Greatland Gold: another AIM success story up 330%

After great success in Australia and a mining giant buying a stake, takeover rumour is rife.

20th April 2020 13:16

by Lee Wild from interactive investor

After great success in Australia and a mining giant buying a stake, takeover rumour is rife.

When stock markets are volatile, as they are now, the opportunity to generate spectacular returns is increased, as is the risk of suffering large losses. But while we’ve seen wild share price swings among normally steady blue-chip stocks over the past few months, it is the AIM market where some of the potential life-changing activity has taken place.

On 31 December last year, 57 AIM companies were double the value they had been 12 months earlier. Many more had doubled at some point during the year before easing back. So far in 2020, 19 companies are currently twice the price they began the year. Since the AIM All Share index hit its low on 19 March, 37 shares are currently double the price.

That’s an amazing return, but it gets better. Ten companies are up by well over 200%, among them the true star stocks that have changed lives.

We’ve written a lot about Novacyt (LSE:NCYT) this year. Making test kits for Covid-19 has generated interest in the business and the shares are up 2,940% so far in 2020. Since making a 6p low last year, they have been up as much as 8,500%. Synairgen (LSE:SNG) are currently up almost 900% this year, and e-therapeutics over 300% higher in 2020.

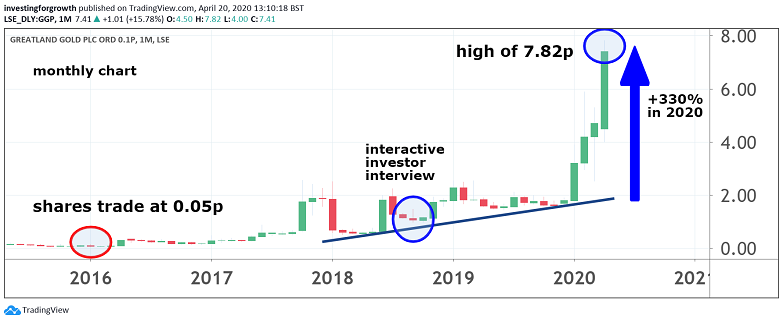

But there has also been an incredible wave of interest in a business that digs holes in the ground for a living. And it’s a company we caught up with in September 2018 when the shares were trading at little more than a penny. They traded as high as 7.82p today, taking the capital gain since our chat to 638% and 320% in 2020 to date. Since trading at 0.05p a share in 2016, they’re up a phenomenal 15,500%.

Source: TradingView Past performance is not a guide to future performance

That company is gold miner Greatland Gold (LSE:GGP), which had already struck gold in Australia when we spoke to chief executive and former Merrill Lynch fund manager Gervaise Heddle.

Newsflow since has been significant, and speculation by one of its major shareholders that the company will be taken over has just caused another spike in Greatland’s share price.

Primorus Investments, a strategic investment company, began building a stake in Greatland during late 2018. Its website says it spent £633,000 buying 37 million shares at a weighted average price of 1.71p per share.

In its latest quarterly update, published earlier than usual due to the coronavirus pandemic, the company reports “further spectacular drill results” from Greatland’s Havieron gold/copper project in the Paterson Province region of Western Australia.

We had also heard from Greatland on 1 April that Newcrest Mining (ASX:NCM) had completed Stage two of the farm-in agreement at Havieron (now Greatland 60%, Newcrest 40%). The move immediately to Stage 3 had now taken place “many years in advance of what is contractually required,” notes Primorus, adding, “We believe this speaks volume about the size and potential of Havieron and the surrounding region.” Newcrest has owned the nearby Telfer mine, which has produced millions of ounces of gold, but is nearing the end of its mine life.

Primorus has made a significant return on its initial investment, but it is not selling yet. Why?

First, the company notes that the drilling footprint has “expanded dramatically,” possibly because Newcrest has “discovered significantly more mineralisation outside the previously defined limits,” which could have “a huge impact for the valuation of Greatland.”

“Our view on the end-game (exit) for our investment in Greatland is very simple. In our opinion Newcrest Mining will seek to acquire the entire share capital in Greatland in the near future, possibly just post a maiden resource estimate for a small part of the overall mineralised system. We expect this maiden resource in late Q2 to early Q3 of this year.”

The thinking is that all of Newcrest’s Australian operations, including Telfer, are 100% owned.

Primorus says:

“We can't see any reason for Newcrest to maintain a minority partner at production level and the market capitalisation of Newcrest at some circa A$24 billion and with billions in cash and at call liquidity, it is easily capable of swallowing Greatland.”

The only question is “what price will they pay?”

“Therefore, we will continue to hold our shares for that possibility and believe the best share price appreciation for our investment is still in front of us.

“The firm also raises the prospect that perhaps large UK institutions will take notifiable interests in Greatland soon. Havieron is shaping up as a once in a generation discovery in a gold bull market. What is not to like?”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.