Goldman Sachs says to buy these six stocks to ride out the global doldrums

Global economic growth is likely to be pretty lackadaisical for a while. So, if you want to give your portfolio a boost, you may be better off looking for stocks tightly tied to the markets’ big investing themes. It’s what Goldman Sachs is doing.

15th September 2023 12:39

by Theodora Lee Joseph from Finimize

Thematic investing is all the rage, especially against the backdrop of lackadaisical growth.

Goldman Sachs identified six global stocks – Mercedes-Benz Group AG (XETRA:MBG), Daikin, TSMC, Philip Morris International Inc (NYSE:PM), Darling Ingredients Inc (NYSE:DAR), and OCI NV (EURONEXT:OCI) – that will benefit from being at the intersection of multiple themes.

If you’re considering playing single-stock thematic exposures, you’ll want to find companies in industries with strong barriers to entry.

Global economic growth is likely to be pretty lackadaisical for a while. So, if you want to give your portfolio a boost, you may be better off looking for stocks that are tightly tied to the markets’ big investing themes. After all, these long-term “megatrends” are going to keep on keeping on, no matter what the world’s economies do. It’s what Goldman Sachs is doing – here are six stocks it says are likely to benefit from those big trends.

Mercedes-Benz Group (Autos)

Its story: It’s an underappreciated car company that's making even fancier cars, which is helping it achieve healthier profits.

Where it’s listed: Frankfurt Stock Exchange.

Its big theme: Electric vehicles (EVs).

Janis Joplin (“Oh Lord, won’t you buy me a Mercedes-Benz? My friends all have Porsches, I must make amends.”) pretty much nailed this one. For years, the sleek, finely engineered Mercedes has been competing head-to-head against Audi and BMW. But now the automaker is upping its game, just as Janis knew it would: aiming to churn out some even more luxurious models that’ll place it among the Porsche crowd. And Goldman is pretty excited about it.

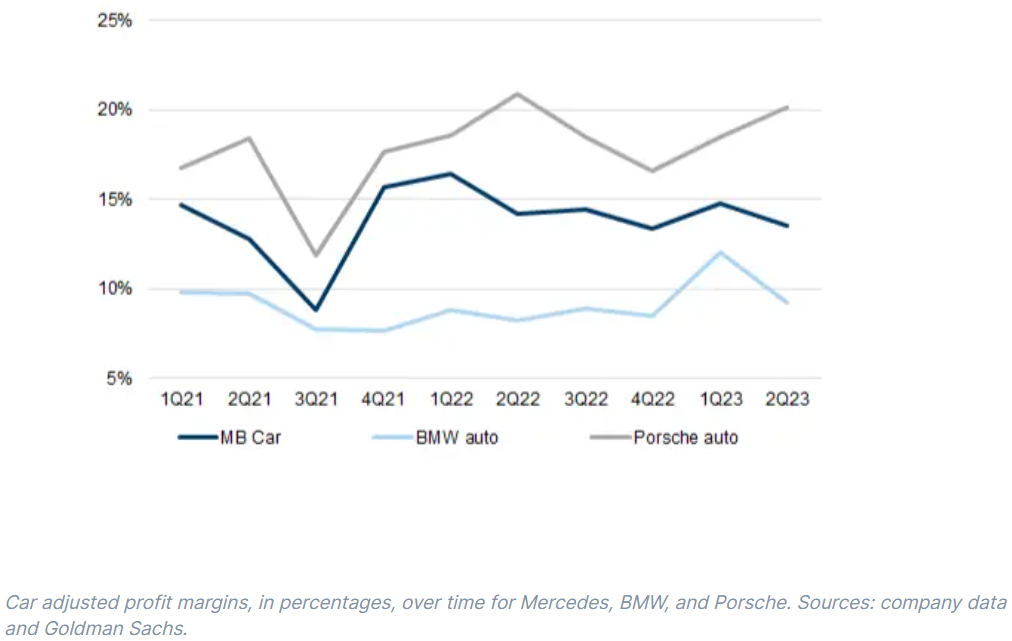

By shifting the focus away from producing compact cars and prioritizing sales of its highest-end vehicles (like the S-Class), the company has been able to achieve double-digit margins for nine of the past ten quarters. Better still, it’s generated more cash on a cumulative basis in the past 36 months than it did over the nine-year period that ended in 2020. That’s a tough feat in a challenging environment – especially for the auto industry. And this company’s not putting on the brakes: it’s extending this approach to its fleet of EVs – electrifying the highest end of its portfolio.

With the auto industry undergoing a huge green transition, Goldman believes Mercedes’ focus on luxury and electrification ticks all the right boxes, and ultimately will help the company maintain its high profit margins.

Daikin Industries (Industrials)

Its story: It’s a best-in-class Japanese air conditioning manufacturer that’s got a growing franchise in the US.

Where it’s listed: Tokyo Stock Exchange.

Its big themes: Energy efficiency and the Japan equity opportunity.

Japanese stocks are in vogue, not least because Warren Buffett’s just bought a bunch of them. More importantly, huge changes are taking place in Japan which could uplift earnings and valuations of local stocks. And Daikin Industries is ticking all the boxes: it’s a Japanese company that specializes in energy-efficient heating, ventilation, and air conditioning (HVAC) systems and products.

Goldman sees the company benefiting from the growing popularity of Japanese companies and the overall push for energy efficiency. And the company already has a good history of out-growing, and out-earning global peers, especially in the US.

One of its cool products, the Daikin Fit, can save more energy than regular systems because it can change how fast it works depending on the temperature. As the focus on energy efficiency sharpens in the US, and as the company continues acquiring US distributors, Goldman sees Daikin grabbing more and more market share.

TSMC (Semiconductors)

Its story: This semiconductor market leader is riding the waves of growing silicon demand.

Where it’s listed: Taiwan Stock Exchange.

Its big themes: Artificial intelligence (AI), 5G, and EVs.

You probably don’t need much of an introduction to semiconductors. They are, after all, everywhere – the in-demand fuel behind the latest AI advancements and the EV rise. So it’s no surprise that TSMC, the world leader in advanced semiconductor chips production, should feature as a beneficiary of multiple themes.

The company holds 60% of the global semiconductor foundry market share, with important clients like Nvidia, which relies on TSMC’s tech to make graphic processing units (GPUs). GPUs are special tools that can process many pieces of data simultaneously, making them useful for machine learning, video editing, and gaming applications.

Goldman believes TSMC can grow sales by 27% in 2024, and 19% in 2025, helped by growth from AI demand. And the company seems determined not to be thrown off course: it’s investing in capacity in Germany, the US, and Japan to mitigate the risks of its current manufacturing capacity concentration in Taiwan.

Philip Morris International (Consumers)

Its story: It’s an earnings compounder that’s been leading the shift to smoke-free tobacco while growing its market share.

Where it’s listed: New York Stock Exchange.

Its big theme: Reduced-risk tobacco/nicotine products.

International tobacco giant Philip Morris has been laser-focused on perfecting a range of smoke-free tobacco products that are not only more advanced and diverse, but also gaining popularity faster than their competitors.

Case in point: the company reported a whopping 1.4 million new users of iQOS, its flagship brand of heated tobacco devices, just last quarter. This number exceeded its previous pace of around 1 million new users and implies that the company is making big market share gains. What’s more, iQOS boasts significantly higher average gross margins compared to traditional cigarettes.

And now Philip Morris is gearing up for an aggressive move, reintroducing iQOS in the United States – the world's biggest and most profitable nicotine market. This move is expected to expand Philip Morris's potential market by a whopping 60%, making the company an attractive investment during a slowdown in global economic growth.

Darling Ingredients (Agriculture)

Its story: It’s a renewable diesel manufacturer and it’s looking at a huge opportunity in eco-friendly aviation fuel.

Where it’s listed: New York Stock Exchange.

Its big themes: Decarbonization and the Inflation Reduction Act.

The company transforms used cooking oil and animal by-products into eco-friendly biofuel feedstock and uses them to produce renewable diesel in a 50/50 joint venture called Diamond Green Diesel (DGD). Goldman believes this strategy positions Darling Ingredients for long-term growth, thanks to the increasing demand for waste fats and oils in the renewable diesel industry. And it certainly doesn’t hurt that the company is already the biggest renewable diesel maker in North America.

As DGD helps drive growth and cash generation in the company, Goldman sees an opportunity for the company to start paying a dividend by 2024 – and that could help unlock a lot of fresh investor interest.

OCI (Agriculture)

Its story: A fertilizer manufacturer offering dividend yield and exposure to clean energy.

Where it’s listed: Amsterdam Stock Exchange.

Its big themes: Hydrogen and clean ammonia.

OCI deals with nitrogen, hydrogen, and methanol stuff to produce fertilizers on a global scale. According to Goldman, the company is in for some bumper times, with the price of nitrogen fertilizers expected to shoot higher next year. There's just not much nitrogen fertilizer lying around, supply is getting tighter, and the cost of things like natural gas is going up.

But what makes the company stand out is what they’re doing in the clean hydrogen and clean fuels space. OCI is building a big blue ammonia plant in Texas, which is set to start running in early 2025, and it’s got partners like Linde and ExxonMobil to help with the CO2 emissions. Clean ammonia is used to power ships and factories, and is a cheaper way to move hydrogen around. And just about any news about OCI's clean fuel projects could be a catalyst for the company’s stock.

So how do you choose a theme to invest in?

Thematic investing often requires a long-term approach. That’s because you’re investing based on global trends that you believe will disrupt the market. So if you’re considering playing single stock thematic exposures, you’ll want to find companies in industries with strong barriers to entry – those that can defend their strong growth and margins. Oftentimes, simply investing in a company that’s exposed to a theme will not yield great results since any advantage will likely be quickly competed away. Alternatively, you can also invest in thematic ETFs. They feature companies along the entire supply chain exposed to your favorite theme, giving you instant diversification.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.