Glimmer of hope for savers as inflation juggernaut slows to 9.9%

14th September 2022 13:01

by Alice Guy from interactive investor

With inflation falling for the first time in a year, Alice Guy examines why the drop might be temporary and explains what interest rate rises mean for cash savers.

At long last, there’s some surprise good news on the economy as the inflation juggernaut slows to 9.9%, the first fall in over a year. The decrease from 10.1% in July to 9.9% in August, defied predictions as experts expected a slight increase to 10.2%.

The drop was mainly due to falling prices at the pumps as petrol inflation dropped from 42.9% in July to 30.2% in August. Victoria Scholar, Head of Investment at interactive investor, commented on petrol prices that, “Underlying that movement has been a 25% fall in oil prices since the June highs amid concerns about a weaker demand outlook as the global economy cools.”

- Read about: Free regular investing | Opening a Stocks & Shares ISA | Cashback Offers

However, despite the fall in inflation, there’s still a tough winter in store for many families. Food inflation increased from 12.6% in July to 13.1% in August and the cost of clothing and average rents also increased.

Inflation likely to rise further

We’re not out of the woods yet, as these inflation figures don’t yet include the latest round of energy price increases, due in October. The average price of energy is due to rise from the previous energy cap of £1,971 to £2,500, an increase of 26.8%.

But energy price inflation will be lower than many feared as Liz Truss’s energy support measures, announced last week, put the brakes on price rises over the winter. Some analysts predicted average energy bills would hit over £7,000 by April 2023, but instead households can breathe a sigh of relief, with energy capped at £2,500 (based on average household energy usage) for the next two years.

However, the medium-term picture is more complex. Although the support measures should ease short-term inflationary pressures, in the medium term they could mean the period of high inflation lasts for longer. Support for bills coupled with tax cuts could result in sustained inflation over a longer period, as consumers have more money to spend over the months and years ahead.

- UK interest rates tipped to hit 4% after new jobs data

- What Truss’s energy cap means for inflation and your finances

As analysts at Bank of America explain, “By lowering peak inflation we see the government's energy price cap allowing the BoE to avoid increasing the pace of hikes. But more fiscal stimulus means the BoE will have to hike more overall. Looser fiscal means tighter monetary (policy).”

And figures out yesterday suggest continuing upward pressure on wages as the ONS announced the lowest UK unemployment figures since 1974, further stoking red hot inflation.

These upward inflationary pressures will affect the Bank of England’s decision, due next week, on interest rates. There is now building expectation that the Monetary Policy Committee will hike rates by a further 0.5%, bringing the base rate to 2.25%.

Impact on cash savings

High inflation and resulting interest rate rises are hitting many borrowers: average mortgage rates climbed to 4.24% in September (based on a two-year fixed mortgage) and a whopping 5.4% for the average standard variable rate, according to data from moneyfacts.

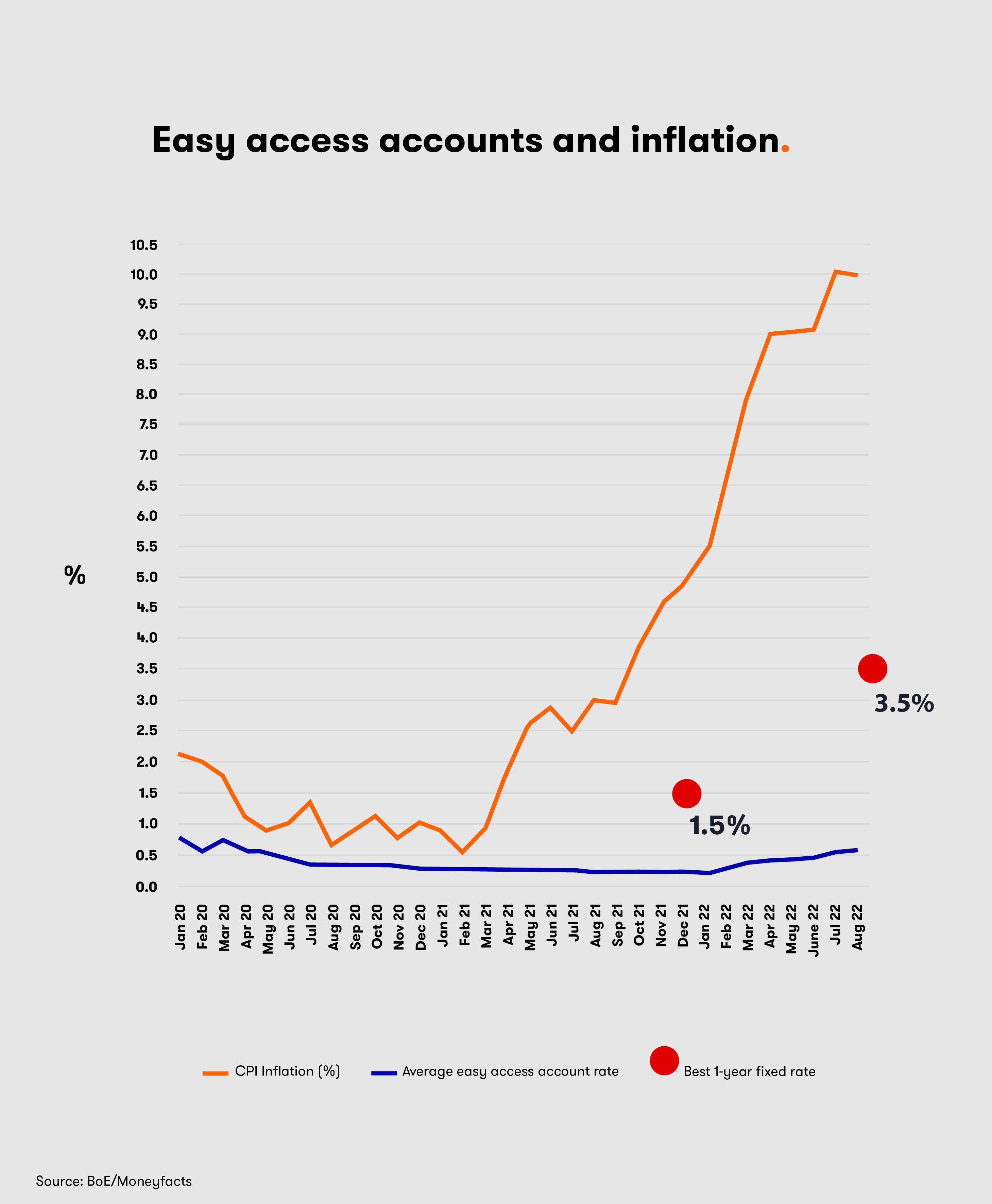

But banks and building societies have been slower to pass on rate rises to savers. The average easy access savings rate was a disappointing 0.84% in September, up from 0.22% in September 2021. It’s a significant rise, but still hardly something to write home about.

If it was a race between inflation and savings rates, inflation would be halfway round the track, whereas savings rates would still be tying up their laces.

However, although slow off the starting blocks, there are signs that savings rates are starting to improve. If you’re able to tie up your money for longer, there are beginning to be a few more attractive rates available.

The best one-year fixed rates are now 3.5% compared with 1.5% last September, and those rates are likely to rise further as interest rates increase.

- What you need to know about interest rates

- 10 things to know about money market funds versus cash savings

Rachel Springall from moneyfacts comments that “The back-to-back base rate rises have had a positive influence on variable savings rates, and this, along with notable competition, has seen the average easy access rate rise to its highest level since 2012...notice accounts are also seeing notable improvements, with the average rate standing at the highest level in over ten years, with top rates breaching 2%.”

But she warned savers to shop around as rates vary significantly between lenders and accounts: “it’s vital savers compare their existing accounts and switch to take advantage of the current competition.”

Impact on shares

For investors, the slight fall in UK inflation is likely to have negligible impact on share prices. These days, the UK economy has less impact on the stock market than it once did and despite the encouraging UK inflation news, the FTSE took a nosedive this morning following a sell-off in the US, ironical caused by bad news on US inflation.

- Interest rate hike: what does it mean for your savings, mortgage and investments?

- Dividend investing: four tips to beat rising inflation

Victoria Scholar said today: “Hotter-than-expected US inflation figures out yesterday prompted heavy selling on Wall Street, which suffered its biggest decline since June 2020 at the height of the pandemic. The S&P 500 slumped 4.3% while the tech-heavy interest rate sensitive Nasdaq Composite plunged 5.2%.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.