750 billion European recovery fund. However, unlike Biden’s stimulus bill, how the recovery fund is utilised remains to be seen. The fund will be divided up by member states, with each government given discretion on allocation, but with the important caveat that a minimum of 30% be earmarked for investment in renewables. Unlike the case in the US, the recovery fund money is ready to be distributed, and will form part of the funding for the EU’s proposed ‘Green Deal’. This is a policy framework designed to transition the continent to carbon neutrality by 2050, with €1 trillion earmarked for its funding over the next decade.

However, it is important to note that these funds are yet to be committed, and that the process should begin in the latter part of 2021 in the case of the EU recovery fund, whereas Biden’s stimulus bill still requires debate by Congress, and so its timeline remains uncertain. In our opinion this leads to a rare avenue of growth, whereby the direction of travel is certain but the stock-specific beneficiaries are not. These words should be music to the ears of professional investment managers, with the managers behind Henderson EuroTrust (LSE:HNE) and F&C Investment Trust (LSE:FCIT) having already identified the merit in both growth as a thematic investment and in individual companies that can offer market-leading growth, be it directly through renewable infrastructure or broader sustainable alternatives to conventional industries.

In the UK the Green Industrial Revolution plan, unveiled by the government in November 2020, should also offer investment opportunities. This circa £12 billion plan outlines policies in detail, unlike the US or EU plans. Headline policies include banning the sale of combustion cars by 2030 and having the first town in the UK entirely heated by hydrogen by the end of this decade. The plan also includes the previously announced pledge to quadruple offshore wind power by 2030 (to 40GW, enough to power every UK home), which will likely prove a boon for those renewable infrastructure strategies that invest in UK wind farms, such as Greencoat UK Wind (LSE:UKW). This should increase the opportunity set for new investments, which could help UKW maintain its expected returns and dividends. However, there is also the danger that renewed capacity could lead to lower power prices and lower returns for investors. The government has announced it will double the amount of renewable energy it subsidises from next year as a part of its climate plan. While this does mean there will be secured revenue streams on offer, the last major auction saw subsidies tumble, and pressure on investors to invest in renewables means there is high demand which could lead to the same again.

While renewable infrastructure will be an important beneficiary of the upcoming stimulus, it is not the only sustainability initiative we expect to see gain political and investor attention in the coming years. Issues around food scarcity, waste management, reducing the carbon intensity in agriculture and resolving water scarcity will also need to be resolved. This produces a number of sustainable infrastructure themes beyond renewable energy, such as more effective urbanisation, the addressing of demographic changes and the tackling of environment issues beyond simply reducing CO2 emissions (e.g. by deforestation and energy efficiency). We expect further capital to be allocated to these themes in the near term, and there have already been recent examples of this, such as Germany having pledged €8 billion to hydrogen projects and the US earmarking a portion of its stimulus bill to improving the energy efficiency of US houses. As we outline below, strategies like Jupiter Green (LSE:JGC)have been able to successfully capitalise on the sustainability trend without simply investing in renewable energy. An example of this is JGC’s holding in Borregaard, which tackles the need for alternative fuels by producing a product that substitutes petrochemical products with lignin – a natural product from wood waste. Another example is JGC’s holding in Befesa, a specialist company that recycles hazardous waste from electric arc furnaces.

Investors are often reminded to invest over the long term, typically to benefit from compounding returns and to seek to dampen the impact of short-term volatility. Structural drivers certainly seem apparent in the renewable infrastructure space, but the ongoing flow of announcements seems to indicate further nearer-term catalysts which could drive returns and create new opportunities, especially as the World Economic Forum has estimated that it will take $2.4 trillion of infrastructure investment each year to meet the demands of the Paris Accords.

Green with envy

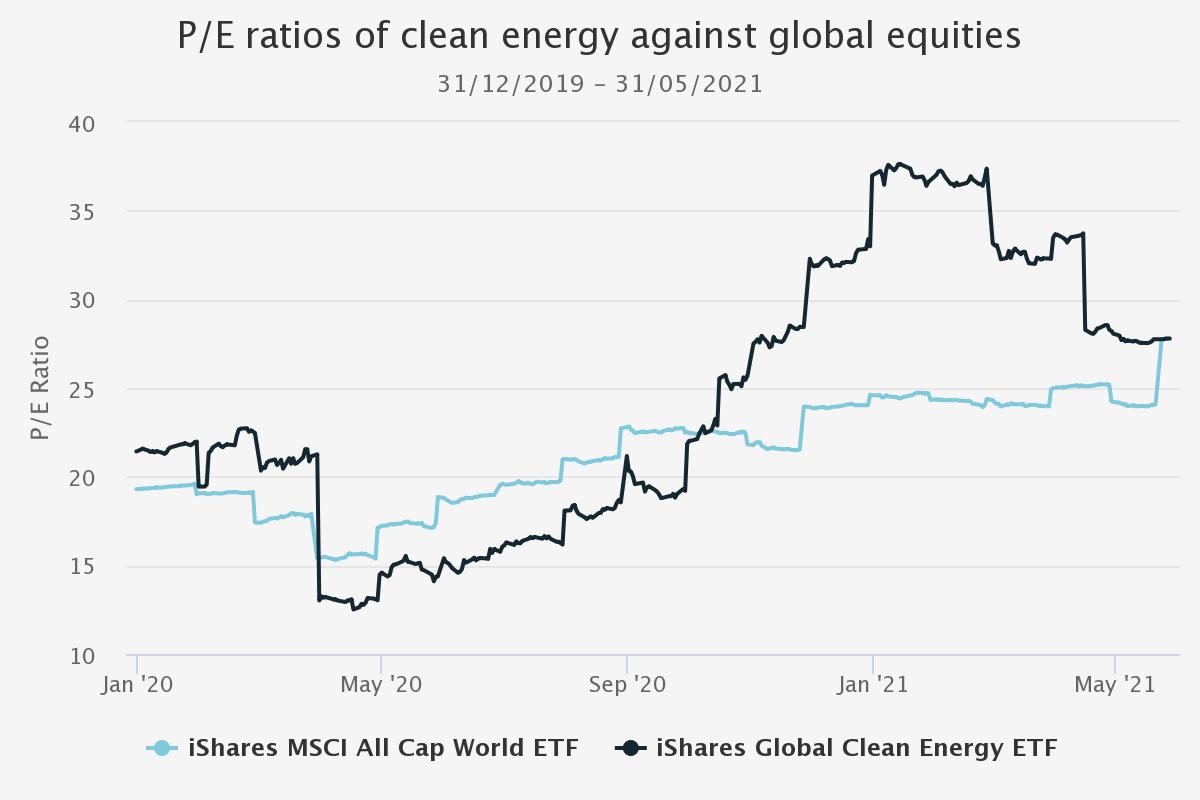

By the beginning of 2021, bearish investors were highlighting the elevated valuations clean energy companies traded at, with the iShares Global Clean Energy ETF (LSE:INRG) trading at a P/E of 37.6 times, its all-time high, compared to the 24.4 times of the iShares MSCI All Cap World ETF. To some extent we think investors were willing to pay a premium for any sector which retained a clear growth trajectory in a ‘flight to safety’. However, investors also saw this stimulus coming down the pipeline, and the expansion in multiples shown below clearly accelerated in the build-up to the US election as Biden took the lead. However, we would note that renewables have since returned to more reasonable valuations that are now on a par with the valuations of global equities, which we think implies that not everything is in the price yet.

P/E ratios of renewable and global equities

Source: Morningstar, as at 31/05/2021

A number of active managers, such as the teams behind Mid Wynd International (LSE:MWY)and BlackRock Energy and Resources Income (LSE:BERI), took the opportunity of the spike in valuations to trim down their positions in renewables and low-carbon themes and lock in their gains. Yet the fall in valuations in our view makes the sectors more attractive.

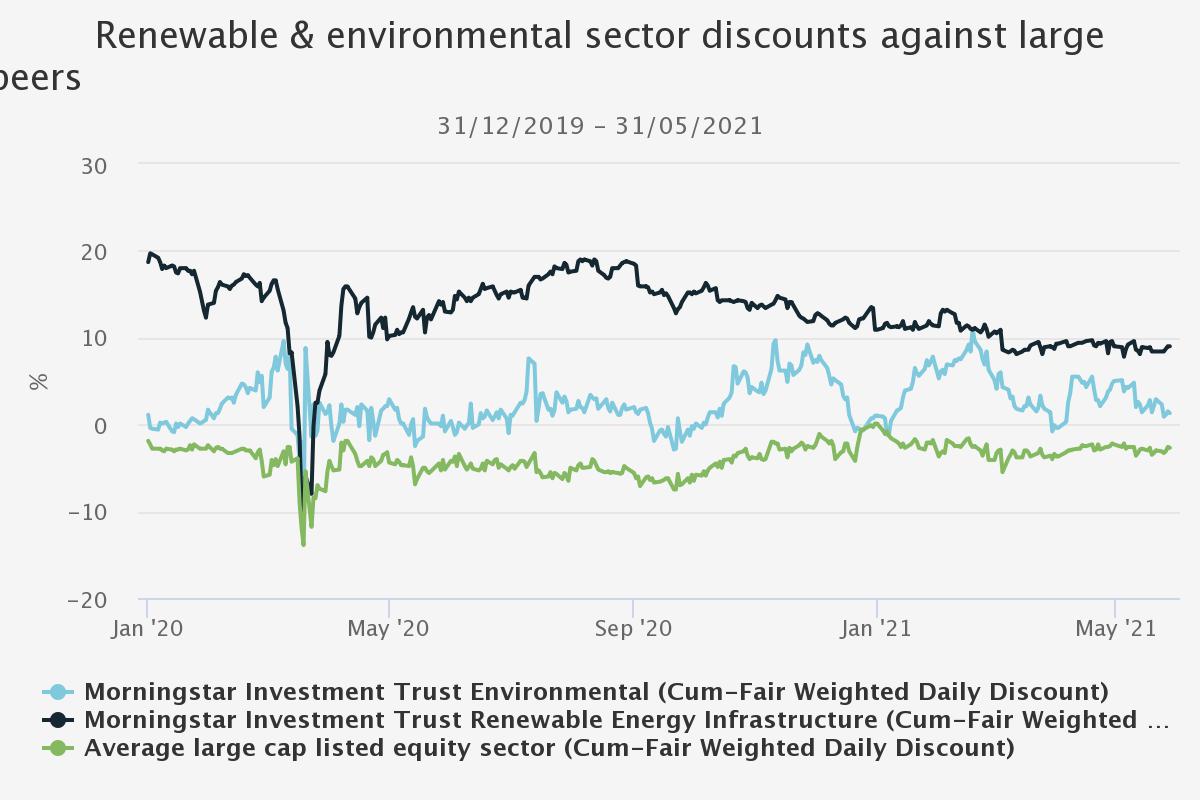

Within the UK investment trust space, renewable infrastructure trusts continue to attract significant premiums, although the average premium is lower than it was pre-pandemic. Power prices fell dramatically during the crisis, which may have led to concerns about the valuations of assets and future income.

Sector discounts since 2020

Source: Morningstar, as at 31/05/2021. The large-cap average reflects investment trusts in the global, UK, North America, Europe and Japan sectors.Past performance is not a reliable indicator of future returns

Sustainable solutions

For investors looking to take advantage of the forthcoming renewable tailwinds, we think there are two AIC sectors which should immediately come to mind: Renewable Energy Infrastructure and Environmental.

As can be seen by the below table, the NAV return profile of the two sectors is very different. The environmental sector’s risk/return profile behaves more like a conventional equity fund, which leads to comparatively higher volatility but also generally greater total return potential, though with a higher correlation to equities at the share price level. Renewable energy on the other hand has a much more modest risk/return profile, where its long-term total returns have tended to be lower than those of listed equities though also having lower volatility. This is in part due to how renewable infrastructure is valued, typically using quarterly or half yearly valuations based on cash flows and long term assumptions. This infrequent valuations schedule, combined with the lower return profile, leads to the sector’s low NAV volatility.

Via their exposure to equities, environmental trusts may offer the greatest upside potential as a result of the incoming stimulus packages. Renewable energy trusts may benefit from an increasing pipeline of new investments, potentially helping to offset the significant investor demand for such assets that we are currently seeing, competition for which would otherwise lower potential returns, as we discussed in a recent note. Those trusts with a multi-asset or multi-geography approach may be the most obvious beneficiaries of the stimulus if they are able to invest in the newer sources of energy or affiliated industries, potentially at an earlier stage in order to harness higher initial returns such as The Renewables Infrastructure Group (LSE:TRIG).

Performance and risk stats

| Five-year nav total return | Five-year share price return | Five-year share price volatility (ann) | Five-year share price correlation (to iShares ETF) | |

|---|---|---|---|---|

| AIC Renewable Energy Infrastructure | 46.7 | 55.5 | 5.8 | 0.5 |

| AIC Environmental | 103.8 | 119.2 | 16.4 | 0.8 |

| iShares MSCI ACWI ETF | 100.4 | 12.2 |

Source: Morningstar, as at 31/05/2021

Past performance is not a reliable indicator of future returns

We believeGreencoat UK Wind (LSE:UKW)could be a beneficiary of the UK shift towards renewable energy. UKW was the first renewable energy infrastructure trust to launch, and its subsequent growth since then gives shareholders significant economies of scale which should allow it to take on exposure to larger projects, such as the planned expansion of UK offshore wind, which is planned to quadruple in capacity by 2030. Whilst primarily targeting income generation (with a forecast yield for the current financial year of c. 5.4% at the time of writing), the managers also seek to grow NAV by at least the rate of inflation, and have been successful at doing so historically. Excess cash flows are reinvested to achieve this, further helping to diversify the asset base and grow scale.

US Solar Fund (LSE:USF)is dedicated to solar power assets in the US. Now fully invested, USF expects to pay its targeted 5.5c dividend per share for the first time this year. USF is also looking to expand, with a very successful capital raise in 2021 allowing it to invest in new opportunities and further capitalise on the US’s trend towards renewable energy, plus the Biden stimulus package should help provide a stream of future investment opportunities. As a relatively early operator in the sector, USF’s management company New Energy Solar Manager’s strong relationships in the industry give it advantages in sourcing acquisitions. A key attraction of the trust is the ultra-long-term nature of its cash flows, whereby USF’s energy production is 100% contracted for an average of 15 years, proving a highly stable cash flow to support its dividend. We highlight that USF trades in US dollars, not sterling, causing investors to face additional exchange rate risk when investing in the trust.

While the above trusts are focussed on specific sources of renewable energy, The Renewables Infrastructure Group (LSE:TRIG) seeks to be a ‘one-stop shop’ across a range of renewable technologies and power-generation sources. At present TRIG has investments across solar, wind and battery storage, with exposure to over 70 wind and solar farms across the UK and Europe. With this spread and range of portfolio investments (and increasing geographical diversification), the managers seek to reduce the volatility of returns. Having raised significant equity capital over 2020, the managers were able to increase their exposure to offshore UK wind power projects following the announcement of the UK government’s Green Industrial Revolution plan. As well as attractive long-term income-based returns, TRIG also aims to see these returns positively correlated to inflation.

Unlike the previous trusts mentioned, Impax Environmental Markets (LSE:IEM)is a listed-equity-focused investment vehicle seeking to invest in small- and mid-cap companies that the managers expect to benefit from the transition to a more sustainable economy. This relatively broad remit gives them latitude to explore opportunities in various different avenues, such as in the more efficient delivery of services in water, waste and energy. Whilst focussed on growth opportunities, the managers are wary of overpaying for such growth. Such a valuation overlay can at times lead to them excluding stocks or sectors with strong momentum (as was the case with Tesla and hydrogen power companies over much of 2020), but the focus is on identifying long-term beneficiaries from structural trends.

Like IEM, Jupiter Green (LSE:JGC) also invests in companies which are linked to broader sustainable themes, in JGC’s case those themes being: circular economy; clean energy; water and sustainable agriculture; and nutrition and health. JGC has recently undergone a change in its emphasis, focussing on smaller, more growth-orientated companies. This change has already served JGC well, leading the trust to outperform global small-cap equities and seeing it shift from trading on a discount to a premium. JGC’s manager, Jon Wallace, aims to take advantage of its relatively small size to invest in small-cap companies which typically are of too low a market cap to be noticed by JGC’s larger peers. JGC also has the capacity to invest up to 5% in unlisted companies, something which Jon intends to utilise.

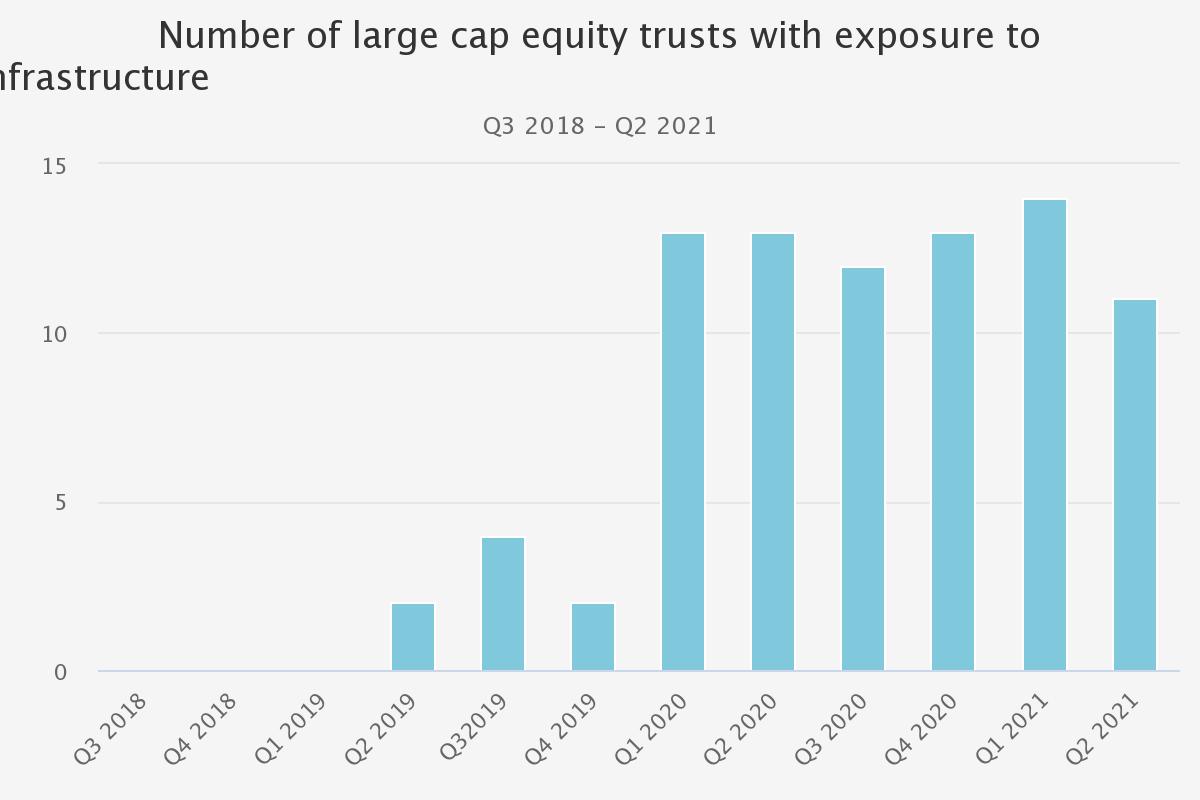

Creeping Ivy

As has been shown by their performance and valuations during the pandemic, sustainable investments have come onto the radar of many investors, including professional managers. In fact, as shown by the below chart, 2020 was the year that marked a substantial increase in the number of trusts allocating to renewable infrastructure. Being forward-looking beasts, investment managers had started pricing in the impact of policymakers signalling their intention to commit to financially supporting the shift to renewables. This is shown by the below chart, which indicates the number of regional large-cap equity trusts which hold renewable infrastructure companies as part of their portfolio while not explicitly having renewable investment mandates.

Number of large-cap equity trusts with allocations to renewable infrastructure

Source: Morningstar, as at 31/05/2021. The data reflects investment trusts in the global, UK, North America, Europe and Japan sectors.

One of the conventional equity trusts allocating specifically to the renewables sector is Henderson EuroTrust (LSE:HNE). Whereas other managers allocate to sustainability based on a thematic view, manager Jamie Ross instead sees renewable energy companies as individually compelling businesses offering the same quality of management, strength of balance sheet and growth prospects of any other European stock. One of the best-performing holdings for HNE over 2020 was the trust’s allocation to Vestas Wind Systems, the Danish turbine manufacturer, with Jamie believing that companies which sit on the right side of sustainability can justify higher multiples as a result.

However, the path to a sustainable economy requires more than simply building wind farms and solar panels: it will also require a monumental amount of natural resources to construct tomorrow’s sustainable infrastructure. While concrete and many different metals will be needed for the installation of infrastructure and the construction of batteries, it is copper that has been one of the biggest winners so far. This is unsurprising, given the additional demand pipeline which can now be foreseen for copper against a relatively constrained supply pipeline.

As an example, building a wind farm typically requires between 2.5 and 6.4 metric tons of copper (equivalent to the copper in 14,000 conventional gas-powered cars). The demand for copper is estimated to become so great that a deficit of one to ten million tons is predicted by 2030 if further mines are not built, according to commodities trader Trafigura Group. Even if further mines are built, the cost of extraction is likely to be greater as most of the most readily accessible deposits have already been utilised, and in any event development of a mining project to maturity takes several years. The forecasted rise in the number of electric vehicles, which require up to 3.5 times more copper than conventional cars in their production, should also contribute to the demand for the material.

BlackRock Energy and Resources Income (LSE:BERI)and BlackRock World Mining Trust (LSE:BRWM)are both positioned for a structural shift in the demand for copper because of the energy transition. Since June 2020 BERI has permanently altered its portfolio to retain a dedicated allocation to companies which are helping the transition to a low-carbon economy, currently composing 23% of the portfolio. This has been a fortuitous change for the team, as said allocation was a major contributor to the trust’s returns over the last 12 months given the relative outperformance of renewables. BRWM, on the other hand, is a more direct beneficiary of the ever-increasing demand for metals, given its thesis of investing in miners which show capital discipline and a willingness to reward shareholders with dividends. The managers have long been cognisant of the huge demand for metals that a sustainable economy will produce, having long retained substantial underlying exposures to copper (currently c. 19%).

There are also managers outside of the commodities and natural resources sector who are also capitalising on this trend, with Mid Wynd International (LSE:MWY) arguably being one of the most aggressive allocators in this regard. MWY’s managers, Simon Edelsten and Alex Illingworth, follow a thematic approach to global equity investing while also incorporating a detailed ESG screen that has positioned their trust as one of the better examples of ESG integration. One of the themes which they have been allocating to since 2020 is ‘low-carbon world’, investing in companies which address the need for sustainable solutions. Yet the team have also increasingly been allocating to mining stocks, a direct result of the need for metals in the transition to a more sustainable economy.

Conclusion

Where 2020 was marked by the outbreak of the global pandemic, 2021 may end up marking the transition to a sustainable global economy. This year will bring with it billions in investments in sustainable initiatives and renewable infrastructure across many of the major global economies. This investment brings opportunities and, as we have outlined earlier, there are many ways investors can benefit from this. That could be achieved through the unlisted renewable infrastructure trusts like TRIG or the dedicated sustainability strategies like IEM, which straddle the entire opportunity set presented by a more sustainable economy. Such strategies potentially offer not only attractive risk/return profiles, but also offer investors effective sources of diversification in their portfolio. Evidence shows that an increasing number of generalist investment managers have realised this opportunity to enhance shareholder returns, whether through direct opportunities in renewable energy, or indirectly by exposure to companies providing the necessary raw materials. Much like the inevitable need to address climate change, and whether or not they are aware of it, renewable investing may soon become a core part of investors’ portfolios.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.