Is Goodwin one of those rebound stories?

8th September 2017 15:31

by Richard Beddard from interactive investor

just published its results. You've got mixed feelings about this one haven't you, Richard?

Very. The first thing to recognise is that Goodwin has been successful in the past, and the culture that brought success won't have just evaporated after a few years.

That said…

That LTIP?

Well, yes. I felt the Long Term Incentive Plan approved at the last AGM was a betrayal. Giving large amounts of shares to directors tied to performance criteria is common practice these days, but Goodwin had previously made a virtue of not using these schemes. In fact, like a spurned lover clutching onto an old love letter, I keep this quote from Goodwin's annual report in 2014 close at hand:

The unacceptable results over the past six years of many supposedly Blue Chip companies run with independent boards with very much incentivised executive directors is something that the Board of Goodwin PLC has no intention of emulating.

I agreed with Goodwin, that short-term incentives (the 'long' in long-term incentive plan is a chimera) encourage executives to cut investment, make dodgy deals, and do anything to prop up profit and get their share awards.

So Goodwin has gone short-termist?

It's difficult to say. Less than a year has passed. But I don't think it has gone to the dark side. While Goodwin's racked up debt, it's done it mostly in the name of investment.

The company may have taken the view it needed to deploy powerful short-term incentives because it's objectives were in part short-term, to effect a turnaround. If that was the case, it's taking longer than the company thought.

There's little sign of improvement in Goodwin's most recent results and the company admits there are "significant doubts" it will grow enough to award the LTIP shares to the directors after all.

The performance-related bung was a bad idea, then, but it might not happen after all. Let's move on. Any other doubts?

Loads. And I have to admit, the main one concerns the investment I feared might evaporate. Now I wonder whether it's been worth it…

What? You accuse Goodwin of saying one thing and doing another, and now you're flip flopping. You want more investment, and then you don't.

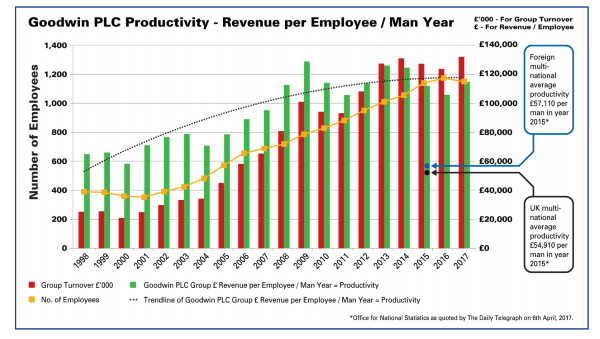

It's complicated. Let's take a step back. In the annual report Goodwin showcases this chart showing how productive it is:

Impressive isn't it? Goodwin's twice as productive as the average multinational manufacturing company.

Wow, it's super productive…

Actually, I don't think so. That chart only tells part of the productivity story. Revenue per employee measures labour productivity, but there are other sources of productivity aren't there, principally capital.

Goodwin, an engineering company, says it has become more productive through automation. If it's splashed out on computers, automated machine tools and robots, you need to include them in the productivity calculation. Otherwise, Goodwin might be increasing the productivity of labour by substituting it with capital.

OK, can you calculate its capital productivity?

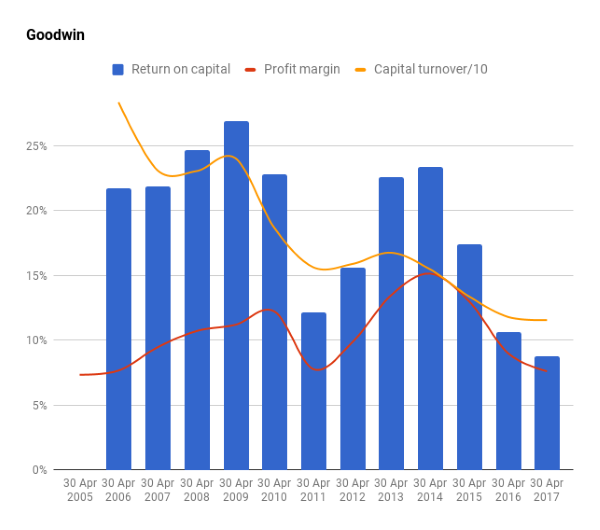

Let me show you another chart. This one should be familiar to you. It's the standard DuPont analysis, and it looks a bit like a mirror image of Goodwin's productivity chart:

Return on capital has declined from a stonking 20% plus to a barely acceptable 9%. According to my spreadsheet profit has tripled since 2005, but the amount of capital used by the business has increased seven-fold. You can see that capital turnover (the yellow line), which is a measure of capital productivity, has declined steadily.

Goodwin has been spending lots more on capital expenditure than it depreciates every year, which is often a good sign. It means a company is investing, and one day those investments should make more profit. However, those investments aren't as profitable as the company would have hoped.

Profitability's declined, but that's not Goodwin's fault is it? I mean there's recession in the oil industry…

True. The bumper profits of yesteryear were largely the result of high oil prices.

Goodwin sells patented check-valves to oil and gas companies for use in pipelines, and before oil prices crashed three years ago the valves were in high demand. Now it's finding the oil industry much tougher going and its Mechanical Engineering division is putting more effort into courting business from markets like defence and civil engineering than it used to.

Meanwhile, Goodwin's relying more heavily on a second division, Refractory Engineering, for profit. It is a completely separate group of companies that mainly supplies the jewellery industry, especially in India and China, with materials and equipment for casting jewellery. Though Mechanical Engineering earned twice as much revenue this year, Refractory Engineering earned almost as much profit.

To an extent at least the decline in profitability is not Goodwin's fault. But I'm not really interested in blame. I'm trying to imagine what happens next.

OK, tell me. What happens next?

If Goodwin recovers to former levels of profitability and we invest now, we could be rich I tell you, but this may not be one of those rebound stories.

Goodwin has been investing heavily for a long time and for much of that time it must have been focusing investment on its most lucrative market, which was oil and gas. Now it must pivot, and for the last year or two it's probably switched investment to other markets. But it may be less well known in those markets, and its expertise and patents may be less applicable.

I think it's likely to be less profitable, which is why I'm wondering whether the investment was worth it.

What if oil prices go up though? That would be good for Goodwin.

That would make the future like the past. And of course, history shows that oil prices go up, down and back up again. But this time it could be different.

Oh come on. You know "this time it's different" are the most dangerous words in finance. Oil prices will rise again surely.

As I understand it, this is the situation: When oil prices have been high in the past it's usually been the result of an artificial constriction on supply imposed by monopolistic oil producers, or by war in oil producing regions, i.e. the Middle East.

Now there is a new source of supply, shale oil, in a stable region, the USA, which needs cheap oil to keep its economy going. The shale oil industry is so new nobody really knows how big it could be, especially as it's in a state of near hibernation while oil prices are low. Basically, there's a sleeping gusher ready to be turned on, should oil prices rise, and that might prevent them rising very far.

Experts have conflicting views on whether shale oil will lead to permanently low prices. No doubt some non-experts do too. I'm not one of them.

There's also the development of alternative sources of energy to consider.

Goodwin is less vociferous than it used to be about the future for oil and gas, but in the key risks section of its annual report it says: "...these markets may suffer short-term declines, over the medium to long-term the growing worldwide demand for energy will ensure these markets remain buoyant."

Do you want to pin your hopes on that?

Goodwin must pivot, or wait for next oil boom, which may never come you mean? Seems a bit speculative to me.

It's beginning to seem that way to me too. Goodwin's prospered before and I think it will prosper again, but it could be a long and rocky road.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.